Customer Experience in Banking

In the digital age, it’s easier than ever for customers to switch to the bank that meets their expectations best. This reality places a great deal of emphasis on making sure every interaction and touchpoint you have with your banking customers is a positive one. Whether it’s the accessibility of your online products and services or the ease of engaging with your digital platforms, customers have rising expectations that you need to meet—and exceed—in order to retain their loyalty and their custom.

In this blog, we’ll cover the importance of customer experience (CX) in banking, the expectations your customers likely have and the most common ways banks fall short on satisfying those consumer demands. We’ll also share some proven strategies for enhancing the customer experience your bank has to offer, with some helpful examples of banks that are getting CX right.

Key takeaways

Good CX has a lasting, positive effect on customer loyalty and engagement.

Digital experience intelligence (DXI) is key to understanding customer expectations.

Data-driven CX insights enable you to prioritize high-impact CX improvements that lead to greater customer satisfaction.

Why is customer experience in banking important?

Customer experience in banking holds immense significance, as it serves as the cornerstone of trust, loyalty and sustainable growth. In an industry rooted in trust and financial well-being, the quality of interactions and services offered significantly influences customer perceptions.

A positive customer experience not only fosters loyalty but is also a powerful differentiator in a competitive market. It shapes how customers engage with their banks, affecting decisions to remain loyal, seek additional services and recommend the bank to others. Banks that invest in making CX a priority reap the following benefits:

Increased customer retention

If customers leave every interaction with your bank’s website or mobile app feeling positive and satisfied, they’re much more likely to remain loyal customers. Of course, the reverse is also true: if your customers repeatedly encounter struggles, technical issues and confusion, they’re bound to seek out a competing bank that promises a better user experience. Investing in an improved customer experience ensures that customers will remain happy and engaged while reducing the number of people who churn due to frustration or negative customer experiences.

Improved brand image

It’s worth remembering that your CX can be seen as a reflection of how highly you value your customers. If you’ve invested in delivering a great user experience, you’ll be seen as trustworthy, reliable and user-focused. On the other hand, it’s all too easy for negative perceptions about your bank to creep in when customers are fraught with technical or performance issues or CX-related frustrations.

Growth and profitability

Satisfied customers are more likely to remain loyal and engaged, using a wide variety of products and services and providing ongoing revenue. Equally, customers who have a positive impression of your bank will be more open to exploring new products or services you may have to offer them in future, from loans to credit cards, investment accounts, mortgages and insurance policies.

What customers expect from their online banking experience

Companies like Amazon and Netflix have changed customer expectations over the past few years. As a result, the bar has been raised for any company delivering digital experiences through a website or app. Today, it’s the same for banks as it is for other industries: users expect speed, convenience, security and personalization. Let’s explore each of these expectations and what they mean for your bank’s digital platforms.

Speed and convenience

Customers greatly value the convenience factor of any digital experience, and this holds just as true for banking. Users want to be able to access their accounts easily, make transactions quickly and generally manage their finances without hassle.

🔍How does your bank stack up? Check out the Web Performance Index to see how your bank stacks up against leading financial institutions.

Trust and security

Customers want to feel safe knowing they’ve made the right choice when it comes to who is looking after the security of their financial information and transactions. Just as bad CX can undermine how your bank is perceived, a well-designed, thoughtfully implemented customer experience builds confidence among customers and offers assurance around your credibility.

Personalization

Many modern apps and digital experiences tailor their offering to suit what is known about a user’s preferences, demographics and behaviors. Today’s banking customers expect a personalized experience that intelligently takes these elements into account. Showing an awareness of your customer’s circumstances, adding a personal touch where possible, and offering relevant products and services is an excellent way of demonstrating that you care while increasing the likelihood that your customers will engage.

Why do some banks fail to deliver a good customer experience in digital banking?

No bank sets out to deliver a negative customer experience, and making an informed decision about where to focus on improvements isn’t easy without the right insights in hand. Here are three of the main reasons some banks struggle to implement the changes their customers really want.

They lack the right tools

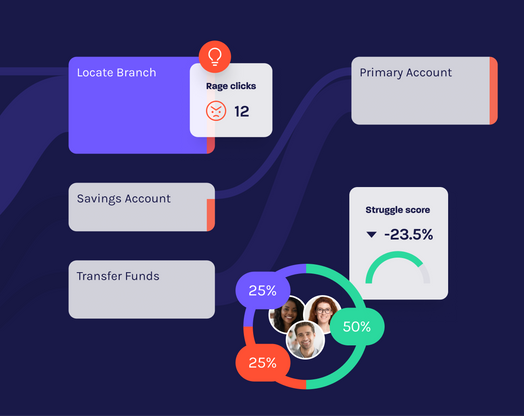

The first step in exceeding your customers’ expectations is truly understanding what they are. Banks that have not yet invested in DXI are simply missing key insights that explain customer behaviors, needs and preferences. By measuring every interaction, a DXI platform uncovers trends that help you develop products and services that satisfy customer demands—making it an invaluable tool for banks aiming to enhance the customer experience.

