The future of compliance in complaints management and digital banking

The UK’s Financial Conduct Authority (FCA) has recently published its much anticipated consultation on the duty of care for retail financial services (CP 21/13), and the theme of Consumer Duty is back at the top of the agenda. The FCA uses its latest document to focus attention on remedies for what it sees as areas of persistent weakness &ndsash; one of which is complaints management.

At the intersection of customer experience (CX) and compliance, complaints management in financial services has taken on new challenges as retail banks and wealth management firms grapple with the increased shift to mobile apps and web and the heightened expectations of their customers. Without human interaction, like that which occurs during in-branch and phone interactions, how can banks record and track what the customer did and saw on digital channels, and how can banks ensure the experience was effective and frictionless? And if it’s not, how can banks uncover what went wrong to address the issue?

With the consultation drawing to a close on July 31, 2021, this blog looks at what inbound measures we can expect concerning complaints management, why they matter and precisely what institutions should do to future-proof their digital complaints management processes.

What does the FCA say about Consumer Duty?

The consultation contains two key proposals.

Firstly, a new Consumer Principle sets out more rigorous standards of conduct. Going beyond the existing Principle 6 requirements the FCA offers two options for firms, which it says must either:

- “act to deliver good outcomes for retail clients” or

- “act in the best interests of retail clients”

The second proposal is a set of cross‑cutting rules to support the Consumer Principle. They set out clear expectations for firms’ cultures and behaviors, requiring firms to do three things:

- Take all reasonable steps to avoid causing foreseeable harm to consumers

- Take all reasonable steps to enable customers to pursue their financial objectives

- Act in good faith

What’s in it for the customer?

To be effective, the FCA acknowledges that the new principle and rules should drive a better experience for consumers. So, the FCA is also targeting four key outcomes from these measures, which are:

- Communications should “equip consumers to make effective, timely and properly informed decisions about financial products and services.”

- Products & services should be “specifically designed to meet the needs of consumers, and sold to those whose needs they meet.”

- Customer service should “meet the needs of consumers, enabling them to realize the benefits of products and services and act in their interests without undue hindrance.”

- Pricing should “represent fair value for consumers.”

Where does complaints management fit in?

Poor complaints handling is preventing financial firms from providing these outcomes. The FCA acknowledges that firms are facing challenges when it comes to their complaints handling processes.

Proper investigation

Complaints are a natural extension of customer service, and the FCA wants to avoid them being dismissed without proper investigation. This can lead to consumers missing out on redress payments to which they are entitled. However, the regulator notes the lack of commercial incentives for firms to support consumers throughout the product lifecycle. The complaints handling process can be time consuming and expensive, which impacts the firm’s ability to hear and address customer complaints.

Root cause analysis

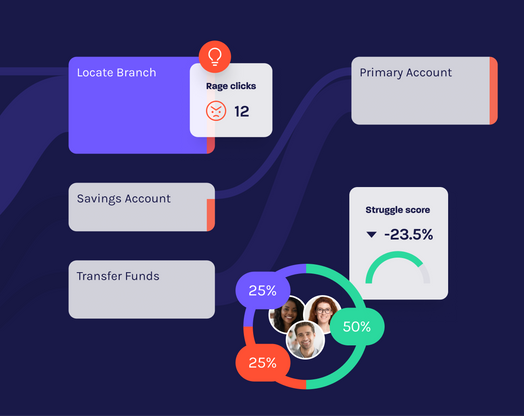

The FCA calls out the importance of firms using the data they hold on their customers’ use of products, their interactions and other behaviors to identify where their processes may be causing friction and frustration. The FCA specifically calls out that applying root cause analysis for complaints in the context of digital journeys is much more difficult for firms to tackle than those stemming from other channels.

Post-sale costs for consumers

Finally, the consultation recommends that consumers should not be saddled with unreasonable post-sale costs. In this context, “cost” refers to time and inconvenience resulting from instances of bad customer service as much as financial costs. The pressure is on institutions to upgrade and validate their existing customer processes, including those for making complaints.

What do firms have to do to achieve compliance in complaints management?

There are three main duties a retail firm must uphold when it comes to complaints handling compliance:

- Firms must demonstrate that their complaints processes are robust, allowing consumers to make a complaint efficiently and confidently.

- Firms must track the full customer journey, regardless of channel, proactively identifying and eliminating issues that hinder customers.

- Firms must demonstrate that their service processes do not cause inconvenience for the customer and do not take an inordinate amount of time to complete.

How do you prove compliance in digital complaints management?

As discussed in our recent Digital Complaints Management in Financial Services white paper, the rapid acceleration of digital banking resulting from COVID-19 has left many firms exposed in their ability to demonstrate the above obligations due to a lack of proper supporting technology. With complaint volumes expected to rebound as we accelerate out of the pandemic, the ability to achieve compliance in complaints management hinges on three critical factors:

- Your ability to surface the data required to perform accurate root cause analysis through your digital channels. This is an important capability for you to harness across the map. For your complaints it will not only help you achieve full compliance, but it will also defend you from mischievous complaints by providing evidence of best practices and good faith.

- Your ability to analyze existing digital complaints processes from your customer’s point of view, so you can ensure their journey is friction-free and optimized.

- Your ability to track and benchmark digital complaints KPIs (e.g., average time to log a complaint, number of clicks or swipes needed to complete the process on web and mobile) to help you spot and resolve problems in digital journeys proactively.

In order to achieve these capabilities on digital channels, financial firms need access to digital tools. The duty of care starts with the need for firms to monitor what their customers are doing on their digital channels so that they know when there may be an issue and have the information and tools to step in. Digital experience analytics empowers teams across the organization with the real-time insights they need to capture, visualize and analyze every digital journey on mobile apps and websites to deliver compliant and effective digital products and experiences. Firms can adapt quickly to heightened digital demand, while features such as compliance monitoring and alerts ensure businesses and their customers stay firmly on the right side of change.