Pressure to track digital interactions grows as FCA-tracked complaints mount

As 2021 draws to a close, the UK Financial Conduct Authority (FCA) has published its latest set of complaints data covering the first half of 2021. In our recent report Digital Complaints Management in Financial Services, we anticipated a rebound in complaints activity as the UK economy bounced back, consumers re-engaged and expectations of service kicked back in. This recent statement supports our view.

As FCA complaints data shows (when excluding payment protection insurance, or PPI, from the mix), there was a second consecutive half-yearly rise in complaints, up 3% overall since H2’20 and 6% when compared with H1’20. In the two years leading up to COVID, we see a downward trajectory in complaints, with a 3% drop from H2’18 to H2’19. A steep drop of 17% followed the onset of the pandemic, reflecting the impact of lockdown on consumers. Many found themselves interacting through new digital channels as branches closed and telephone contact centers were overwhelmed. However, customers have adapted and complaints are once more beginning to surge.

Fig 1: FCA complaints opened (exc. PPI) by product group, H1’18-H1’21

Source: Analysis of FCA H1 2021 complaints data (exc. PPI)

Digging deeper, Table 1 reveals the trend we saw throughout the pandemic in more detail. Limited progress was made in complaints relating to banking and credit card providers, which fell by 4%. However, in all other categories tracked by the regulator, complaint levels have risen sharply, by as much as 31% in the case of pensions.

Table 1: Comparison of FCA complaints opened (exc. PPI), H1’20 vs. H1’21

| Product Group | H1’20 New Complaints | H1’21 New Complaints | % Change |

| Banking & Credit Cards | 944,044 | 902,278 | (4)% |

| Decumulation & Pensions | 55,917 | 73,337 | 31% |

| Home Finance | 99,270 | 104,647 | 5% |

| Insurance (exc. PPI) | 705,994 | 825,790 | 17% |

| Investments | 63,411 | 74,805 | 18% |

| Total | 1,868,636 | 1,980,857 | 6% |

Source: Analysis of FCA complaints data for H1 2021 (exc. PPI)

Even in the banking and credit cards segment where overall levels of complaints have fallen, there are still signs of ongoing weakness. Figure 2 shows five of the leading drivers of complaints, which add up to 72% of total new complaints opened in H1’21. In general, the trend over the last two halves has been positive, with drops in complaints relating to customer service, errors, delays and the unsuitability of advice. But in guidance, we see some signs of stress, with a 21% rise in complaints to almost 41,000 in H1’21 compared to 34,000 in the previous half.

Fig 2: Spotlight on drivers of FCA complaints opened (exc. PPI) in the FCA’s “banking and credit cards” and “home credit” product groups, H1’19-H1’21

Source: Analysis of FCA complaints data for H1 2021 (“Banking and Credit Cards” & “Home Credit” only)

This area of guidance is important, particularly in an era of intensified digital interaction. The FCA explained the difference between advice and guidance in a recent clarification note, stating that:

“Guidance can help you understand the different investment options before you decide for yourself how to invest your money. Some people use it to narrow down their options before seeking advice.”

Guidance therefore focuses on the provision of information about financial products. For example, in an investment context, this would include information about the different types of products available as well as general principles to consider before investing. In the area of digital compliance, this element of guidance is core, particularly when it comes to firms’ ability to connect customers efficiently and effectively with the information they need to make better informed decisions.

As discussed in our recent white paper on past business reviews, the pandemic has changed the lives of consumers in myriad ways. Not only did it accelerate the well-established shift of services from physical to digital channels, but it also disadvantaged many of the most vulnerable customers, who have seen economic hardships and the withdrawal of access to advice and guidance in the wake of multiple lockdowns. In response, the FCA has redoubled its efforts to protect consumers, launching a wide-ranging consultation on a new duty of care for the industry in May 2021. Their proposals included a new consumer principle, a set of cross-cutting rules and target outcomes, and will see regulated retail financial institutions held to a much higher standard in areas such as pricing, product design, customer communication and complaints handling.

