FCA Plan & CX in Financial Services

We are barely halfway through the year and the world is reeling from all that 2020 has thrown at us. The pandemic has paralyzed the UK, countless individuals have dealt with personal tragedies and even more, professional and financial uncertainty. As we tried to process the steady stream of unprecedented events to hit lockdown Britain, consumers rewrote their terms of engagement and industries changed beyond recognition.

In financial services, online transacting rocketed as cash usage halved and call centers jammed with fraught customers reaching out for help. Customers who had only ever banked in-branch were suddenly making big decisions online. And as fraudsters preyed on distracted consumers, the UK’s ‘vulnerable’ population reached double the size recorded a year previously.

The Financial Conduct Authority’s (FCA) 2020/21 Business Plan reflects these turbulent times with much attention being paid to vulnerable customers and the increased use of digital channels. Keep reading for a summary of their guidance and what it means for financial services firms.

The challenge with digital conduct risk

The online delivery of financial solutions has been somewhat stalled to date by industry uncertainty over the practicalities of digital conduct risk and the lack of specific rules for online engagement. But as the pandemic left firms no choice but to change gear, the FCA duly followed suit, overhauling its annual Business Plan to focus on the need and the delivery of conduct in this heightened digital age.

Changes in guidance to support digital adoption

A long-standing ‘go-to’ for understanding the regulator’s priorities and concerns, no stone has been left unturned in this year’s 25-page document. Having openly stated at the start of the crisis that firms should “provide strong support and service to customers during this period,” the document leads by example, referencing the “rapid action” taken “to respond to the immediate shocks and urgent interventions required in the coronavirus emergency.” But whilst Covid-19 may have been the catalyst that accelerated the adoption of digital channels, these changes are part of a longer term trend that has seen a steady growth in the use of online and mobile apps for financial services.

Breaking down the regulator’s recommendations

The FCA has worked tirelessly but realistically to get a hold of this new landscape, taking drastic steps over the last few months to give firms the leeway they need to “be clear and transparent and provide support as consumers and small businesses face challenges at this time.”

As banks reopen and consumers blend online with face-to-face services, firms have a renewed challenge: complying and tracking the multi-channel and increasingly personalised customer journey. As we look beyond the here and now, the FCA’s focus will turn to four medium-term objectives, engineered to help firms maintain robust digital operating models and protect consumers in an increasingly online world:

- Enabling effective consumer investment decisions

- Ensuring consumer credit markets work well

- Making payments safe and accessible

- Delivering fair value in a digital age

Transformation for the digital age

The regulator has emphasised the role digital operating models should play within financial businesses. Its message is clear: pandemic or not, we need to prevent or reduce harm to consumers and markets alike. Yet more change is afoot as the FCA says the current regulatory framework is too focused on rules and process, and not enough on principles and outcomes.

“As the industry squares up to the future, financial providers can expect to be increasingly viewed through the same lens as their typically better-oiled retail counterparts. As normality prevails, customers will have little patience for firms who get it wrong, but for those who get it right, the opportunities will be immense.” – Dr Sian Lewin, co-founder at RegTech Associates

Sector focus for industry-wide change

The UK financial sector is vast. Yet, with a diverse customer base comes myriad financial needs and solutions and a multitude of issues and challenges. The regulator’s Sector Views sets out a series of recommendations for the seven financial cohorts – retail banking and payments, investment management, wholesale financial markets, insurance and protection, retail lending, pension saving and retirement income, and retail investments.

While the FCA has decided to focus its resources on those markets where it sees the greatest potential harm, a series of common cross-sector threads will drive industry-wide change for the better.

- Culture in financial services: driven by purpose, leadership, people management and remuneration and governance

- Operational resilience: business continuity planning and preparedness for inevitable and unexpected disruption

- Financial crime and anti-money laundering (AML): maintaining momentum on preventing money laundering and scams

- Innovation and technology: continued collaboration between the industry and the FCA in enabling advances across products and services and maximising data

- Investment Management: embedding the SM&CR (Senior Manager & Competency Regime), driving and utilising effective oversight, and the provision of suitable products and services

The link between CX & compliance

To address digitally-driven challenges, the industry must be armed with digital solutions and expertise. As the regulator commits to transforming its own working practices and ideals, the plan stresses its expectation for market players to work collectively and innovate for the best consumer and business outcomes.

Disruption presents opportunity, and there’s everything to play for. With sophisticated data and in-depth analysis, businesses can offer targeted, personalised solutions via unique digital customer journeys. And as truly multi-channel customer engagement becomes the norm, the financial providers who can deliver a suitable and seamless customer experience across every touchpoint will succeed in turning today’s opportunity to their advantage. Digital CX and digital compliance are converging.

