Empowering the next generation: How BFSIs can improve customer financial literacy

New Glassbox survey reveals consumers want more financial advice from their banks and financial institutions to navigate a challenging economy.

Tossing aside avocado toast and DIY coffee brewing–it's time to talk real-world financial advice. In an economy where the market is as unpredictable as the weather, how are consumers gearing up to take charge of their finances? That’s why this month, we decided to interview 1,000 U.S. consumers to better understand how people are feeling about their financial prowess, how financial institutions are helping customers during tough times, and why customer experience is more important than ever.

The changing tides of the economy and the absence of safety nets

When the financial tide gets choppy, people sometimes look to financial institutions for that metaphorical life jacket. According to our research, however, 64% of respondents have experienced financial difficulties during the recent economic downturn but here's the eyebrow-raising bit–more than half (58%) of those didn't receive any advice from their banks or financial institutions. This got us thinking about the roles these institutions play when things get wobbly.

According to the research, 55% of consumers felt financial institutions weren't doing enough when it came to preemptively addressing concerns during tough economic times. Considering the financial sector is the engine room of our economy, this is a huge missed opportunity for banks and financial institutions to engage and support their customers in meaningful ways–leading to increased customer satisfaction and loyalty, which in turn drives better overall business performance. Leaders in the financial services space shouldn’t just be looking at proactive financial guidance as a nice-to-have feature, but rather as a revenue-generating competitive differentiator, as 87% of those surveyed would be more likely to engage with a banking institution that demonstrates a strong commitment to consumer financial education and responsive support during challenging times.

Adding a personal twist to customer experience

As our world whizzes towards a future of automation and digitization, our study also reminded us that the personal touch still packs a punch. More than half (57%) of those surveyed said they preferred good old-fashioned human interaction when navigating financial uncertainty. What’s even more interesting is that this sentiment struck a chord across generations, especially with the baby boomers (62%) who said "no thanks" to automated solutions. Surprisingly, even the tech-savvy millennials (50%) and Gen Z (39%) squads agreed they prefer speaking with live agents, proving that the human touch continues to be a timeless and effective engagement tactic.

How banks can help create financial superheroes of tomorrow

While money may not buy happiness, having strong financial literacy can certainly ease economic woes and anxieties. Our research revealed that only 51% of consumers had a moderate level of confidence in their financial knowledge. For banks and financial institutions, this presents a profitable untapped opportunity. But what are they looking for? According to our survey, 62% of respondents expressed a clear desire for personalized offers and incentives tailored to their financial needs, such as lower loan rates or higher yield savings account interest rates. They were looking for more than just a financial life jacket; they wanted a tailored approach that could help them weather the financial storm with confidence.

Millennials and Gen Z, today’s digital dynamos, are thirsting for knowledge. A whopping 88% of millennials and 82% of Gen Z would prefer to bank with institutions that provide consumer financial education, especially when times get tough. These younger generations also want it easily accessible, with 41% of millennials and 37% of Gen Z more likely to trust their mobile apps and web platforms for financial guidance than just 24% of baby boomers.

The survey makes one thing abundantly clear–if they want to deliver a strong customer experience, the financial sector needs a strategy that blends technology with the human touch. When the going gets tough, financial institutions need to be ready to support their customers of all generations and across the entire spectrum of financial literacy, and that means meeting customers where and how they want to engage.

By embracing a hybrid model that combines technological advancements with the human touch, financial institutions can empower individuals to navigate economic challenges more effectively. As millennials and Gen Z emerge as eager learners, prioritizing financial education through mobile apps and web platforms can create a more informed and financially resilient future generation. It's time for the financial sector to take a proactive stance, ensuring that consumers receive the support they need when they need it, to build a brighter financial future for all and to support their own longevity by building a more loyal and financially savvy customer base.

It pays to know what your BFSI customers really want

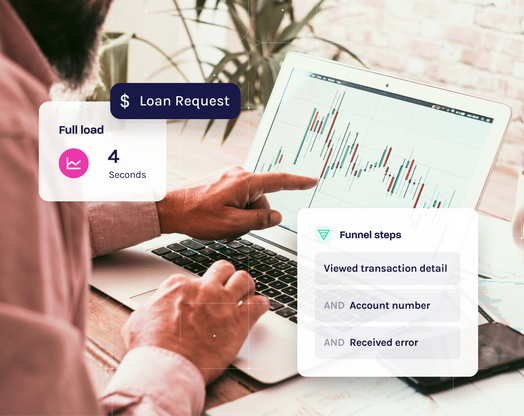

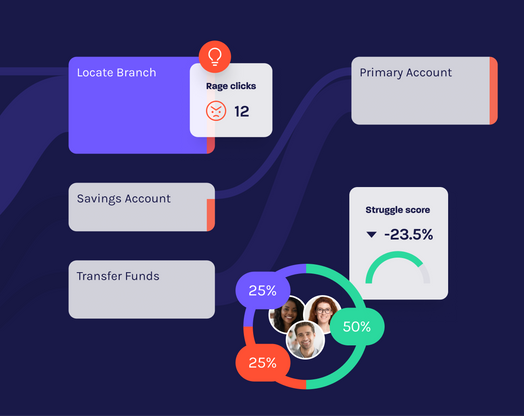

A digital experience intelligence (DXI) platform like Glassbox can give your team a deeper understanding of the customer experience so you can make meaningful improvements that impact brand loyalty, customer retention and revenue. Learn more about Glassbox's Financial Services platform.