Digital risk management and compliance in the insurance industry

For insurance customers, few things are more frustrated than being told that they require an additional piece of information such as their registration number and then having their session time out while they look for it. This may not seem like a major hindrance, but in fact it has been shown that potential customers will choose to not purchase new subscriptions if they cannot even access a potential quote. Today’s consumer is primarily concerned with two things: convenience, and the safety of their personal data. As such, if your insurance website or application is riddled with bugs or defunct links then you are going to lose potential clients. This is why it is extremely important to ensure that a website is up and running at an optimal level and that digital risk management is being employed by relevant technologies. This will make sure that there are no digital threats and that loss of revenue is not occurring. Time is money, and money is time, and trust is priceless.

So how you employ digital risk management strategies to ensure you’re providing the best customer experience and building trust?

Following the customer digital journey

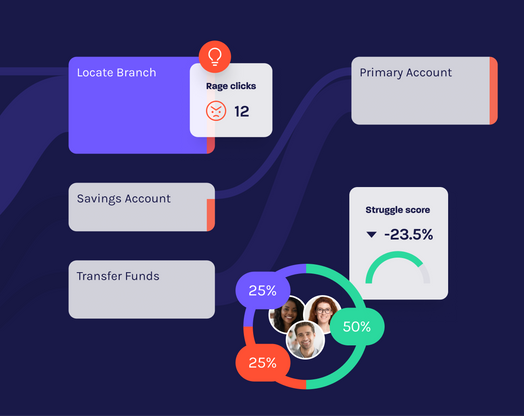

First, an insurance company needs to take a look at the digital customer journey and examine the collected digital customer experience trends which are provided via a customer analytics platform. Once you can accurately gauge how your platform is being used by customers and whether or not interaction is being disrupted because of a ‘timed out session’ or a broken link then you can begin to address the problems hindering new customer acquisition. When you discover what path customers are taking through your site, you can tell if they’re easily finding the information they need with regards to privacy, the use of their data, and specific insurance plans.

Platforms that allow companies to record, monitor, review, and evaluate every customer session give them an upper hand when it comes to addressing all platform related issues that may be affecting why a customer has decided not purchase a policy subscription. This data can then be used to ensure that compliance is met should an investigation into new market trends be launched, fraud suspected, or if complaints are lodged.

Compliance has never been more important

In the past, when business took place primarily on paper, compliance was mainly concerned with how customer records were stored, who had access to them, and when or how they could be removed from the system. With the advent of the telephone, calls were recorded, and it was easy to alert customers to this fact, so they could consider what they were committing to the semi-permanent record. Now in the digital age, literally everything can be uploaded and digital record keeping used to keep track of all this data.

It may seem like this increase in data would make it harder than ever to maintain client privacy, but it is now easier than ever to ensure that compliance is met and the necessary regulations followed. Digital analytic platforms do this by storing, monitoring, and analysing every customer journey and then sifting through big data to provide trends and possible areas that need to be addressed, without revealing the private details of any one customer. This data can also be used to ensure that compliance regulations are met, as the technology is updated in real time as the regulations change according to country and state.

So how can insurance companies ensure that digital risk management is in place and their handling of customers information is meeting compliance?

Digital risk management and customer analytics

Today’s client wants to be confident that their personal information, such as the details of their insurance policy, is stored safely and confidentially. That is why it’s so important to use a customer journey analytics platform that will store and analyse only the data related to use of the site, while all private details are stored separately. Whether support is trying to pinpoint why customers are experiencing errors while requesting a quote, or you’re trying to improve your customer analysis, you can take a macro view without exposing customer details to unauthorized personnel.

In a world increasingly concerned with privacy, it’s important to be sure you’re compliant with all rules concerning customer data. The GDPR has already had a huge impact on how personal data is handled, and it’s inevitable that other nations will introduce their own data protection laws. Staying ahead of these regulations is important for consumer confidence, and just plain good business sense.