Customer Journey Mapping for Banking CX Success

Updated 10/2/2024

Think about those apps you actually use in your daily life—Netflix, Amazon, Spotify. What do they have in common? They all offer seamless, personalized experiences that are highly relevant to your specific needs in any moment.

This is what your customers expect from any digital interaction they have with your bank. But how do you connect the dots across so multiple flows and product lines to offer a single consistent experience — one that turns customers into loyal evangelists?

You start with customer journey mapping. This guide tells you how. We’ll cover:

- Why customer journey mapping is so critical to meet customer expectations

- How to stay on top of changing customer behavior

- Steps and best practices to effectively create a customer journey map [free template included!]

Let's get into it!

Key takeaways:

Customer journey mapping helps identify areas for improving and optimizing your customers’ experience (CX) with your bank.

Traditional banks are under threat from digital-only banks as they gain favor, making CX even more important to differentiate.

Effective journey mapping requires you to source customer feedback and track their behavior across your website and app to make customer-centric changes

What is customer journey mapping in banking?

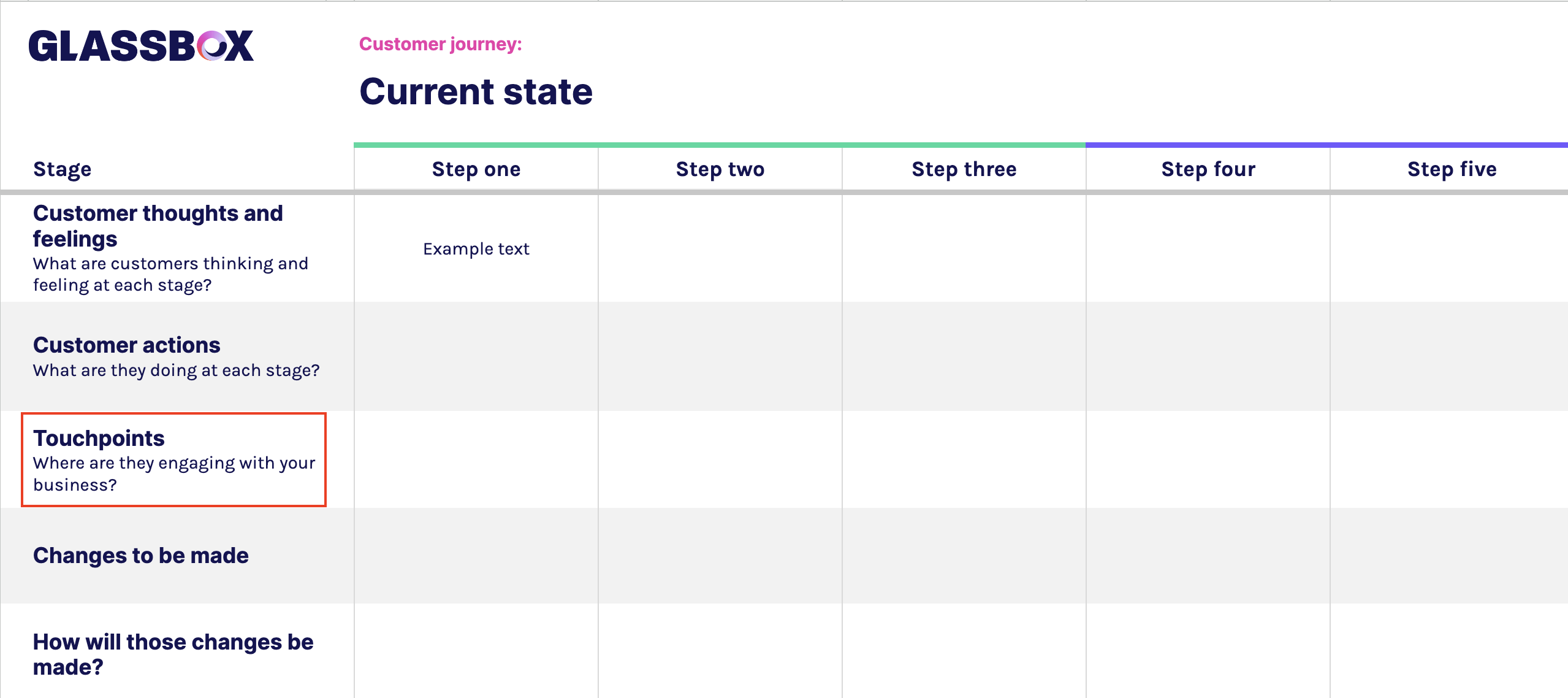

A customer journey map is a step-by-step visual breakdown of how customers engage with your bank’s products and services—capturing their actions, thoughts and emotions throughout the interaction.

By visually mapping the interaction, you can uncover key insights like:

The behaviors customers exhibit

What they’re engaging with on your website or app

What actions they take or don’t take

Where there are areas of struggle or friction

In turn, these insights help you improve functionality, fix errors and identify opportunities to increase conversions or decrease time-consuming roadblocks.

Put simply, customer journey mapping is critical for making informed, customer-centered changes to your website and product.

Use these journey maps in the planning stage as well as when you’re optimizing existing customer experience. And since customer behaviors are always changing, you’ll want to consistently revisit these maps to monitor their interactions and proactively remove hurdles from their pathway.

Each time you make one of these maps, you’ll want to define its scope so your efforts are focused—more on this below.

