7 key trends shaping the future of mobile banking

Mobile banking is quickly becoming the primary way that people access finance and investment services. In this blog, we examine the seven mobile banking trends that are shaping the future.

Modern banking customers are spoiled for choice

A recent study from Chase revealed that two out of three respondents can’t live without their banking app.

And it’s no surprise—in recent years, banking apps have sprung up from all corners of the finance world. From traditional banks to just-launched fintechs, everyone is offering better ways to access and manage money.

It’s a great time to be a bank account owner. But all this technological competition means that you need to step up your mobile banking app game.

To have that go-to banking app that everyone wants, you need to understand the latest mobile banking trends—and then build a frictionless, user-centered experience around them.

In this blog, we’ll dive into:

How mobile banking works

How mobile banking has evolved in recent years

Seven mobile banking trends you need to know about

Let’s get started!

What is mobile banking?

Mobile banking is a technology ecosystem that allows people to carry out banking activities on their mobile devices. These activities can range from simple actions, like checking bank balances, to applying for loans or transferring large sums of money.

While mobile banking technically began in the 1990s, its popularity has skyrocketed in recent years due to the internet revolution. Most people now have smartphones with fast internet connections, giving them access to mobile-optimized banking apps and services.

What’s more, banks are now incentivized to provide fast, convenient banking technologies. Today’s consumers want convenient, modern digital experiences—and banks that don’t keep up will lose out to faster, smarter competition.

How does mobile banking work?

Most mobile banking today is done via apps rather than internet browsers. Apps allow banks to have greater control over the security of their service and to collect data they can use to optimize the user experience.

The mobile banking experience starts with the customer logging into the app. Banking apps don’t usually save your bank details—instead, they connect to a secure data center owned by the bank. The app uses a HTTPs connection to communicate with the bank while keeping all data fully encrypted.

Delivering convenient, safe banking experiences

When a user wants to perform a transaction, the app sends a request to the bank’s application programming interface (API), which is like an information exchange. The bank then performs the same checks it does in other situations—like when a user withdraws cash from an ATM.

Finally, the bank returns an authorization or sends the requested information, and this is displayed on the app’s user interface. While the app performs countless security checks and information exchanges “behind the scenes,” a well-optimized interface will create a simple, enjoyable experience for the user.

The history of mobile banking

Basic mobile banking started in the 1990s, with some banks notifying users about transactions and bank balances via SMS message. In the early 2000s, phones started featuring wireless application protocol (WAP) technology, enabling internet access. Banks began offering limited access to payments, transfers and statements through mobile websites.

However, the landscape evolved by leaps and bounds in the 2010s as early smartphones became popular. Banks started creating dedicated banking apps that allowed customers to carry out a wide range of transactions and banking activities from their phones.

Adapting to modern user needs

In the 2010s, mobile wallets became widespread, allowing users to make in-person payments with a tap of their phone. Banks also began offering open APIs to allow other providers to access their data. With this capability, third-party providers could begin to create new services—such as accounting and peer-to-peer payment apps.

Now in the 2020s, providers continue to evolve their services in line with mobile banking trends. Digital-only neobanks are taking advantage of the modern consumer’s love for convenient mobile experiences. Often able to innovate faster than traditional banks, neobanks offer ultra-modern banking apps with integrated investment, savings, accounting and currency exchange features.

Key mobile banking statistics

In the first quarter of 2023 alone, over 63% of US bank account holders processed banking matters on their smartphones or tablets.

89% of consumers, including 97% of millennials, use mobile banking.

60% of smartphone users prefer using a finance app over a mobile site to check their investments.

48% of account holders use mobile banking to transfer money between accounts or send money to someone. In comparison, only 38% do it via their desktop computer.

29% of millennials are likely or very likely to open a deposit account with digital-only banks, compared to 5% of baby boomers.

56% of negative mentions of banking apps on social media are related to technical issues, and 17% of negative mentions are related to crashes.

7 mobile banking trends that you need to know

Both traditional banks and neobanks are working hard to win customers through innovation. The latest mobile banking trends suggest that customers want convenience, security and a user-centered banking experience.

1. Cardless ATM withdrawal

Consumers increasingly want fast and convenient financial experiences—even when withdrawing banknotes.

Banks now cater to this by offering cardless ATM withdrawal, which typically works via a banking app on the user’s mobile phone. Users can generate a QR code or tap their phone on the ATM’s near-field communication (NFC) sensor to authorize a withdrawal.

2. Biometric authentication

Since banking apps can be used to send money, users want to be sure that nobody can access their accounts. Biometric authentication assures that even if somebody else gets a user’s phone (or password/PIN), they can’t log into a protected account.

Biometric authentication works by scanning the user’s fingerprint or using the phone’s camera to scan the user’s face. The app will only grant the user access to their bank account if it can verify their identity as the account holder.

According to a report from Cisco, 81% of smartphones have biometrics technology, making this security option widely available.

