The Consumerization of Banking

How Digital Experience Intelligence Is Powering the Shift to Frictionless Finance

Banking has changed. Customers no longer benchmark their bank’s website or app solely against those of other financial institutions. Instead, they measure their experience against giants like Amazon, Google or their favourite B2C app. This shift is profound, and the stakes are high. If a bank’s digital journey disappoints, customers may walk away.

In this new era, Digital Experience Intelligence (DXI) is becoming essential. It’s the technology that helps banks see, understand and remediate experience issues in real-time—enabling them to drive smoother journeys, reduce friction and build trust. This article will explore how frictionless finance is reshaping banking, highlight real-world examples and identify how DXI supports loyalty, revenue and compliance goals.

The Drive Towards Frictionless Finance

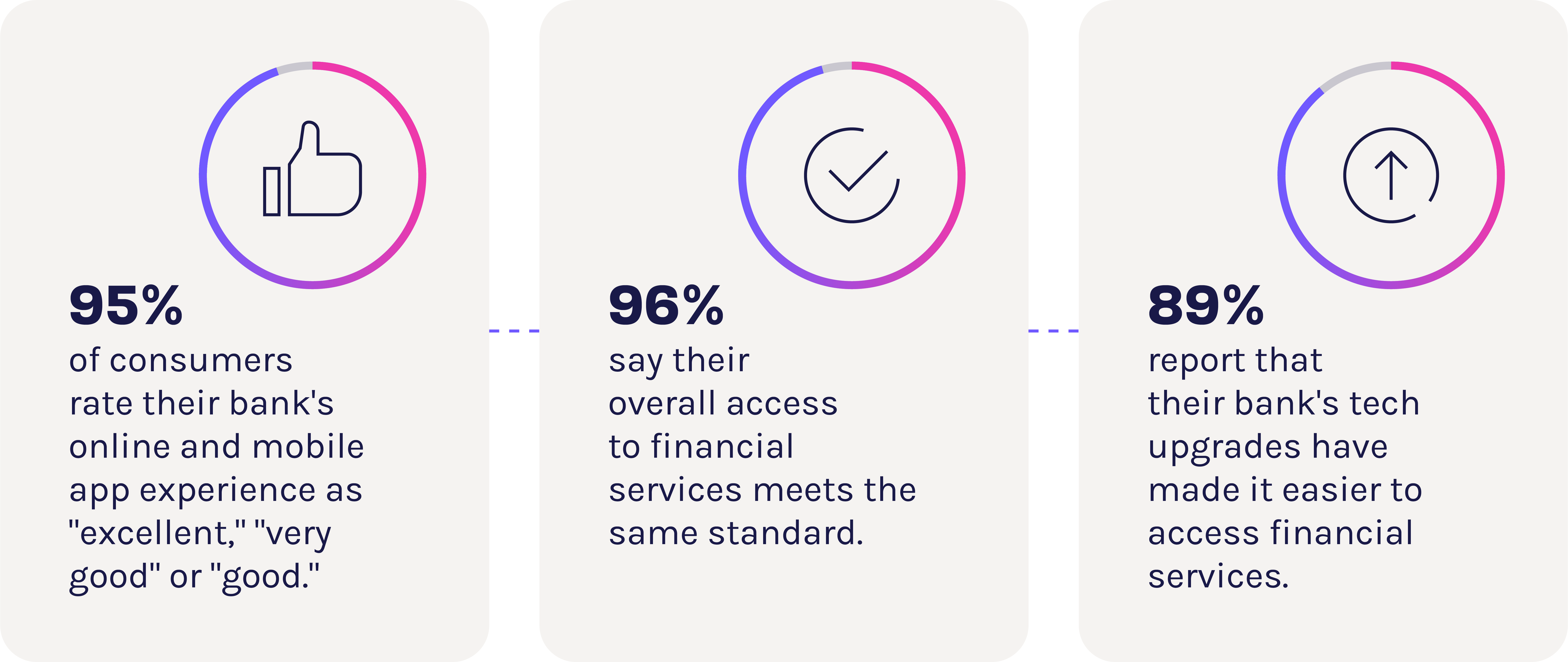

Consumers are increasingly measuring banking experiences against the smooth, intuitive digital interactions they have with leading consumer apps, not just other banks. And while satisfaction is high, expectations continue to rise with a high bar set as consumers currently expect to be very satisfied with their digital banking experience:

Yet satisfaction alone is not enough. Customers now expect reliability, seamlessness and personalization. Many prioritize secure, error-free interactions—with significant emphasis on protecting personal information—and they want consistent experiences across mobile and web channels. A bank that delivers these expectations not only earns trust but also positions itself to compete with leading digital-first brands.