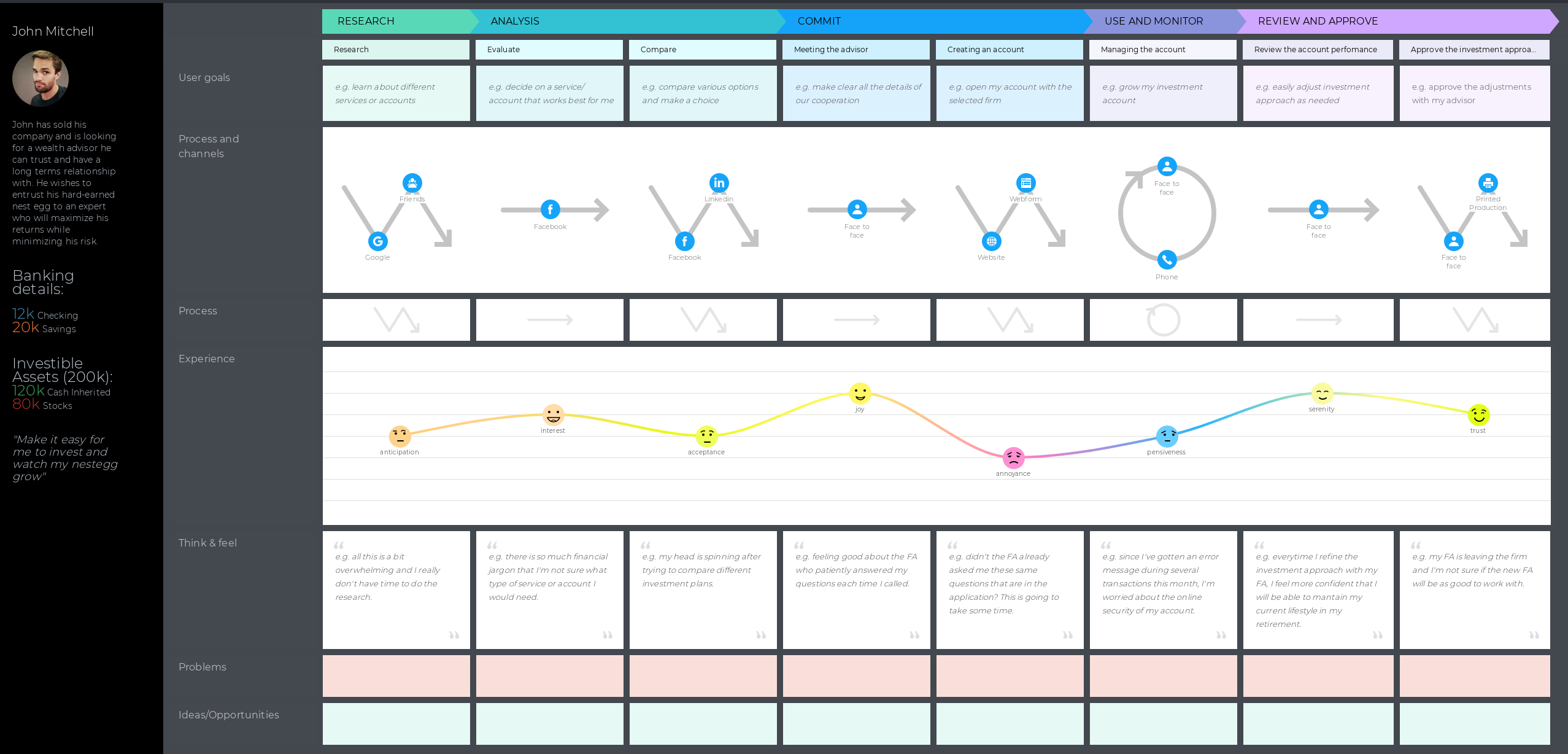

Example of a retail banking customer journey map

A broad customer journey map targeting a specific persona (wealth advisor in this example) looks like this:

Note how the map captures the customer’s holistic journey—from the channels they use in their research (bank discovery) phase to the actions they take, what they think and their overall experience (demonstrated using emojis).

There are also rows at the bottom dedicated to capturing journey problems and ways to solve them.

Your customer journey map would look similar to this one—but not the same since your map’s scope determines the customer goals, needs and actions it visualizes.