3. AI-powered chatbots

AI-powered chatbots are a support function that users can access through their mobile banking app. They allow users to get help faster by answering their questions, handling requests, and directing users to further help resources when necessary.

With AI improving rapidly, some chatbots can now handle sophisticated tasks like making financial recommendations to users. They can also help onboard new customers, decreasing churn and improving customer satisfaction and retention.

According to a study by Juniper Research, chatbots will save banks up to $7.3 billion worldwide by 2023. Bank of America’s chatbot, Erica, was launched in 2018 and, to date, has had over 1.5 billion interactions with the bank’s customers.

Bank of America’s chatbot gives customers fast answers to banking questions.

4. More features and services available through the banking app

Banks are continually increasing the capabilities of their apps to give users more control and convenience. For example, Starling Bank allows users to download statements, make automated payments to staff, and open additional accounts directly from their app. Meanwhile, Monese offers customers an interest-free loan service designed specifically to build up the customer’s credit score.

This makes banking more convenient and flexible for customers while reducing the demand for customer support staff on the bank’s side. It can also help banking customers resolve issues faster. For example, if a Capital One customer loses their physical banking card, they can lock their account directly from their banking app.

5. Voice banking

Voice recognition technology has become increasingly sophisticated recently, and banks are integrating it into their mobile services. Some banking apps now use voice recognition to verify the user’s identity when they log in, providing additional security with added convenience.

In addition, some third-party apps are now syncing with banks to allow users to make payments via voice command. For example, Barclays Bank customers with iOS devices can use Siri to authorize payments simply by speaking. Amazon’s Alexa also enables customers to make voice payments through Amazon Pay, which connects to the user’s bank account.

6. Personalization and customization

Many banking apps now give users personalized updates and recommendations about their finances. These can include simple notifications when a payment leaves their account, through to helpful summaries of how the user is spending and saving.

UK bank Monzo gives users personalized updates on their bills, spending, and investments.

What’s more, many banks are enabling customers to customize their banking service through their app. For example, digital bank Revolut allows customers to set daily, weekly, monthly or quarterly spending limits to get greater control over their finances. Similarly, Chase Bank’s app allows users to automatically move a portion of their income to a separate savings account.

7. User-centered experiences

Innovative neobanks are winning customers over by creating exceptional app experiences. This includes centering user needs by enabling easy authorization, facilitating rapid payments, and offering helpful visualizations of spending.

Revolut gives users helpful breakdowns of their spending.

Some banks go even further by making banking fun. One great example is Ukraine’s Monobank, which introduced gamification to its banking app. Users can earn badges as they complete tasks, like splitting a bill with a friend or spending money abroad.

Monobank’s app uses gamification to make banking a satisfying experience.

However, user-centered design is also vital because many users do not yet totally trust banking apps. One study found that 46% of banking app users are concerned that their accounts will be hacked.

For this reason, neobanks are investing heavily in building apps that are optimized for their customers. This includes continuously gathering customer feedback, fixing errors and making it a priority to give users an easy, frictionless experience.

Go further to create stellar mobile banking experiences

If you’re keeping up with the latest mobile banking trends, you’re on the way to creating a winning banking app. But building innovative features is only half the challenge. To create an app that users love—and trust—you need to understand their journeys and perspectives.

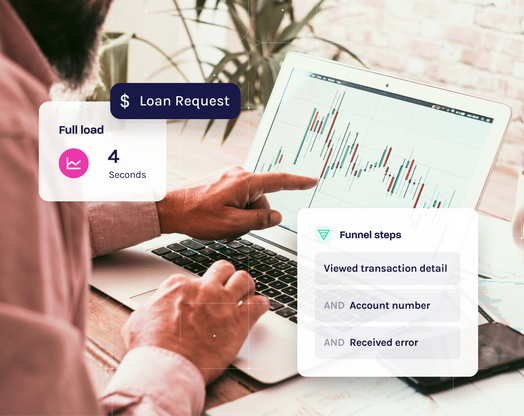

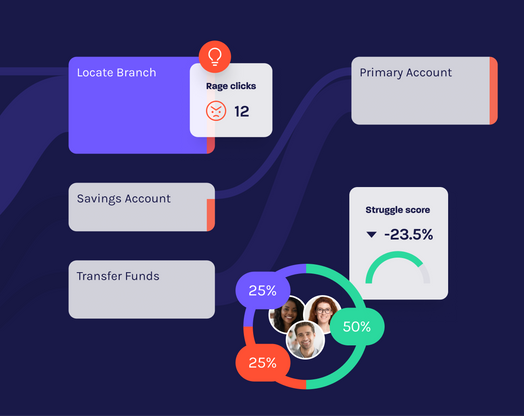

Traditional mobile analytics will help you see what users are doing, but they won’t reveal why. A digital experience intelligence (DXI) platform gives you a complete picture of your customers so you can see why they behave the way they do.

By viewing app performance, customer sentiment and user behavior from a single platform, you can get to the heart of what your customers need. Discover Glassbox today.