In short, consumers want banking that works and feels effortless. The bar has shifted: smooth transactions, intuitive journeys and a sense of security are no longer differentiators, but the baseline for customer satisfaction.

Digital Assistants: Anticipating Customer Needs

One of the clearest expressions of frictionless banking comes from intelligent digital assistants. These are more than simple chatbots that answer questions like “What’s my balance?” They can proactively guide users by, for example, reminding them of upcoming payments, suggesting ways to save or flagging suspicious activity. Behind the scenes, AI analyzes behavior patterns, identifies moments when intervention could help and surfaces solutions in real time.

By anticipating needs rather than waiting for customers to speak, these assistants reduce friction, free users from navigating complex menus and minimize the need for human support. The result is a smoother, faster, more trusted banking experience that aligns with rising customer expectations for effortless, reliable interactions.

Open Banking: Personalization and Faster Financial Decisions

Open Banking is another driver of frictionless finance. By enabling third-party fintechs to access bank data with explicit user consent, customers gain access to richer, more tailored financial services. For example, fintech lenders can analyze cash flow in real time, approve loans faster, or design credit products that reflect actual spending habits rather than relying solely on traditional credit scores.

However, open banking introduces new considerations as highly granular transaction data can carry unintentional biases, with reconstructed features potentially acting as proxies for sensitive personal traits. This underscores the importance of careful oversight and robust digital experience monitoring (DEM) to ensure both personalization and fairness.

Together, digital assistants and open banking demonstrate that frictionless finance is not just a concept, but a set of practical, technology-driven strategies. By leveraging responsible DXI, banks can balance personalization, speed and security, and ultimately eradicate friction while maintaining trust, compliance and customer loyalty.

The Cross‑Channel Revolution: Easing Friction Everywhere with Digital Experience Intelligence

As customers move between apps, web, voice assistants and branch‑driven journeys, friction can lurk in unexpected places. Poor handoffs, technical errors and disjointed experiences all translate into frustration—and in banking, frustration has real cost.

DXI bridges that gap. By capturing and analyzing every customer interaction across channels—web, mobile, voice, call center—it gives banks a comprehensive, actionable lens on where experiences break down. That insight allows remediation before issues snowball into cost, risk or attrition.

1. Easing Friction in the Call Center (Reducing Operational Cost)

When a digital flow fails—by way of a payment glitch, a confusing page or a broken form—customers often escalate to a human. Suddenly, a self-serve issue becomes a support issue. Call center volume rises, costs surge and customer satisfaction takes a hit.

DXI changes that. With a DEM platform, banks can detect journey failures in real time. For example, if a user repeatedly tries, but fails, to submit a form, the system can flag the session, show exactly where the error occurred and initiate remediation through a proactive message or by directing the issue to the right team.

In practical applications, this type of real-time detection can drastically reduce call volumes. By intercepting failed digital sessions before they reach the contact center, banks can lower operational costs, improve resolution times and reduce customer effort.

The result is greater efficiency and stronger customer trust: issues are addressed before they escalate, and users experience a sense that the bank is actively supporting them.

2. Easing Friction in Conversion and Revenue

Not all friction is visible. Some roadblocks lurk in the shadows: technical defects, client-side errors, browser incompatibilities. These are the invisible traps that drive abandonment, drop-off or failed transactions, often without the bank realizing it.

E-commerce research indicates that checkout abandonment hovers around 70% on average, highlighting how even small issues can derail a process. While this may not directly apply to banking, the pattern is similar—unexpected errors or frustrating forms cause users to abandon applications or transactions.