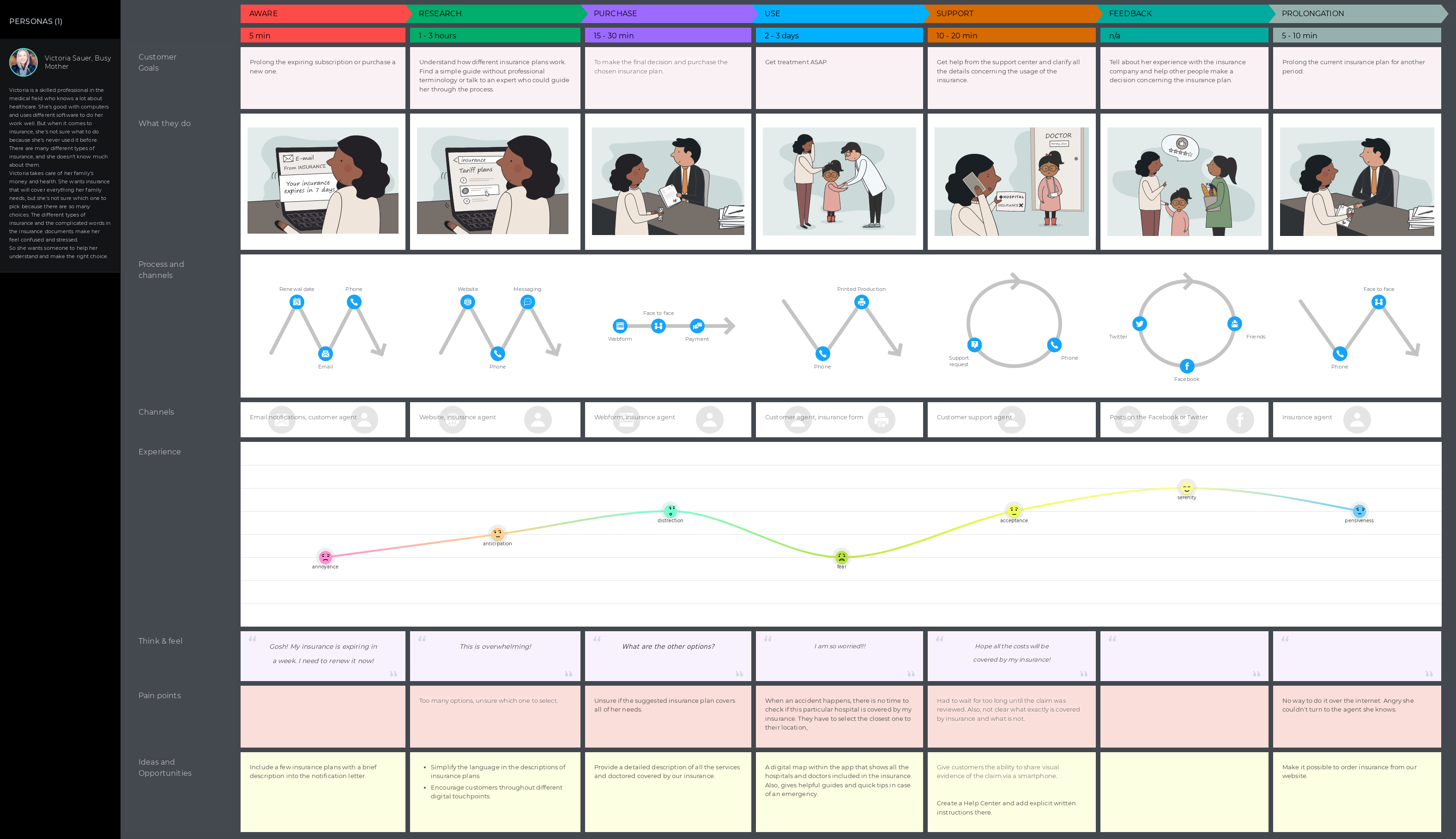

See how the map changes when the target persona’s goal is different (getting personal insurance in this example):

Why is customer journey mapping important for retail banks?

Customers today seek more than the service—they seek banks that understand them and offer a seamless experience.

In fact, customer-centricity and adaptability are the two must-have weapons in banks’ survival kit as digital-first newcomers disrupt the financial industry with their glossy apps and niche products.

Yet, only 21% of banking customers say they’re completely satisfied with the digital experience offered to them. 51% even cited poor digital experience as their reason for switching their financial service provider in 2023.

Thankfully, customer journey mapping is the first step to offering what customers desire—a consistent, smooth sailing experience—as it lets you:

Identify frustrating blockers, inconsistencies and gaps in your customers’ journey

Unlock opportunities to optimize the experience and, subsequently, improve customer engagement, loyalty and retention

The good news? Offering a friction-free experience not only gives banks a competitive advantage but delivers monetary benefits as well.

In fact, financial brands delivering a better customer experience (CX) receive twice as many recommendations and their customers are 2X more likely to try new products or services.

Take it from the UK Bank, one of the UK’s largest high-street retail banks.

When the Current Account Switch Service was introduced in the UK, the bank experienced low conversion rates with its online account opening process.

Customers would fill up the entire form, only to be ejected when they clicked submit—never seeing an error message explaining the cause. Web analytics tools also did little to uncover the root of the problem.

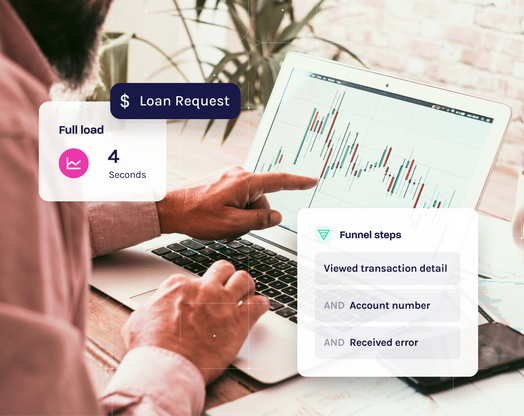

It was then that the UK Bank started mapping its customer behavior and behind-the-scenes technical events using Glassbox’s customer journey analytics.

The data showed them that accent marks or other special characters in the names of the affected customers were triggering a back-end system problem.

By fixing the issue (and consequently, optimizing their customers’ experience with them), UK Bank experienced a significant return on investment (ROI). In fact, by accurately identifying and correcting the blocker back then, the bank captures approximately 800 million digital sessions per month today.

The benefits of customer journey mapping in banking

Customer journey mapping is a must-use asset for getting a granular picture of the digital experience your bank offers.

It’s key to understanding your customers in-depth—learning their pain points, preferences and needs, and eventually better predicting customer behavior.

In fact, when adequately leveraged, customer journey maps can help you eliminate ineffective touchpoints, optimize customer experience and delight customers to the point that you improve retention, even drive referrals.

Customer journey maps can yield the following benefits:

1. Improve customer satisfaction

Customer journey mapping uncovers key insights such as customer pain points and preferences. In turn, empowering banks to proactively address them and significantly boost customer satisfaction.