Inability to keep up with digital transformation

While customer expectations have continued to shift, not all banks have implemented the technologies and strategies needed to keep abreast of increasing consumer demands. To satisfy users’ appetite for personalized content and products and services, banks need to leverage real-time customer behavior data, enabling them to be proactive when engaging users with recommendations and offers.

They don’t have an open line of communication with customers

Your customers hold key insights that, if unlocked, can lead to high-impact customer experience enhancements. These insights aren’t just found in how customers interact with your website or app—they can also be provided directly through surveys and feedback forms or by implementing a voice of customer (VoC) program. Listening to customers and implementing the feedback is essential to making meaningful product improvements.

💡Did you know? Banks can improve customer retention, referral rates, reputation and employee satisfaction by actively listening to customers. This is the reason why companies that implement voice of customer best practices grow their revenue by almost 10x year-on year.

6 proven strategies for improving customer experience management in banking

Looking for inspiration on where to begin with CX improvements for your banking app or website? We’ve rounded up six key areas for you to consider.

1. Simplify the digital account opening process

Streamlining the digital account opening process will create a positive first impression for new customers by making it easier and faster to get started. For example, leveraging optical character recognition to allow users to submit information using their phone’s camera will speed up the process and reduce the need to manually enter details, enhancing customer satisfaction.

2. Implement conversational banking

Adding a chatbot or similar tool to your website or app allows customers to ask questions or find information using natural language. This real-time, more conversational interaction style is engaging and helps users find what they’re looking for quickly, resulting in a smoother customer experience.

3. Improve your mobile banking app

Using insights derived from digital experience intelligence to enhance the design and functionality of your app will greatly improve the customer experience. You can also use real-time information to prevent user struggles and correct technical issues before they escalate, driving up customer satisfaction.

👉🏻 Get more mobile app optimization tips for banks by downloading the guide 5 Mobile App Optimization Best Practices for Banks.

4. Offer self-service

Never underestimate the value of empowering your customers to address their own requirements without the need for contacting customer support. Providing self-service options for common flows—for example, changing account settings, resetting passwords or ordering a new debit card—gives customers greater control and reduces potential wait times, improving the overall experience.

5. Provide a personalized customer journey

By understanding how your customers interact with your digital channels, you can offer tailored product recommendations that feel highly relevant to them. For example, your app or website could suggest suitable credit cards based on a customer’s spending habits. Finding creative ways to tie your communications, products and services into key life events (such as first-time home buying or financing school loans) will make your customers feel valued and understood.

6. Gather and implement customer feedback

Gather feedback at key touchpoints so you can learn which interactions and parts of the journey make banking customers more likely to churn. Using this feedback to implement changes not only illustrates your commitment to continuous improvement, but will also lead to increased customer satisfaction and lifetime value (CLV) and reduced churn. As mentioned earlier in the blog, you can do this by implementing a voice of customer program.

👉🏻 Learn the top 5 benefits of implementing a VoC program in The Complete Guide to Voice of Customer.

Customer experience in digital banking: 3 examples of banks doing it right

1. Wells Fargo

Earlier, we mentioned that speed and convenience are a top priorities for banking customers. Wells Fargo took this particular lesson to heart with the release of Control Tower, a banking app that makes it easy for their customers to see and manage all of their recurring payments and subscriptions. By offering this simplified overview and allowing their customers to make changes to their subscriptions from one central location, Wells Fargo was able to leverage this principle of good CX to deliver greater value to its customers.

2. Chase Bank

Following a long-standing strategy of improving CX within its mobile banking app, Chase Bank followed suit by redesigning its home page, chase.com, to bring the look and feel of the Chase Mobile® app to customers’ desktops and tablets. By restructuring information to be more discoverable and introducing a social-network-style approach to notifying users of key updates, Chase created a digital experience that aligned with the level of personalization its customers have come to expect.

Gavin Michael, Chase’s Head of Digital, said:

“We just made it easier for our customers to live and bank the way they want. We’re excited to bring the look and feel that customers love on the Chase Mobile® app to their desktops and tablets.”

3. Citibank

Citibank garnered multiple industry awards for its focus on intuitive, user-centric workflows within its business banking app, CitiDirect. A key value-add was the app’s interoperability between both mobile and tablet devices, a feature designed to give users a greater degree of workflow flexibility while ensuring the security of sensitive financial information. Through a combination of intelligent CX decisions, Citibank earned the trust and loyalty of its corporate banking customers.

Final thoughts

When it comes to managing their finances, consumers have more options than ever before. Earning and maintaining the loyalty of your customers is key, especially when switching to a more accommodating competitor isn’t the daunting prospect it once was. By reviewing behavioral data to discover what banking customers really want from your website and app, you can implement impactful changes that improve the customer experience to increase retention, reduce churn, and drive profitability. Learn more about how a digital experience intelligence platform like Glassbox can help for Financial Services.