Recent fines should make financial firms question if they’re doing enough to support vulnerable customers

During the pandemic, there has been a sharp increase in the number of customers turning to digital banking. The FCA in both its draft “Guidance consultation: fair treatment of vulnerable customers” (GC20/3) and the “Business Plan 2020/21” has made it clear that it expects firms to look out for signs of vulnerability and help customers – including those using digital channels.

Whilst we await the publication of the FCA’s final guidance on the treatment of vulnerable customers, now expected in Q1 next year, it was announced this week that a large UK bank was fined. It’s a timely reminder of how important the issue of vulnerable customers is. The bank was fined £26m for the way it treated more than 1.5 million borrowers in financial difficulties who fell behind on credit card and loan payments between 2014 and 2018.

The FCA said the bank “failed to treat customers fairly or to act with due skill, care and diligence”. They also warned lenders about mistreating customers facing financial hardship during the Covid-19 crisis. And this is not the first time that the FCA has stepped in; there was a similar issue in June this year when another major bank was sanctioned for the way it handled vulnerable customers. When you add in the cost of redress, the violation cost the banks over £600 million.

Growing focus on vulnerable customers

While the fines relate to issues which pre-date Covid-19, it is important to remember that the FCA has issued updated guidance on how vulnerable customers, including those in financial difficulty, should be treated through this exceptional period.

The Financial Conduct Authority (FCA) defines a vulnerable customer as “someone who, due to their personal circumstances is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care.” The FCA estimate that around half the UK population meet their definition of vulnerability—so this is not an issue affecting a small minority.

Now that most customer enquiries are being executed online and via mobile apps, there’s an increased focus on how financial services firms can protect customers on digital channels while fulfilling regulatory obligations. Vulnerable customers should be a big priority for your digital transformation efforts.

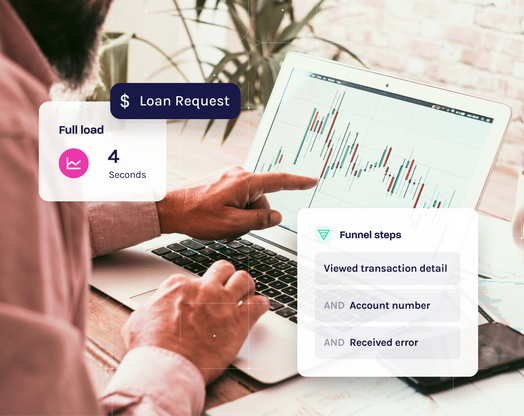

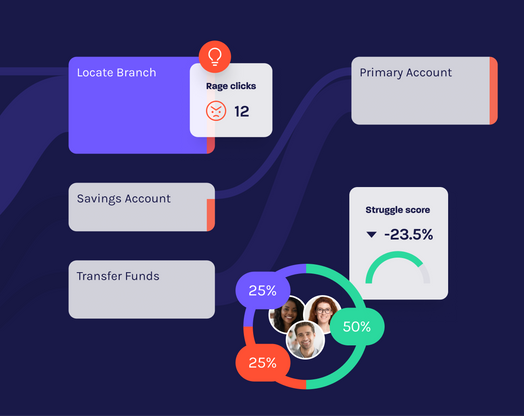

Digital experience analytics solutions automatically capture, monitor, and analyze customer behavior on mobile apps and websites. With capabilities like artificial intelligence (AI), the firm can learn what behaviors fall within a “normal” pattern and those that fall outside of the pattern that could show signs of vulnerability like multiple attempts at completing a form, going backwards and forwards within an application process, or excessive time spent on certain types of content. By identifying sessions in which a user has shown these indicators, customer support staff can reach out to vulnerable customers proactively to ensure the firm is delivering on their duties to customers.

There are growing concerns about vulnerable customer as a result of the coronavirus crisis, and we’ve been reminded this week of the consequences for banks when they fail to provide sufficient levels of care. Firms will be under increasing regulatory pressure to ensure the fair treatment of vulnerable customers, and putting the right solutions in place to monitor digital channels should be a key priority.

Learn more about how to protect vulnerable customers on your mobile app and website with our white paper, Vulnerable Customers & Digital Channels.