2. Make informed, customer-focused optimization

By mapping each touchpoint and the way customers feel and think, banks develop an in-depth understanding of the way customers interact with their products and services. Banks can then use the info to implement customer-informed optimizations.

3. Enhance customer loyalty

Just as a negative customer experience can drive customers away from your brand, a positive experience is directly linked to customer loyalty.

By using journey maps to identify and eliminate pain points, you can create a friction-free and enjoyable experience that encourages customers to stay with your bank for the long term.

4. Optimize channel integration

With the rise of digital banking, customers now interact with banks through various channels, including online, mobile and in-person.

Customer journey mapping enables banks to optimize the integration of these channels, ensuring a consistent and seamless experience across all touchpoints.

5. Enjoy a competitive edge

With a solid understanding of their customer’s needs and behavior, thanks to customer journey mapping, banks can:

Turn pain points into pleasure points

Identify touchpoints to delight customers

Optimize experience to meet customer needs better

Ultimately, this leads banks to offer an unparalleled and differentiated banking experience that sets them apart from their competitors.

6. Increase cross-selling and upselling opportunities

Core offerings such as checking or savings accounts may be the bread and butter for a bank, but to grow revenue, they need to cross-sell and upsell too.

Customer journey mapping let you understand customer needs at each touchpoint and identify moments where you can:

Offer personalization recommendations to add value to customers’ banking experience

Introduce additional products and/or services to existing customers

7. New product and service development

By analyzing past interactions and behavior, banks can use customer journey mapping to anticipate customers’ future needs as well. Leveraging this data, in turn, assists you in developing innovative solutions tailored to these needs.

How to create a customer journey map in banking: A 7-step proven framework

Retail banking customer journeys are critical in today’s world, where there are multiple touchpoints to connect with consumers and so many devices they interact on. Fortunately there are numerous methods, tools and technology available to help connect the dots — with the 7-step framework below, we'll be using Glassbox customer intelligence platform and our free downloadable customer journey mapping template to illustrate the process and help you get off to a flying start.

1. Define goals and customer segments

Begin with setting clear goals, objectives and scope for your customer journey map. This is an essential step to spend time on for setting a razor-sharp focus for the map and to save yourself from information overload down the line.

Ask yourself:

What do we want to learn/accomplish from this customer journey map?

For example, do you want to get existing customers to use the new budgeting tool in the app? Or do you want to get new customers to complete the sign-up process for a checking account?

Your answer to this will guide you in answering the next question.

Which aspect of the customer journey will the map examine?

A customer journey map can be a holistic overview of the full, step-by-step experience. But such a comprehensive scope would overpack it with numerous touchpoints, making it so complicated to read that you’d end up never using it.

This is why you must determine the service scenario the map will visualize and the touchpoints you want to prioritize.

Which customer segment will the map cover?

Typically, banks target different customer personas—categories of users. But instead of using generational cohorts as your personas, consider going deep.

If you already haven’t, use details like customer behavior, goals, pain points and jobs to be done to bucket them into segments.

Learn what motivates each segment to buy, how they think, how they discover your products/services and the reasons why they choose you over other banking service providers.

Then highlight which segment your customer journey map will target.

Remember, each persona gets a separate journey map as each segment has its unique pain points and preferences and their behavior differs in the way they interact with your product/service.

Don’t have customer personas ready? Use the following sources to collect customer data and insights:

|

2. Identify key touch points

A touchpoint is your customers’ point of contact with your product or service. The experiences they have at these touchpoints can shape how they view your product/service.

Each touchpoint is an excellent chance to wow customers with a seamless experience that transforms them into loyal evangelists.

The exact touch points will vary based on what you’re mapping. For a broad journey map, for example, some touch points can be:

Advertising (including digital or print)

Social media

Website

Welcome/thank you emails

Physical branches

Customer service

Reviews

Influencer recommendations

Peer reviews

Customer onboarding

Physical and digital events

Similarly, for a narrower journey map—say one for opening a current account, some touchpoints can be:

Your website

Online application form

Identity verification webpage

Confirmation page

Account approval update email

In-app onboarding and welcome emails

So how can you identify touchpoints?

Here’s how:

Scoop information about how customers are finding you using surveys and interviews.

Use Google Analytics to determine your website traffic sources.

Path Analysis in Glassbox to review the exact steps customers take between the pages you specify (example: touchpoints between the home page to sign up page)

Download the full template here

3. Match touch points to customer emotions and thoughts

Identifying touchpoints is only one part of the equation, the second and equally—even more important—part is determining customers’ experience at each touchpoint.

Are they struggling with the buttons they’re clicking? Is the form taking too long to load?

The goal here is to find out customers’ actions, thoughts and emotions. Then add them to your customer journey map template. But first:

How can you learn what customers are feeling at different touch points?

Engage with customers on touch points to source feedback

Use polls and short surveys at vital touchpoints on your mobile app and website to source voice of the customer data.

For instance, use a customer effort survey to learn about customers’ sentiment at a touchpoint—say after they make a payment from their mobile app or after they complete a loan application form.

Activate VoS data to source insights from customers who didn’t leave feedback

In any customer survey, a fistful of respondents share their thoughts. The remaining? You guessed it right, their thoughts remain undisclosed—giving you a skewed picture of your customer satisfaction metrics.

Voice of the Silent (VoS) data assists in uncovering the silent majority’s feedback. By activating it in Glassbox, you can learn from customers who didn’t leave feedback but had identical experiences to those who did.

