Survey says: What’s most important to today’s digital banking customers?

Do you remember the last time you talked to a bank teller or your bank’s customer service? It turns out about half of us don’t want to remember. A recent Glassbox survey reveals that about half of American consumers prefer frictionless digital banking experiences over human interaction. This is one of the key findings in an increasingly digital and hybrid banking landscape.

To learn more about customer preferences in digital banking security, features, loyalty incentives and related topics, our survey polled 2,000 consumers in the United States and United Kingdom.

How does digital banking compare to in-person experiences for today’s consumer?

- Digital banking rules: People of all ages prefer digital banking over in-person. Almost 80% want to manage some or all their finances digitally, and more than half use digital banking once a week or more.

- Security is a top priority: 40% of respondents reported that online safety is the most important element of digital banking.

- Frictionless platforms are key and drive customer loyalty: 35% said online banking that is easy to navigate and smooth are why they remain with their bank. But…

- Technical issues are a deal-breaker: 32% reported that they are more likely to change banks if they encountered technical issues when banking online.

- Region and age affect mobile banking;

- 26% of U.S. consumers bank on both mobile and desktop, but more than half of U.K. respondents will choose mobile banking over desktop.

- Almost half of Millennials and Gen Z rely on desktop for their digital banking needs, breaking the stereotype that tech-savvy generations automatically turn to apps.

Digital banking takeaways for financial institutions

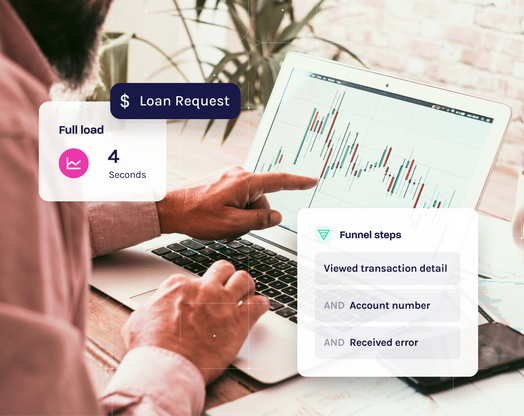

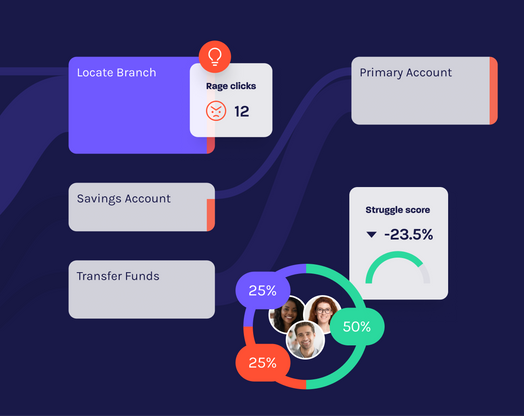

- Customers don’t want to talk to people when they are banking online or in apps. Invest in technology and UX features to quickly gather, assess and respond to issues as they arise.

- With ample banking options available to consumers, if your digital banking experience isn’t smooth and seamless, it will affect customer loyalty—and your bottom line.

- Consumers want to know that there are strong levels of digital security and banks should take all precautions necessary to proactively find and respond to the latest security and data privacy threats.

- Banks need to adapt and transform their digital presence to keep up with consumers’ ever-changing online needs and to be aware of region-specific and demographic preferences.

With the growing importance of digital banking experiences, it’s imperative that banks gain a deep understanding of their customers’ digital behaviors and can rapidly prioritize enhancements to optimize that experience. Digital experience analytics platforms like Glassbox can play a key role in delivering against new digital expectations.

Want to learn more about what’s important to today’s digital banking consumers? Download our eBook, 5 Digital Journeys Every Retail Bank Should Optimize.