DXI surfaces these invisible issues. When a user fails to complete an application or transaction, a DEM platform can capture the full session, flag slow-loading elements, JavaScript errors or validation issues. Then, with root‑cause analysis, banks can pinpoint exactly where the problem lies.

3. Easing Friction in Compliance and Security (Reducing Risk)

Trust isn’t built solely on smooth journeys; it’s built on safe ones. For banks, compliance, fraud prevention and security are critical priorities.

A DEM platform can support these needs with features such as audit‑proof records. By capturing every interaction, click, network call and form entry, such systems allow banks to replay full sessions, showing exactly what a user saw and did. This capability is invaluable for regulatory compliance, dispute resolution and internal audits.

In a Glassbox case study on retail bank fraud detection, the DXI platform helped a bank identify fraudulent behavior, reduce false positives and save $18 million in just seven months.

Beyond preventing fraud, these tools make the customer journey safer and more transparent, helping banks maintain trust while managing risk effectively.

From Technology Issue to Loyalty and Revenue Metric

Digital journeys are no longer just a convenience; they are central to customer loyalty and financial performance.

Customers who have seamless, reliable digital experiences are significantly more likely to remain with their bank, adopt additional products and recommend the bank to others. The reality is that improved digital experiences correlate with higher engagement, increased account usage and measurable revenue growth.

This makes DXI more than a technology investment. It’s now a strategic business lever.

By identifying and resolving friction in real time, banks can protect revenue, strengthen customer trust and turn technology into a driver of loyalty and growth.

The Challenger Threat

Traditional banks face serious competition from challenger banks—neobanks that operate wholly online, lean on superior digital CX and move fast. These challengers offer clear advantages:

Zero‑friction onboarding: Many account openings now take minutes, not days.

Hyper-personalization: Tools like Chime’s SpotMe® overdraft protection, or AI-based savings nudges, use real data to deliver meaningful features.

Transparency and trust: Clear fee structures, real-time notifications, intuitive budgeting tools—everything is designed for clarity and control.

The business model works. The challenger bank market is growing rapidly, projected to expand at a compound annual growth rate of 26.3% in the coming years. And the payoff is real. Digital banking users not only generate more revenue, but they also hold more products and churn less.

For traditional banks, this means CX isn’t just a support function, but also a growth engine. If they don’t match or exceed the experience challengers offer, they risk losing relevance, customers and revenue.

The Positive Side of Friction: A Necessary Balance

While seamlessness is the goal, it doesn’t mean that no friction is necessarily better. Some types of friction can actually enhance safety, trust and long-term value—especially when introduced intentionally.

Financial institutions are increasingly experimenting with “positive friction,” or small pauses and confirmation steps that protect consumers and encourage better decision-making.

Here’s a breakdown:

By balancing frictionless design with deliberate pauses, banks can serve users more responsibly and thus protect their interests without undermining the experience

The Future of Banking Is Seamlessly Integrated

The consumerization of banking is a transformation that’s here to stay. Customers will continue to expect more—faster, smarter, more reliable digital interactions that feel like their favourite consumer apps.

For banking leaders, the path forward is clear:

Remove friction: Everything non-essential must have no friction—eliminate unnecessary steps, reduce error surfaces and smooth out cross-channel journeys.

Strategically apply positive friction: Introduce intentional pauses where they promote trust, safety or clarity.

Leverage DXI as a core capability: Invest in tools that capture, analyze and remediate digital experience issues.

The payoff? More loyalty, lower operational costs and sustainable revenue growth grounded in trust.

Building the Future of Frictionless Banking

Digital experience monitoring is at the heart of frictionless, secure banking. By providing banks with real-time visibility into every digital interaction, DXI platforms like Glassbox help identify friction, resolve issues before they escalate and ensure compliance and fraud prevention are built into every journey.

Whether your focus is innovation, operational efficiency or risk reduction, DXI provides the insight and control to make it possible.

If you’re ready to create digital journeys that are seamless, safe and revenue-enhancing, connect with Glassbox. Together, we can help you design a CX that delights customers, builds trust and drives sustainable growth.