This gives you a more accurate picture of customers’ thoughts. For more clarity around customers’ actions (what they were doing that led to their specific feedback), review session recordings from the same dashboard.

Take the customer journey yourself

Another effective way to trace actions and pinpoint struggles is to put yourself in your customers’ shoes.

Take each step as if you were the customer for the scenario you’re mapping.

Make notes (the more objective you are, the better) for all touchpoints: what goes smoothly, where you struggle and how you feel as you complete the task.

Keep in mind, customer journey frustrations can come in various shapes and sizes. For example, the page load time or the number of times you have to click a button to complete a step. Or, how long it takes (determined by the number of steps) and how complex the process to do something is.

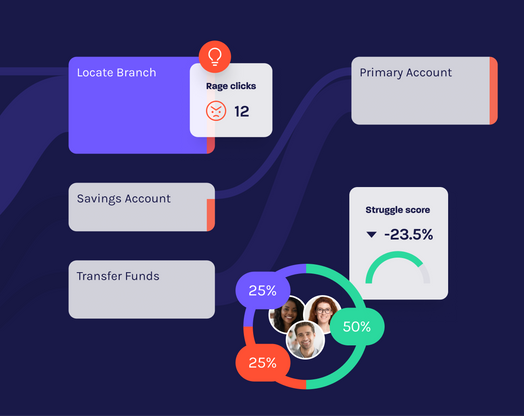

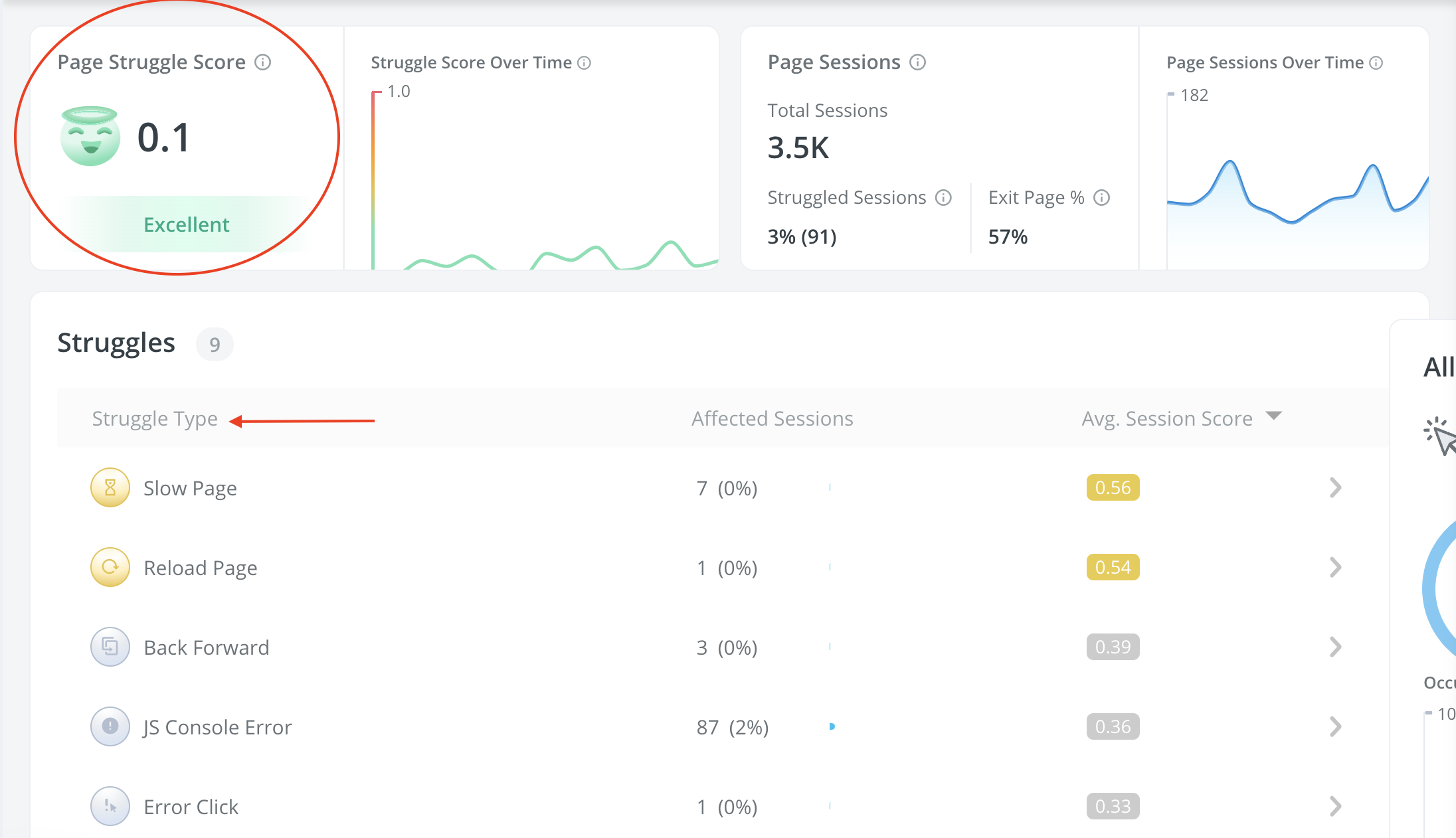

Review struggle analysis and score in Glassbox

Lastly, verify your findings by reviewing recordings showing your customers’ interaction on your website and app.

If you’re using Glassbox, the struggle analysis dashboard makes this step a breeze.

