What Is Fraud Monitoring? How It Works and Why It Matters

Fraud attacks are becoming more sophisticated and widespread. In 2023 alone, consumers lost more than $10 billion to fraud, a 14% jump from the previous year, according to the Federal Trade Commission. Experian’s 2024 Identity and Fraud Report warns that generative AI, deepfakes and sophisticated cybercrime rings are accelerating the problem, with 70% of businesses ranking AI-driven fraud among their top concerns. For financial institutions already juggling regulatory pressures and shrinking margins, those numbers hit close to home.

As high-value targets, banks and insurers can’t afford reactive defenses. Continuous fraud monitoring—supported by real-time data, behavioral analytics and AI—has become essential to stay ahead of payment fraud, identity theft and money laundering while safeguarding customer trust. Modern platforms ingest millions of data points per second, spot anomalies faster than human analysts and surface contextual insights that empower fraud teams to act decisively.

This blog unpacks how fraud monitoring works, why it matters for your organization and where AI adds measurable value. You’ll discover the different monitoring layers deployed across the customer journey, see how advanced tools can reduce false positives and learn practical steps to weave fraud prevention into a broader preventative customer experience (CX) strategy.

What Is Fraud Monitoring?

Fraud monitoring is the continuous surveillance of user activity, device signals and financial transactions to spot signs of fraud in real time. Unlike one-time audits or rule-based batch reviews, continuous fraud monitoring ingests live data streams, applies advanced analytics and triggers immediate fraud alerts the moment suspicious activity appears.

At its core, an effective monitoring program follows three guiding principles:

Proactive detection of unusual behavior: Machine learning models assess every click, swipe and payment against established behavioral baselines, flagging anomalies such as sudden IP changes or high-value out-of-pattern purchases.

Dynamic risk scoring: Each session, device and transaction receives a real-time risk score that evolves as new data arrives, ensuring potential fraudsters are identified even if they switch tactics mid-journey.

Actionable insights and intervention: Granular context—what users did, which fields they edited, how quickly they entered data—feeds analysts or automated systems so they can confirm identity, add step-up authentication or block the transaction with minimal customer friction.

Monitoring differs from fraud detection in scope and timing. Monitoring is the always-on process that analyzes streams of events, while detection is the outcome, which identifies specific fraudulent transactions or behaviors that violate risk thresholds. In other words, continuous monitoring enables swift detection and response before losses accumulate.

Types of Fraud Monitoring

Financial institutions deploy several complementary layers of continuous fraud monitoring to protect every stage of the customer journey. Each layer focuses on specific fraud patterns, helping you detect payment fraud, suspicious activity and identity theft before losses and compliance headaches mount.

Transaction Monitoring

Transaction monitoring scrutinizes every financial transaction—wire transfers, card purchases and Automatic Clearing House payments—for red flags such as sudden spikes in value or out-of-pattern spending. Linking these insights to anti-money-laundering (AML) programs allows you to meet regulatory mandates and spot money laundering schemes in real time.

Account Login Monitoring

Login monitoring tracks authentication attempts, device fingerprints and geolocation shifts to identify brute-force attacks or credential stuffing. Machine learning flags anomalies like rapid failed logins or a trusted customer suddenly accessing the platform from an unfamiliar device.

Customer Lifecycle Monitoring

Fraud risk doesn’t disappear after login. Onboarding, password resets and customer service chats can all expose vulnerabilities. Lifecycle monitoring examines those non-transactional touchpoints and leverages session replay to reveal user intent, reducing false positives that frustrate legitimate customers. By replaying every click and field entry, analysts can quickly see whether a “suspicious” change of address is fraud or simply a user correcting a typo.

Insider Threat Detection

Employees and contractors can misuse privileged access, making insider fraud a growing concern. Continuous fraud monitoring establishes behavioral baselines—what systems an employee typically accesses, when and how often—then surfaces deviations like unusual after-hours database queries.

Credit Fraud Monitoring

Credit fraud monitoring protects lending and card issuance channels by correlating application data, historical repayment behavior and identity graphs to spot synthetic identities or rapid-fire credit requests. Generative AI tools can generate convincing fake documents in seconds, making advanced scoring models and network-level intelligence essential. By tying these insights back into your broader monitoring ecosystem, you create a holistic shield.

Why Is Fraud Monitoring Critical in Financial Services?

Fraud is more than an operational nuisance for financial services, it’s a direct hit to revenue and reputation. Unchecked scams can erode profit margins and force institutions to spend heavily on restitution, investigations and chargeback fraud management. Research shows that every dollar lost to fraud costs financial institutions an additional $4.41, underscoring the urgency of proactive defense.

Regulators raise the stakes further. AML, Know Your Customer (KYC) and Customer Identification Program (CIP) rules demand continuous monitoring and timely reporting. Non-compliance can trigger multimillion-dollar fines and personal liability for executives. Institutions that pair robust fraud monitoring with dedicated compliance solutions stay audit-ready while avoiding the operational drag of manual reviews.

