3 ways to boost banking cross-sells and upsells with better CX

What do Kevin Hart, AI and Amazon recommendations have in common? They’re all (probably) influencing your clients right this very minute. When consumers carry around expectations for lightning-fast, hyper-relevant digital experiences from their latest Netflix binge to their banking app, cross-selling and upselling financial products requires a whole lot more than segmentation and finely tuned campaigns.

The most successful cross-sells and upsells aren’t just recurring initiatives, but key components in a broader motion that makes any client feel like a real actual human rather than a faceless account.

For J.P. Morgan, that meant recruiting comedian Kevin Hart for an online video series focused on financial coaching challenges. For Bank of America, that meant taking chatbots to the next level with Erica, an AI-enabled “financial assistant” that has logged 1.5 billion interactions since launching in 2018. And you don’t need to look any further for spot-on product suggestions than Amazon—as Chandler Bing would say, could they be any more relevant? No wonder Amazon earns 35% of its annual revenue from cross-selling.

These are the same hyper-personalized experiences customers crave when it comes to financial products—37% of customers want their bank to be “more like Amazon.” Like it or not, you aren’t just competing with your direct competitors, but any company that’s continually pushing the envelope to offer a better, deeper, more nuanced customer experience (CX).

But what does CX-driven selling actually look like in practice?

In this post, we’ll take a look at some common pitfalls that make personalization feel hollow, and how to cross-sell and upsell more effectively with standout CX instead.

The problem with personalization

By professional estimates, a bank can achieve up to $300 million in revenue growth for every $100 billion in assets just from personalizing its customer interactions. And yet for that untapped opportunity, clients are still routinely underwhelmed:

28% of financial institutions send the same messaging to all their customers.

34% of financial institutions manually leverage data for segmented messaging.

Just 15% of financial institutions leverage connected data to send highly personalized communications.

91% of CEOs believe customer-centricity is essential to business growth, yet just 31% of US customers believe their bank is customer-centric.

Only 21% of banking customers are completely satisfied with their provider’s digital experience.

More than half (51%) of banking customers who switched providers in 2022 did so for a better digital experience.

Impersonal digital experiences don't just hinder cross-sells and upsells, but retention as a whole. A whopping 62% of customers would switch to a different financial services provider if they felt treated like a number. This frequently occurs when interactions are personalized enough to signal that you’re aware of the importance but not enough to actually offer real value to your customers. As a result, the entire banking customer experience can feel hollow, even insincere.

BCG describes true personalization as “grounded in developing a deep understanding of each customer’s unique needs and orchestrating a set of tailored experiences across digital and human channels.”

A CX-driven approach to cross-selling and upselling does exactly that.

3 ways to implement CX-driven cross-selling and upselling

CX has turned personalization—and, by extension, cross-selling and upselling—on its head. It’s not just about the products, but repeatedly demonstrating that you value and understand every single client. This is becoming increasingly critical to attract and retain banking customers:

73% of all customers expect companies to understand their unique needs and expectations—up from 66% in 2020.

Customer-centric companies are 60% more profitable.

61% of banking customers want personalized recommendations.

72% of customers rate personalization as “highly important” for financial services.

With CX-driven cross-selling and upselling, customers don’t buy more products because they were swayed by a rep or generalized promotion. It’s because their bank has consistently demonstrated an effort to deliver as much value and satisfaction as possible. So what does this actually look like in practice? Here are three ways to leverage CX technology and best practices:

1. Optimize account onboarding

It’s tough to cross-sell or upsell if your customers don’t even make it through onboarding. A lackluster sign-up flow can doom your efforts from the get-go, especially considering:

The majority (71%) of customers want their financial services provider to offer a clear digital process for opening an account.

41% of customers who try non-traditional financial services do so because of easy setup and onboarding.

57% of consumers would choose a financial services organization like PayPal over a traditional bank.

Opening a new bank account or applying for a credit card isn’t as easy as ordering a Halloween costume for your dog. But even if your customers have to provide more information than they would with other purchases—or go through additional steps like ID verification—you can still make it a relatively painless process with:

Auto-complete, auto-suggest and predictive search to help customers fill out fields faster

Typo-tolerance to process form fields with spelling errors

Fields pre-populated with data from prior interactions (for example, if a customer peaces out halfway through signing up for an account, then returns at a later date)

Real-time form personalization, like incorporating the customer’s name in subsequent form questions

Process bars to indicate how far customers have left to go

Simple, concise language without any industry jargon or complex terms

2. Incorporate cross-sells and upsells naturally into the customer journey

Effective product recommendations are highly relevant and contextual to individual needs at any point in the customer journey. Think of Amazon’s “Customers also bought” feature—it doesn’t come across as pushy, interruptive or even salesly. On the contrary, it actually feels helpful, like Amazon is trying to figure out which one of their bajillion products you actually want and need.

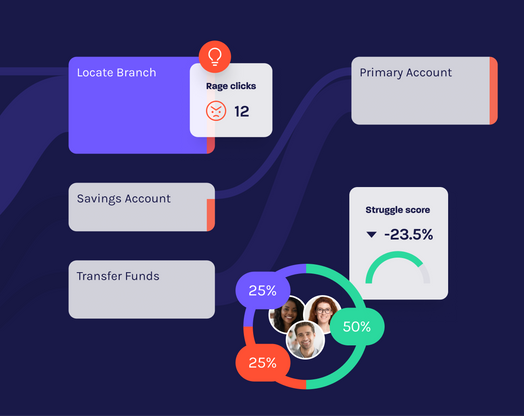

Now, automating product recommendations with Amazon-level accuracy can be a tall order, even if you have the ability to measure every tap, click and swipe. AI-enabled technology like digital experience intelligence (DXI) consolidates interactions to form a 360-degree view of the entire customer journey, contextualizing real-time behavior to uncover the why behind the what. In identifying patterns and predicting behavior—including product suitability—DXI makes it easier to surface the right offer to the right customer at the right time.

However, you don’t have to limit your recommendations to the products themselves, but also how to use them. More than half of consumers (51%) want more help than they’re getting from their financial provider, and 40% are “unhappy” about the generic advice they’ve received. Providing tools and resources to track spending, set budget goals and make more informed financial decisions doesn’t just increase opportunities to naturally incorporate cross-selling and up-selling, but also communicate how much you value your customers.

3. Expand personalization to technical devices

Surprisingly, personalization has a strong technical component. It doesn’t just mean treating customers as individuals but enabling them to interact just as easily with your app or website across any device. This may sound obvious, but it’s actually a lot harder to implement than simply differentiating between mobile and desktop layouts.

The quality of your customers’ digital experience can vary greatly depending on an exhausting number of technical variables, including their operating system, platform version, screen resolution and pixel density. Autonomous CX leverages generative AI to respond to customer behavior and essentially self-correct sources of friction as they occur. Since customers will have greater exposure to products the more time they spend with your site or app, enhancing real-time interactions can directly benefit cross-selling and upselling.

Back to you

If personalization is the key ingredient to effective cross-selling and upselling, then CX is the secret sauce. When the entire customer experience is designed to make each client feel appreciated and understood, your offerings become just another way for them to derive as much value and satisfaction as possible. This not only increases trust and strengthens relationships, but increases the likelihood of customers sticking around for the long haul.

For more tips and tricks for delivering seamless CX in banking, check out the blog Delivering exceptional customer experience in banking: 6 strategies for success.