Start with selecting the page you want to review—say the sign-up page on your website when folks open a current account.

The dashboard will then show an overall struggle score for the page (based on the automatic tracking and analysis of over 30 customer behaviors such as rage clicks that indicate they’re struggling). This makes it quick and easy for you to identify issues.

There’s also a list of struggles customers encounter on the selected page on this dashboard:

By clicking on a particular struggle, you can find session recordings showing you video-like recordings of customers experiencing the struggle.

The best part? Glassbox doesn’t just automatically track user activity but also captures technical events on your server’s end. By doing so, it shows you the impact of technical issues like bugs and glitches on customers’ experience on your website/app.

👉 Pro tip: Take a page from Glassbox customers and use the struggle score metric to bring internal alignment.

Our VP of Product Management, Muli Farkas notes that establishing cross-functional teams is only half the battle. The rest? Finding common ground (read: common metrics) to get everyone on the same page.

“The purpose is to create delightful customer experiences, but in reality—especially in big companies—we have a lot of different stakeholders, disciplines, groups. And they have different metrics, goals and processes. They’re measuring differently. Some operate in sprints, some operate in campaign cycles… This can create fragmented experiences, so it’s really important to solve the internal alignment first,” Muli says. “A lot of our clients use the Glassbox struggle score, which identifies how easy it is for a user to complete an action.”

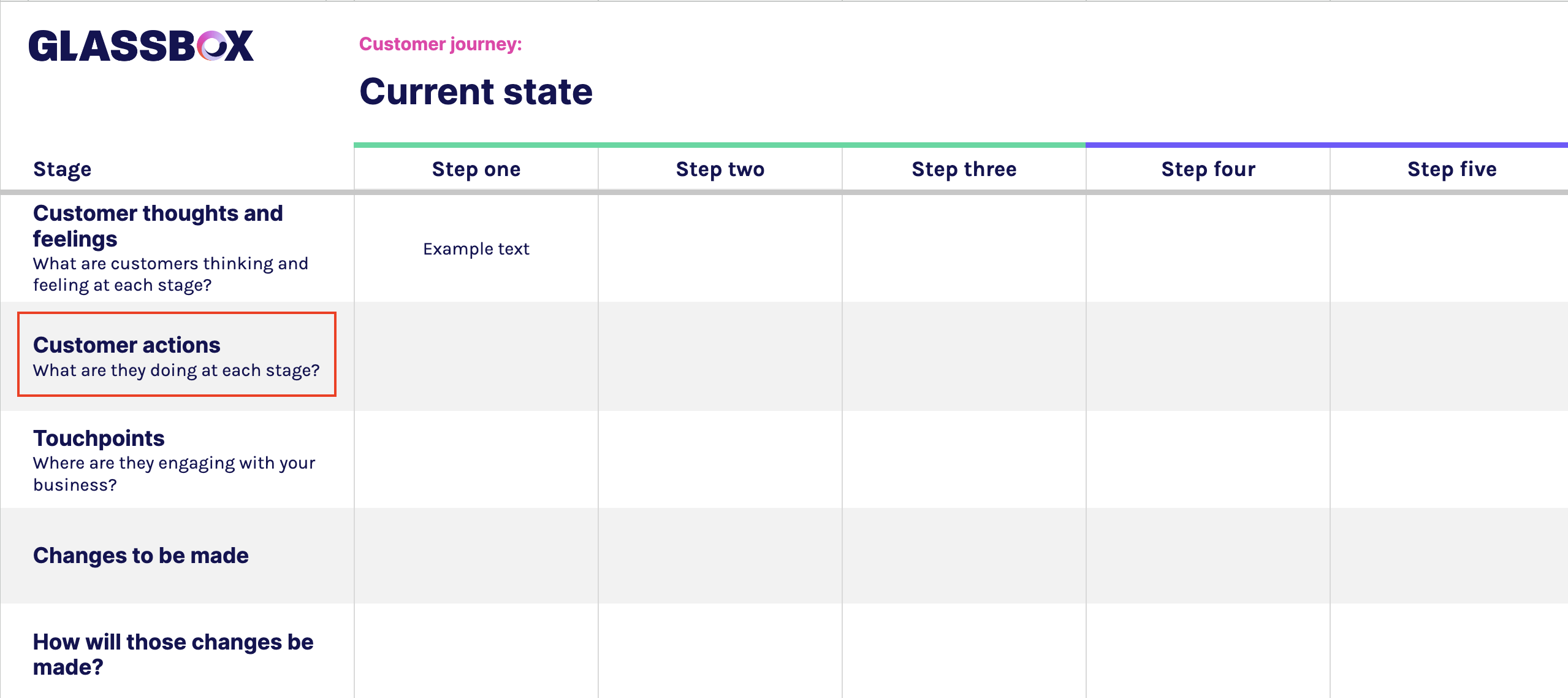

Teams still have their own metrics but the struggle score serves as the common metric that encourages collaboration to fully understand digital customer journeys. As you match customer thoughts and struggles to touchpoints, remember to add them under the current state section in your customer journey template.

4. Create your customer journey map

Next, visualize the customer journey, laying out all stages and touchpoints.

Diagramming tools like Lucidchart, Gliffy or FlowMapp make it easy to create flowcharts and diagrams visualizing the journey. Most also offer customizable customer journey templates that you can use to hit the ground running.