The threat landscape is also evolving at breakneck speed. Real-time phishing kits powered by generative AI automate social-engineering attacks, flooding call centers with account-takeover attempts. AI-enhanced monitoring tools can recognize these patterns faster than humans, cutting detection times from days to seconds.

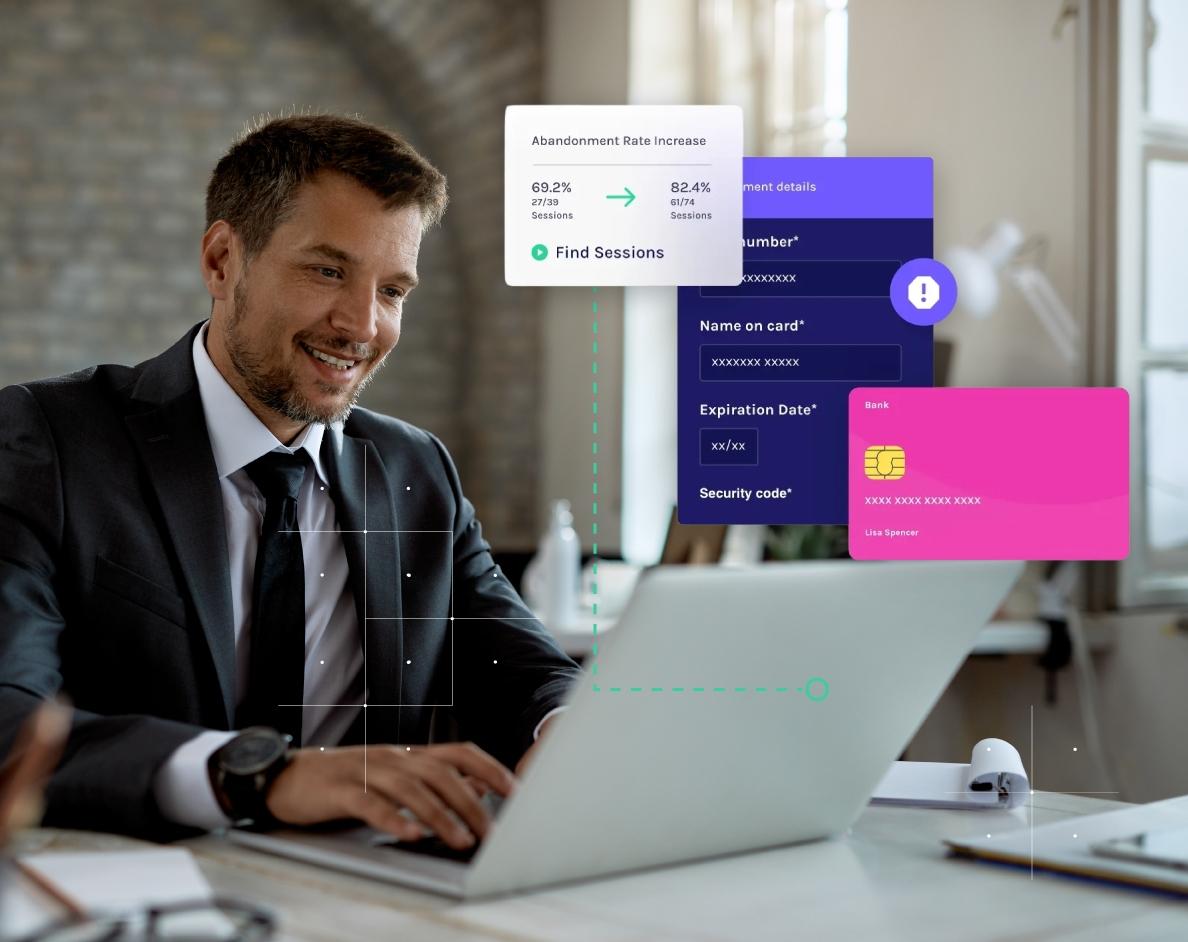

Beyond loss avoidance, financial service solutions that utilize intelligent fraud monitoring deliver a competitive edge. Customers expect frictionless access and airtight security; failing at either invites churn. Glassbox’s Fintech customer leveraged session behavior insights to detect suspicious activity, like enumeration attacks, without disrupting legitimate users. In one case, the fraud team identified 81 usernames accessed from 35 IP addresses across 15 devices, enabling faster investigations and more confident fraud decisions.

Also, by integrating fraud analytics with predictive digital experience analytics, you can create a virtuous cycle where insights improve compliance, compliance data enriches customer-experience models and both inform product innovation. This synergy positions forward-thinking institutions to outpace threats while delivering market-leading service.