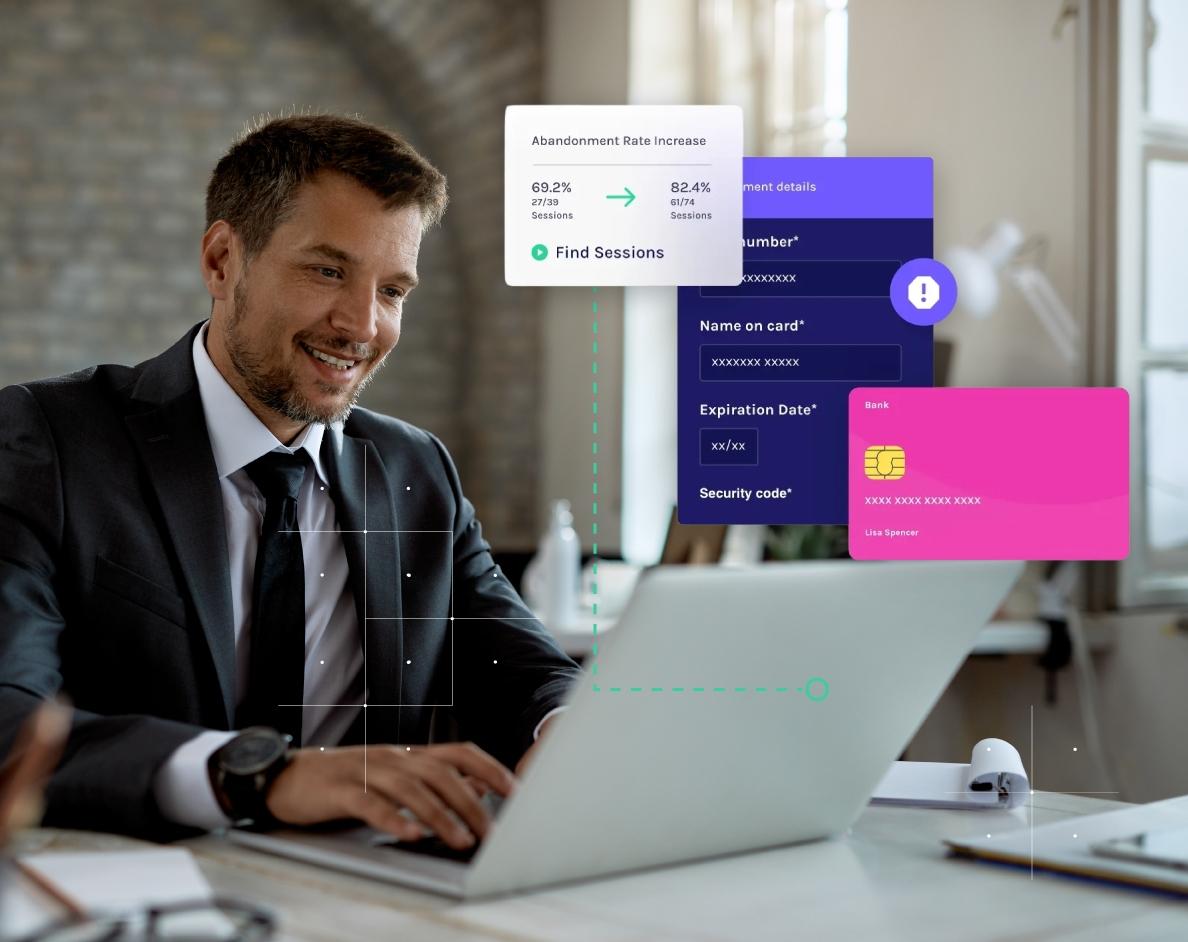

The Glassbox advantage

A powerful, enterprise solution, Glassbox provides a single view of customer behavior at every stage of the digital journey. The unique ‘One Digital Truth’ perspective enables collaborative, cross-functional working and the ultimate delivery of targeted digital products and services. Designed and built for compliance in data-sensitive environments, Glassbox empowers organisational teams with the insight they need to deliver compliant and effective digital business models.

Fast installation means firms can adapt quickly to heightened digital demand, while bespoke features such as compliance monitoring and automated alerts ensure businesses and their customers stay firmly on the right side of change.

Now’s the time to get serious about digital

Explore the opportunities we have unearthed in the Business Plan in our white paper, Clarity in a Crisis: Driving Digital Conduct in a Pandemic Age. You’ll get practical ideas of how financial firms can maximize these opportunities through technological investment and easy adjustments.