Banking 2020: Risk management in the digital age

As we move into the new decade, the banking industry faces new security challenges and an uphill battle to gain consumer confidence in light of widely publicized breaches – many of which impacted even widely respected financial brands such as Equifax and Capital One.. Meanwhile, the latest trends emphasize personalized customization, 24/7 convenience, and innovative features to give customers a deeper, more organized view of their finances. For financial and banking institutions, risk management in the digital age requires a proactive, technologically-informed approach to handle potential concerns responsibly.

Risks and Opportunities for Banking in 2020

The banking trends of the next decade will be focused on putting power and information in the hands of consumers, providing easy access to budget strategies, credit reporting, savings and retirement planning, and other customized features. Mobile banking will become bigger than ever, as users prioritize convenience – allowing for mobile deposits, funding transfers, bill payment, and account management all from within a dedicated smartphone app. Institutions who offer the greatest amount of mobile friendly features gain a competitive advantage in the increasingly crowded financial market.

Meanwhile, risk management in the digital age becomes more complicated than ever as security technology – and methods to evade it – gain in sophistication. Banking companies need to prioritize digital risk assessment and reinforce updated risk management practices to ensure that all customer data is private, encrypted, and secured appropriately. As government and regulatory bodies become more aware of the risks of digital operations, regulations and compliance requirements are expected to increase, and companies will be held to a higher standard for maintaining security.

Focusing on Solutions for Risk Management in the Digital Age

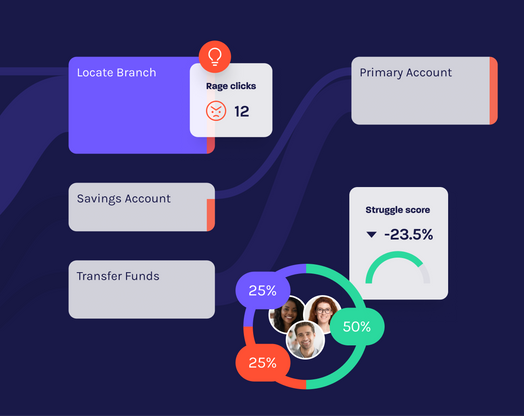

Use the latest technology to stay ahead of the curve – maintain digital records, protect data, monitor customer transactions, and stay compliant with changing regulations using risk management software. By employing a digital risk assessment model, companies can determine which risks are most likely to occur, and which have the potential to cause the most significant losses financially. Utilizing session replays that are tamper-proof and timestamped supports your technical development and customer service while providing an evidential record in case of any security incidents. With digital risk management software, you can securely compress and store your data beyond the regulatory minimums – save and access records for any length of time, for the lifetime of your company. Easily process and present records in case of an audit or investigation, and ensure GDPR compliance quickly and conveniently. Advanced customer data visualization allows for data to be encrypted as it enters the system in real time, and mask sensitive confidential information based on systematic rules or by backend user role. The latest software innovations make it simple to take the necessary steps to ensure your business and your clients are protected, no matter what the circumstances.

Take Your Protection to the Next Level

The right software solutions can make all the difference in helping your business successfully mitigate new risks in the digital arena and resolve potential problems before they occur. Contact us today to discuss how Glassbox can help you upgrade for 2020!