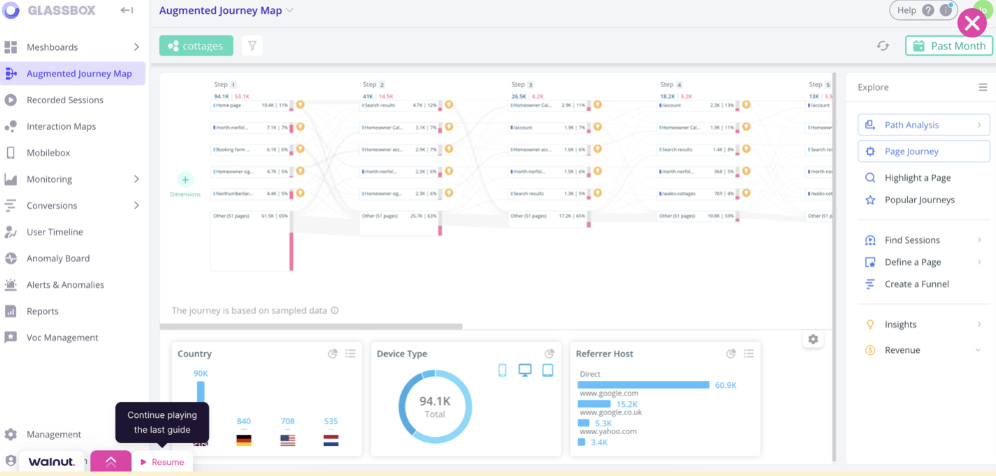

If you’re looking to create a comprehensive customer journey map with a multi-dimensional view though, use Glassbox Augmented Journey Map. Let’s show you how that works:

How to make your customer journey map with Glassbox

After you set up Glassbox on your website and/or mobile app, it shows you the full journey folks take on your site with its customer journey analytics.

You can find the full funnel-like visualization of all the steps customers take on your website during a defined time under the Augmented Journey Map:

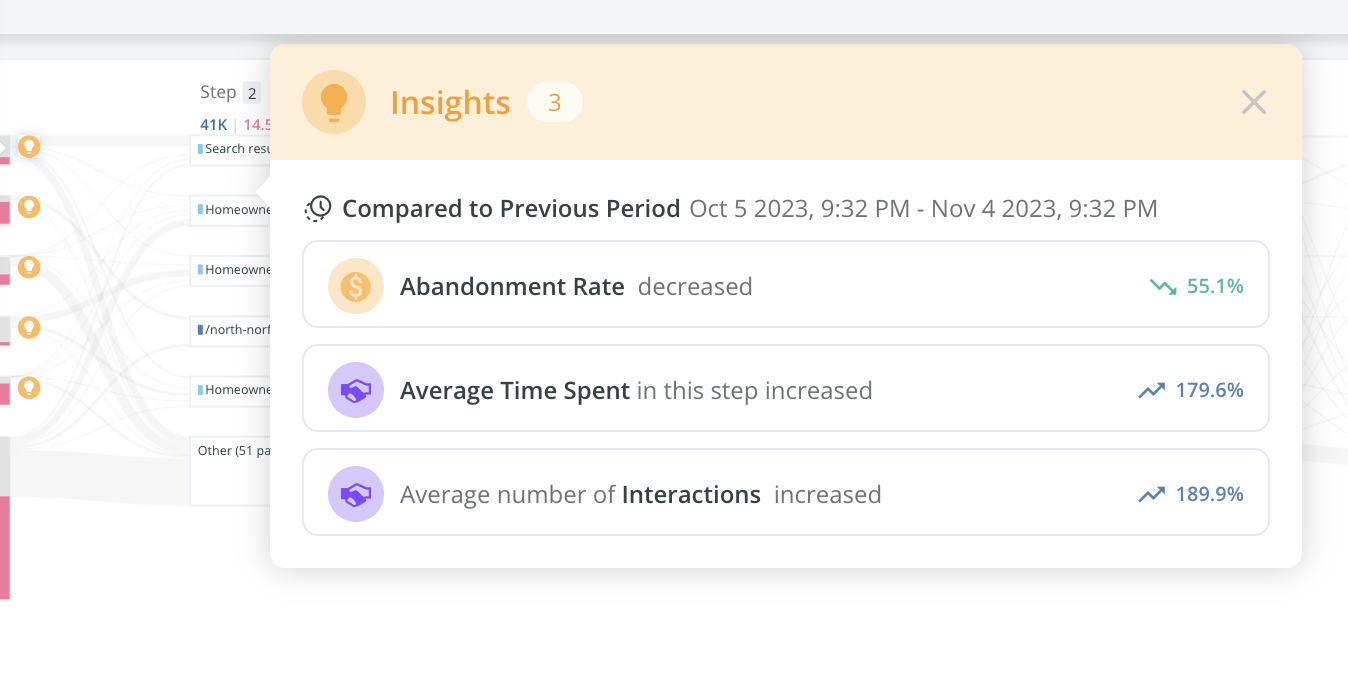

When you click on the yellow insights button, Glassbox will highlight key insights for the particular step—such as the average time people spent there.

This information, in turn, indicates how seamless the touchpoint is (the longer a customer spends there, the more friction they’re encountering).

Not sure what folks are struggling with that’s taking them too long to complete or pushing them to leave the page? Click and expand the highlight to review session recordings showing the struggle.

Take a self-guided tour Glassbox tour to see how it helps you understand the customer journey.

5. Identify pain points and opportunities

At this point, you’ll already have a fair idea of where your customers are struggling and what’s holding them back in the journey you’re sketching.

To further double down on the frustrations in the customer journey, look for session recordings showing rage clicks and similar behavioral signals.

