Supporting the needs of vulnerable customers in a digital world

Over the last few months, many of us will have experienced some financial challenges as a result of the coronavirus pandemic. Sadly, millions of people have either been furloughed or have lost their jobs altogether and those already suffering from financial hardship are enduring additional difficulties. Recent figures from the Institute for Fiscal Studies show that household incomes have fallen sharply and the non-payment of bills has increased, leading to more debt being carried forward, possibly at sustainable levels. Latest OECD estimates indicate a worst-case scenario for the end of 2020 will be a rise in the UK unemployment rate to 15%. Taken together, these financial impacts mean that a greater number of financial customers will be experiencing vulnerability than before the pandemic, some for the first time.

Download Now: Guide to Vulnerable Customers and Digital Channels

But vulnerability does not just result from financial hardship or distress, it can also be due to ill health, major life events such as bereavements or lower levels of financial capability due to a lack of knowledge or confidence in managing money. In all these cases, according to the Financial Conduct Authority (FCA), a vulnerable customer is…

‘someone who, due to their personal circumstances is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care’.

Covid-19 is an unfortunate example of how quickly people can become vulnerable, illustrating that it is not always a permanent condition but one that can be transient and take people by surprise.

Customer vulnerability has been high on the FCA’s agenda since 2015 and the recent Guidance Consultation (and fines for not following the guidance) signal just how seriously the regulator is taking the fair treatment of vulnerable customers and responsibilities the regulator requires the financial sector to assume to ensure this is the case. To underline the point, Nisha Arora, Director, Consumer and Retail Policy at the FCA said in a speech in February:

“We will be monitoring firms’ responses and, where necessary, will use our supervision and enforcement tools to ensure that firms are treating their vulnerable customers fairly and delivering the right outcomes.”

The industry is on notice.

What are the regulations about vulnerable customers?

As it currently stands, the FCA is not proposing to create additional Handbook rules to cover vulnerable customers. Instead, it considers its Principles for Business to be an adequate statutory framework within which to issue regulatory guidance for firms. Issued in July 2019, the Guidance Consultation on the fair treatment of vulnerable customers lays out the FCA’s expectations for firms and includes several examples of best practice.

The key responsibilities for firms under this guidance are:

- Understanding the needs of vulnerable customers by identifying the types of vulnerabilities in their target market and customer base and assessing how these vulnerabilities may impact the needs of their customers

- Skills and capability of staff to both identify vulnerabilities and understand the best way to adjust the customer experience in line with the impact any vulnerability may have on the customer’s needs

- Taking practical action with respect to product and service design, good customer service and communication – designing products with vulnerable customers in mind, providing additional support or specialist customer services teams for vulnerable customers and considering the needs of vulnerable customers in all communications.

- Monitoring and evaluation of how a firm’s understanding of vulnerable customers is embedded across its business and how the firm’s activities are impacting outcomes for vulnerable customers. Firms should use the output of these evaluations to continually learn and improve their understanding of the needs of their vulnerable customers.

Firms must consider how they embed the fair treatment of vulnerable customers throughout the organization, as part of the cultural DNA of the firm. Senior Managers (as defined by Senior Managers and Certification Regime) also assume personal responsibility for the application of this guidance as part of their obligation to “take reasonable steps to ensure that the business of the firm for which you are responsible complies with the relevant requirements and standards of the regulatory system”.

What is the industry’s perspective?

In its response to the FCA’s guidance consultation, UK Finance (which represents the views of over 250 financial firms in the UK) firmly states the UK financial sector’s agreement with the need to ensure vulnerable customers are treated fairly. Not only does this make good business sense in terms of customer retention, it is also a moral and ethical obligation. But, UK Finance members also raise concerns that the guidance ‘relies on firms using sophisticated analysis and management information (MI) rather than existing systems’. The industry believes that the types of good practice outlined in the FCA’s guidance could require significant levels of IT changes, incurring additional costs.

Ensuring fair treatment of vulnerable customers, however, need not be a huge IT transformation effort, especially for firms who are offering financial products and services over digital channels. Indeed, with the increasing adoption of digital channels as a result of lockdown and the FCA’s emphasis on the fair treatment of digital customers in its 20/21 business plan, this is an ideal time for firms to review how well their digital channels are aligned to the guidance on vulnerable customers. As industry commentators suggest, COVID-19 makes it even more critical.

Vulnerable customers and digital financial services

Industry experts, such as Giles Whittam, have recently talked about the importance of identifying vulnerable customers as early as possible, but ask ‘how easy is it to identify these customers in an increasingly digital-only interface?’ It is indeed tempting to assume the lack of human interaction involved in the use of mobile or web-based applications makes it harder to understand and cater to the needs of vulnerable customers. But digital channels and business models actually offer some advantages over face-to-face or telephone banking.

Firstly, digital customer journeys can be personalised to ensure they are receiving the right information at the right step in the journey — if customers have previously disclosed a specific vulnerability, their digital interactions can be modified to ensure they are treated fairly. Secondly, because everything is digital, it can be automatically monitored, recorded and analysed.

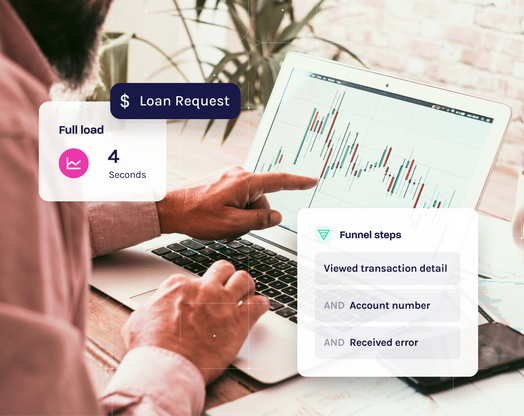

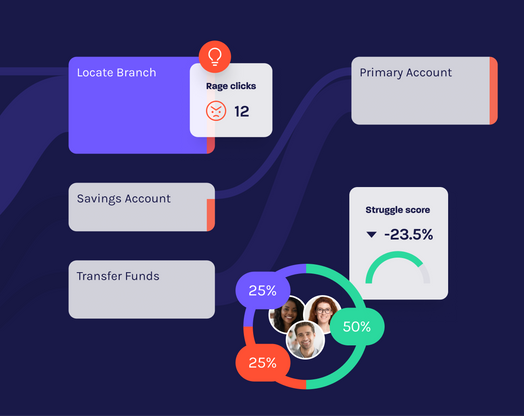

Glassbox allows every single part of a customer’s journey — every mouse click, keystroke, button hover or screen swipe — to be treated as data points. These can then be used to identify behaviour that may indicate vulnerability, refine customer journeys, allow for additional customer service intervention via other channels and provide the necessary analytics and insights for firms to continuously evaluate their treatment of vulnerable customers.

In its 2017 Financial Lives survey, the FCA estimated that nearly 50% of the UK’s adult population exhibited one or more characteristics of vulnerability. As the effects of the coronavirus pandemic continue to be felt, that number will grow and grow. Firms will be under increasing regulatory pressure to ensure the fair treatment of vulnerable customers, especially those using digital channels. Putting the right solutions in place sooner rather than later should feature very highly on Senior Managers’ To Do lists.