The FCA’s new Consumer Duty: Are your digital channels ready?

The wait is over, and we now know what the FCA (UK Financial Conduct Authority) expects from firms in its new Consumer Duty. And fortunately, the final rules and guidance don’t introduce drastic or unexpected changes when compared with the previous draft consultation.

Time is of the essence for the new Consumer Duty

The most obvious change is around the implementation date. The FCA has listened to the feedback from the likes of UK Finance, which pointed to the scale of change required to provide the capabilities and data to monitor customer outcomes and to provide evidence that the four outcomes have been achieved. And as a result, the deadline has been extended by 3 months to the end of July 2023 for new and existing products, and the end of July 2024 for closed books.

However, the extension comes at a price. The FCA has set out interim deadlines for firms to make sure that progress is made. The first key date arrives in just 3 months at the end of October 2022 when firms are required to get their board to approve the implementation plan. This must include any new technology that will be necessary to provide the capabilities and data to meet the Consumer Duty’s requirements.

The digital imperative

If you’re familiar with Glassbox, you won’t be surprised that we’re focused on the implications of the Consumer Duty as it relates to digital channels. Below are 5 key digital capabilities the Consumer Duty will require of all firms:

1. Digital record keeping

The growth of AI to drive the personalization of customers’ web and app experiences means that firms should have the ability to capture and replay individual sessions and use the data to ensure that customers receive good outcomes. Not every session will need to be retained for the same length of time, so firms should be able to define the retention criteria for individual sessions. You will also need to decide if they need to capture PII to meet the Consumer Duty requirements. You can read more about digital record keeping here: Digital Record Keeping: Q&A with Emily Overton, Records Management Girl

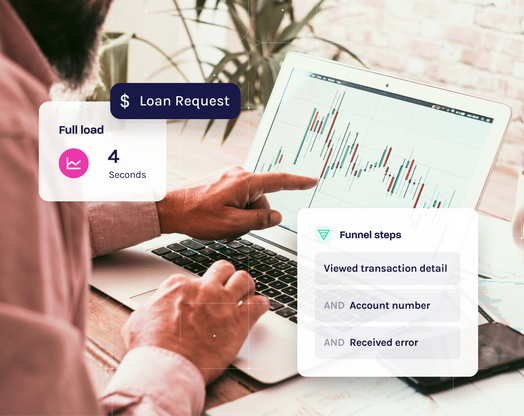

2. Monitoring

Firms have thousands or millions of sessions on their website every month. As well as keeping a record of those sessions (as you do customer phone calls), firms will need to monitor those sessions and be alerted to signs of customers who are struggling or behaving in a way that suggests they may not get the outcome they want. Firms can decide how they want to react – a real time offer of support or an offline follow up. Firms need to be able to support individual customers as well as aggregating the data into a macro picture. There is more information about monitoring digital channels here: How digital conduct monitoring can keep your customers safe.

3. Complaints

Firms are already subject to detailed requirements for dealing with complaints. But the Consumer Duty puts an emphasis on complaints and using the data from them to test if consumers are getting good outcomes, and if not, why. Firms need to be able to use complaints data to find other customers experiencing the same issues or outcomes. In addition, firms need complete records to be able to carry out comprehensive root cause analysis to identify if the issue is the customer journey, content, browser, device, customer – or some combination of the above. Read more about complaint analysis and resolution here: FCA complaints growth adds pressure to track digital interactions.

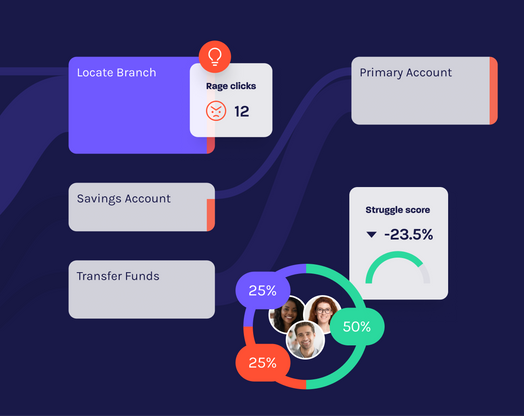

4. New sources of information

In the guidance from the FCA, it talks about new sources of information. This list is not exhaustive, but it includes behavioral insights, root cause analysis, A/B testing, user timeline, complaints, struggle analysis, voice of customer and more. Many of these sources of information are used to enhance customer experience. But the difference in a Consumer Duty context is that rather than keeping data for a couple of weeks (which tends to be the CX requirement), firms will need to keep data on digital interactions for longer. The Consumer Duty calls for CX information to be viewed through a conduct prism.

5. Reviews, investigations and outcome testing

The Consumer Duty calls for firms to keep records to evidence that the 4 outcomes have been achieved. That data can be used to undertake outcome testing and populate dashboards and reports to the board, as well as to support past business reviews when required. You can read more about this here: Avoid business risks of buy now, pay later loans.

Your digital call to action

The first priority is the development of a credible implementation plan by the end of October. The good news is that technologies like Glassbox’s Digital Experience Intelligence platform provide the capabilities to both monitor and capture sessions in digital channels, giving you a fast-track to building your the implementation plan. If you’d like to learn more about how Glassbox can help you meet the requirements of the Consumer Duty, we’d be delighted to show you how. Please contact us or request a demo.