Using big data solution providers to dispense digital advice

One of the biggest challenges in the digital age is taking industries that thrived on face-to-face relationships and turning them into digital successes. In some ways, it is like prying fingers off the old technology in order to get them to embrace the changes that lie in store. But it is also the loss of the person-to-person rapport that has for so long defined the financial industry.

The issues financial services will encounter with the increase in demand for digital advice are primarily based around three key criteria: the transition of current customers to the digital system, the staggering amount of unique situations, and the ability to create ideal digital customer journeys that will lead to the best results. With big data solution providers, these problems can be conquered, and financial companies can continue to provide the expert advice they have already been dispensing, just through a different medium.

Transitioning current customers

A transition isn’t just about making sure your customers know what to expect; it’s about providing the same level of service and privacy as if they were meeting with a financial advisor in their own office. This involves updated terms and conditions for privacy settings, the ability of the digital programs to generate multiple reports for the user, and making sure they are provided consistent and relevant information at all times. In other words, making a customer feel digitally confident includes security, reliability, and accuracy, whether they be human or otherwise.

The uniqueness factor

Financial digital advice is a delicate industry because each case is unique. Every customer digital experience will be different, and therefore the best technological solution needs to offer many different options as each case arises. Every company will need to account for as many outliers as possible and figure out ways to work them into the technology or have the manpower to resolve them.

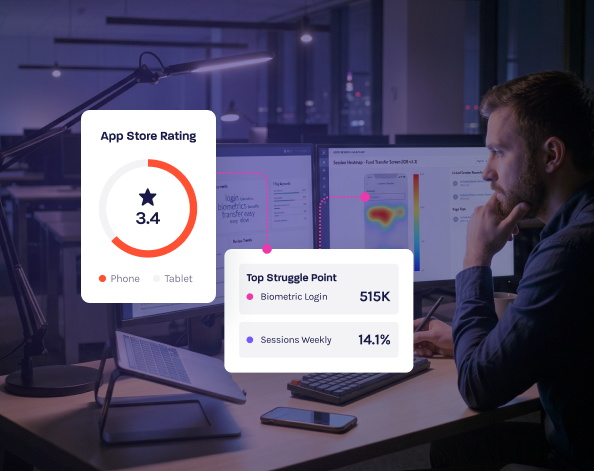

The right technology strategy will give your company to meet the needs of each individual customer by identifying issues during their individual journey, as well as how much extra human input is needed. While technology may be able to make predictions about the market, it doesn’t always mean a perfect result and therefore, human oversight is still needed to insure a customer’s investments are protected and properly distributed.

The ideal digital customer journey

Digital financial advice is a hybrid of expert advice and robotic calculations together. While digital financial advice would be governed primarily by the information provided by the user, the generated solutions need to be as on point as if the customer were still having that in-person connection with their financial advisor.

While going digital may shift the workload of financial advisors, it still does not render them obsolete. Computers can only predict and resolve so much before an actual person needs to oversee the process and confirm that the customer was given correct and up-to date information.

How big data solution providers can help

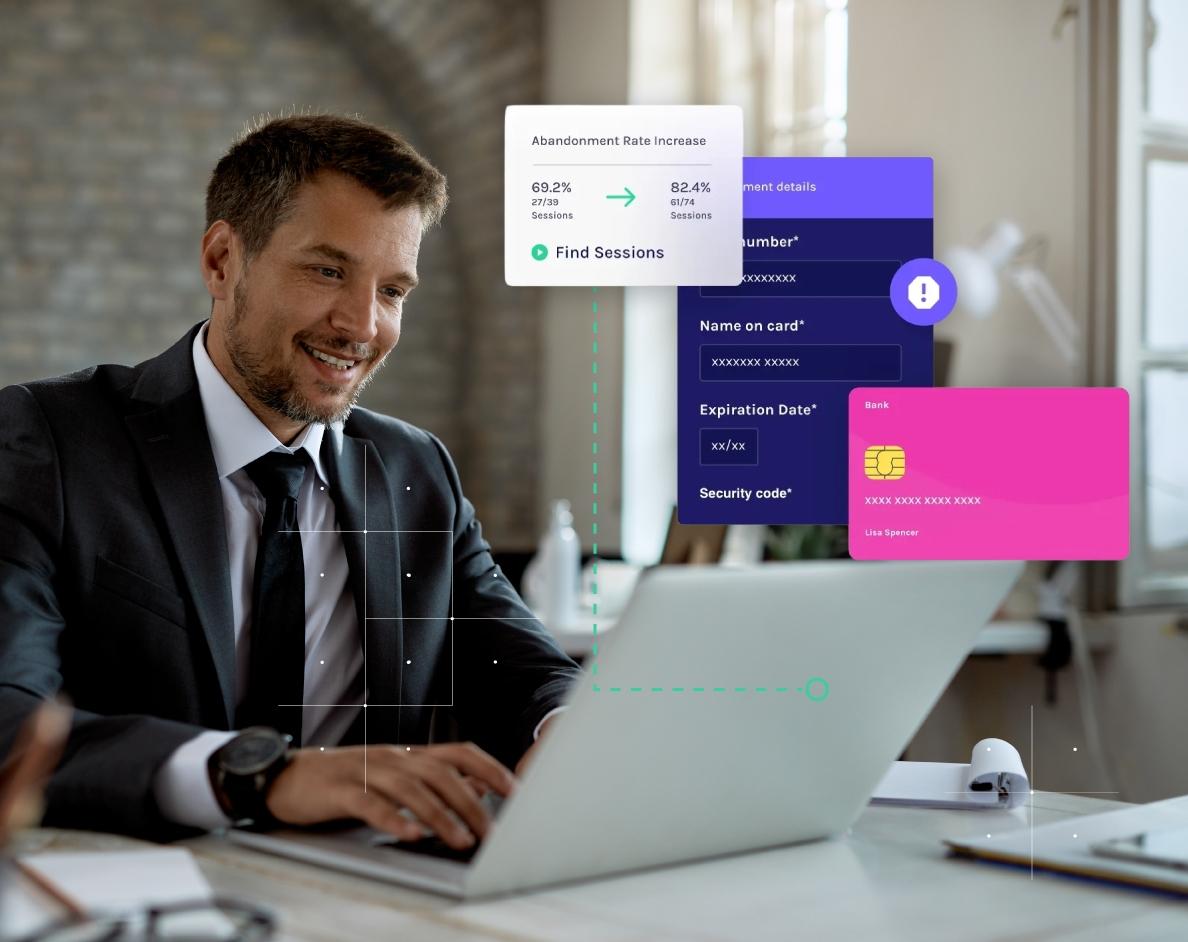

Based on a report by A.T. Kearney, by 2020 more than $2 trillion will be managed by so-called “robo-advisers”. Without the assistance of big data solution providers, many companies will not be able to offer solutions that can support investments of that magnitude. Therefore, when preparing your company for the transition to a more digitally-dominated atmosphere, your staff should be made up of a mixture of change agents, with some who excel technically and others who are more financially inclined.

The beauty of working with a big data company is that the information that is siloed from the digital experiences can be dispersed to all employees and allow everyone access on a level playing field. When it comes time to make the full transition, Glassbox can support your company so that no part of the customer experience gets left behind in the shuffle.