This also means more stringent rules around how institutions deliver fairer outcomes for customers, placing growing pressure on firms to demonstrate they are up to the challenge of identifying, monitoring and correcting conduct issues as they arise.

From a digital conduct standpoint, the implications here are serious and wide-ranging. For example, guidance needs to be accurate, up-to-date and delivered in a manner that supports each customer in making the best decisions possible. With more interactions happening online, firms need to be able to track, remediate and evidence the digital journeys of their customers. With complaints in this dimension rising, pressure to do so is building. Elsewhere, the FCA delivered its feedback statement and a further consultation on draft rules and guidance in December, with a final policy statement expected in July 2022, the risks for those firms that fail to grasp the digital compliance nettle will be severe.

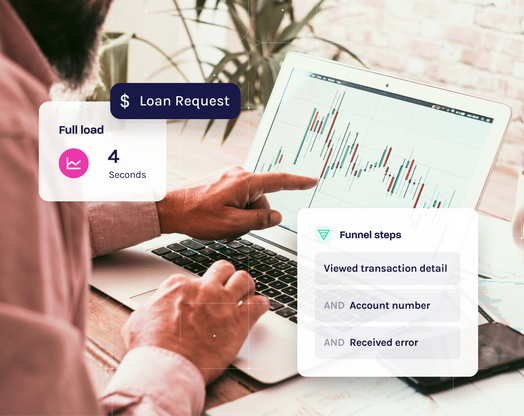

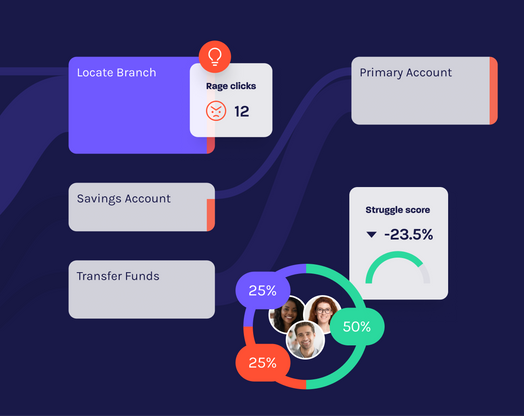

So how can firms best address these issues when it comes to digital channels? At Glassbox, we believe financial institutions need to capture digital interactions in the same way they do phone calls. Firms need the tools to create a complete record of every digital journey. The Glassbox platform provides a digital record of every customer tap, swipe and click as well as the information and content provided during the session – for every device and experience delivered. As discussed in our recent complaints report, the ability to instantly replay and analyze every session that gives rise to a complaint can also enable firms to investigate and resolve it more quickly and easily.

Having a forensic record of each customer session means there can be no question about what really happened. If a complaint is not upheld, the firm has the evidence to defend their decision if challenged by the FCA or the Financial Ombudsman. Such measures will also be essential in successfully defending firms undertaking past business reviews (PBRs) through the provision of traceable and reliable audit trails for investigators to follow and review.

As the spotlight turns increasingly to digital interactions, financial institutions must be able to surface all the data required to perform accurate root cause analysis (RCA). This is needed to diagnose and solve customer issues across the map before they trigger complaints. RCA can be used to address technical issues across websites and apps as well as problems concerning the customer journey, specific content and the overarching customer experience as they navigate firms’ digital channels. From a PBR standpoint, this can help institutions to contact all customers impacted by an issue proactively before a complaint is registered, as well as allowing the firm to check and confirm that all essential steps were completed with appropriate time spent at each key stage of the customer’s journey (e.g., reading a product description or the associated terms and conditions).

The new Consumer Duty will require firms to adopt a more proactive stance; firms will need to maintain forensic records and be able to monitor all activity to ensure that customers are not experiencing harm, that they are achieving good outcomes – and have the evidence to prove it.

As we move into 2022, institutions should brace for more complaints, while future COVID-related challenges will certainly cause further hardship for their customers. Against this strained backdrop, and with the regulator firmly focused on its widening consumer protection agenda, there has never been a better time to review your existing measures and ensure your firm is well prepared for the future of digital conduct.