How Fraud Monitoring Works

Effective fraud monitoring transforms raw data into real-time protection through a structured, AI-driven workflow. Modern platforms combine behavioral analytics, machine learning and continuous transaction monitoring to detect threats within milliseconds. Here’s how the process unfolds.

1. Data Collection

The journey starts with a wide net:

Web sessions, mobile interactions and in-app events

Payment data, fund transfers and other financial transactions

Device IDs, browser attributes and network metadata

Behavioral signals such as typing cadence and navigation speed

By unifying data across channels, institutions build a 360-degree view of each customer journey. Glassbox’s tagless capture enriches this layer by recording every click and field change without performance drag, laying a clean foundation for deeper analysis.

2. Behavior Analysis and Anomaly Detection

Machine learning models benchmark each user’s normal behavior, then flag deviations in real time. Unsupervised techniques highlight previously unseen fraud patterns, and session replay technology adds visual evidence to separate genuine customer struggles from fraudulent behavior. With anomalies identified, the system gauges their seriousness.

3. Risk Scoring

Dynamic risk engines assign fraud likelihood scores that update as new data flows in, blending:

Historical fraud patterns and velocity checks

Device reputation and geolocation shifts

Identity graphing correlations that expose synthetic profiles

Scores that cross predefined thresholds trigger alerts.

4. Alert Generation

When risk levels exceed policy limits, the platform issues immediate fraud alerts to analysts, case-management dashboards or automated workflows. Tuning thresholds with compliance tools ensures alerts align with AML and KYC mandates, capturing suspicious transactions without overwhelming teams. Granular context—session replays, transaction details and behavioral notes—travels with each alert for rapid triage.

5. Action

Based on urgency and business rules, the system can:

Block or hold the transaction for review

Trigger multi-factor authentication or step-up verification

Escalate complex cases to fraud analysts equipped with full session intelligence

Balancing user experience with fraud prevention is critical. Glassbox’s preventive analytics recommend the least intrusive intervention that still neutralizes risk, supporting broader preventative CX strategies.

Do Digital Banks Use Real-Time Monitoring?

Digital-native banks depend on real-time monitoring to keep pace with nonstop traffic and instant transactions. Unlike legacy batch reviews, always-on analytics evaluate every Application Programming Interface (API) request, card swipe and authentication event as it happens, slashing dwell time for fraudsters from minutes to milliseconds.

Behavioral insights are central to this strategy. By comparing keystroke speed, scroll patterns and device posture against historical baselines, AI can distinguish a frustrated customer making repeated password attempts from a credential-stuffing bot.

Scalability is another advantage. Cloud-native fraud monitoring platforms automatically scale during promotional surges, maintaining sub-second response times without manual intervention. For digital banks courting global audiences, this elasticity is the difference between seamless onboarding and headline-grabbing service outages.

Ultimately, real-time monitoring isn’t optional for new-age institutions, it’s table stakes.

How Technology Powers Modern Fraud Monitoring

Artificial intelligence and machine learning sit at the heart of today’s most effective fraud monitoring platforms. These models learn from billions of past transactions, update themselves in real time and spot patterns humans would never notice.

However, machine learning doesn’t work in isolation. Several complementary technologies strengthen your defenses:

Ongoing model training: Continuous learning reduces model drift and cuts false positives, ensuring legitimate customers sail through while fraudsters hit a wall.

Device fingerprinting: By analyzing hardware, software and browser attributes, fingerprinting ties activity to a unique device. When stolen credentials surface on a new fingerprint, risk scores spike instantly.

Identity graphing: Linking disparate identity signals—email, phone, IP, social handles—uncovers synthetic or stolen personas faster than manual reviews.

Anomaly detection with session replay: Visualizing every tap and swipe reveals the intent behind suspicious behavior. Analysts can see whether a rapid-fire form fill is a bot or a rushed customer, enabling precise interventions without harming user experience.

Together, these capabilities form a feedback loop where each insight enriches the next, creating a self-improving shield against emerging threats.

Elevate Fraud Detection with Glassbox

Ready to take fraud detection to the next level? By layering continuous fraud monitoring into its digital experience platform, Glassbox delivers unmatched visibility and speed. Session intelligence at scale, powered by tagless capture and session replay, uncovers user intent and accelerates case resolution. Real-time, AI-driven alerts flow directly into your case management or SIEM tools, ensuring high-risk sessions never slip through the cracks. And with open APIs, Glassbox integrates effortlessly into your fraud, AML, and CX systems, uniting teams around a single source of truth.

Glassbox’s advanced behavioral analytics and compliance-ready workflows help financial institutions detect suspicious behavior the moment it occurs. The result is proactive, real-time monitoring that strengthens security without adding friction. Whether you’re optimizing onboarding, securing high-value transactions, or staying ahead of regulatory demands, Glassbox gives your teams the context and confidence to act fast.

Future-proof your fraud strategy with a solution designed for modern banking. Explore Glassbox for financial services and compliance solutions or take a platform tour to see the technology in action.