Here’s how to identify customer frustrations and struggles

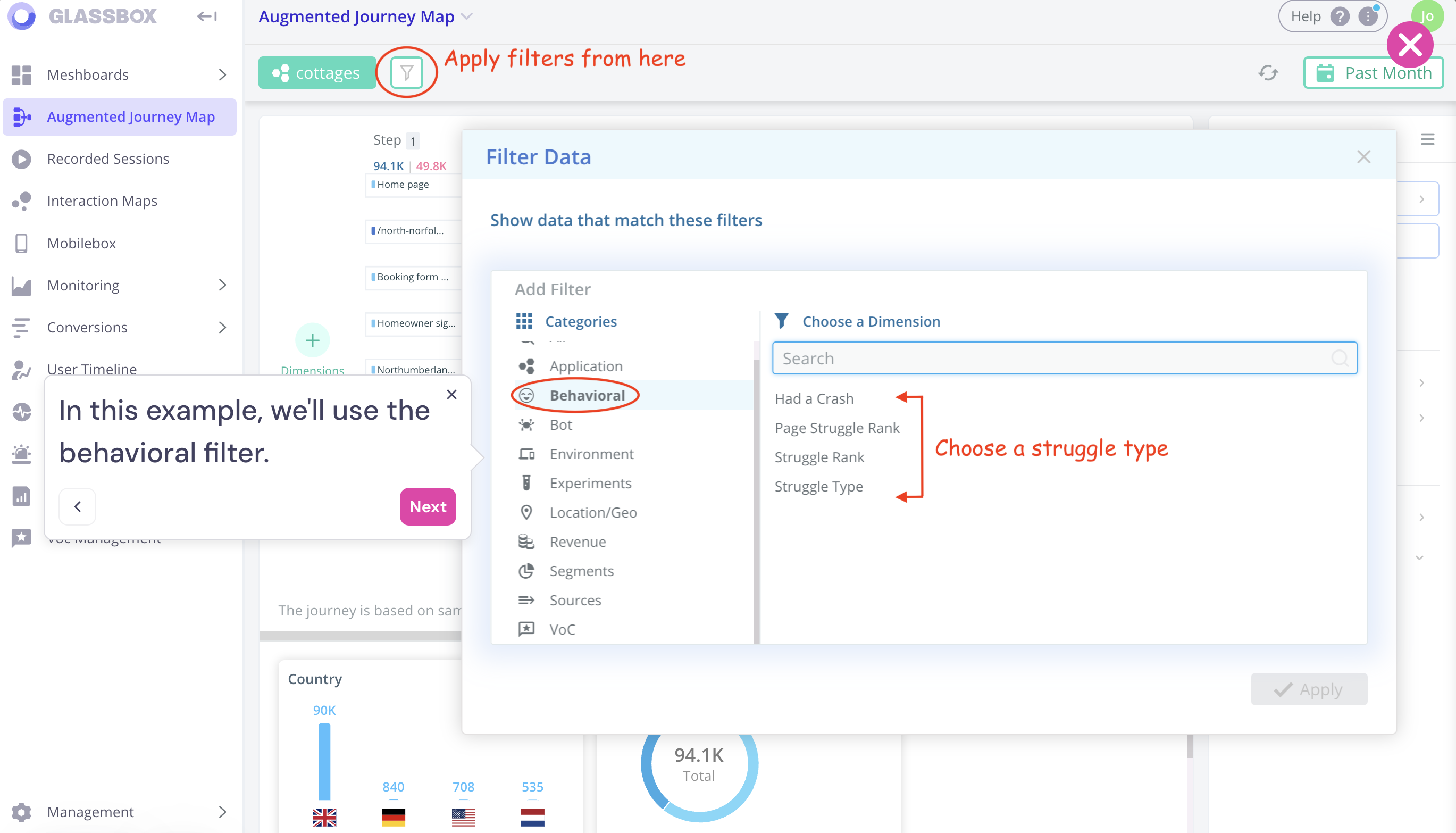

In the same Augmented Journey Map dashboard where you created your customer journey map in the step above, use filters to narrow down struggles.

Simply:

Select the filter icon

Choose from a list of 10 filters (in this case, Behavorial)

Next, select Struggle Type and specify struggle (example: rage clicks)

This will give you all session recordings showing where folks were rage clicking.

All that’s now left to do is add these frustrations and blockers in the customer actions row in your template.

You can also include links to relevant session recordings showcasing the struggles in the template for easier cross-team collaboration.

6. Use data to make necessary changes and improvements

Finally, based on all the work you’ve done so far, identify issues to correct right away and areas for improvement. Some common issues you may find:

Complex onboarding processes: Overly complicated onboarding with many steps to complete provides a negative first impression that diminishes customer experience.

Poor user experience (UX): Confusing website or app navigation, slow loading times and unresponsive design can frustrate customers and cause them to leave.

Lack of personalization: Customers may feel that their bank doesn’t understand their individual needs, resulting in irrelevant offers and services.

Complex products and services: Difficulty understanding complex financial products and services can hinder decision-making.

Limited digital services: Banks that lag in offering digital services, such as mobile check deposits, digital account opening or online loan applications, may frustrate customers.

Cross-channel inconsistency: Varying experiences between online, mobile and in-branch services can cause confusion and frustration.

Ineffective communication: Customers may not receive timely or relevant communication from their bank, leading to missed opportunities or misunderstandings.

Inadequate customer support: Difficulty reaching customer support or receiving timely assistance when facing issues or inquiries can cause frustration.

Security concerns: Worries about data breaches, identity theft and fraudulent activities can erode trust in online banking.

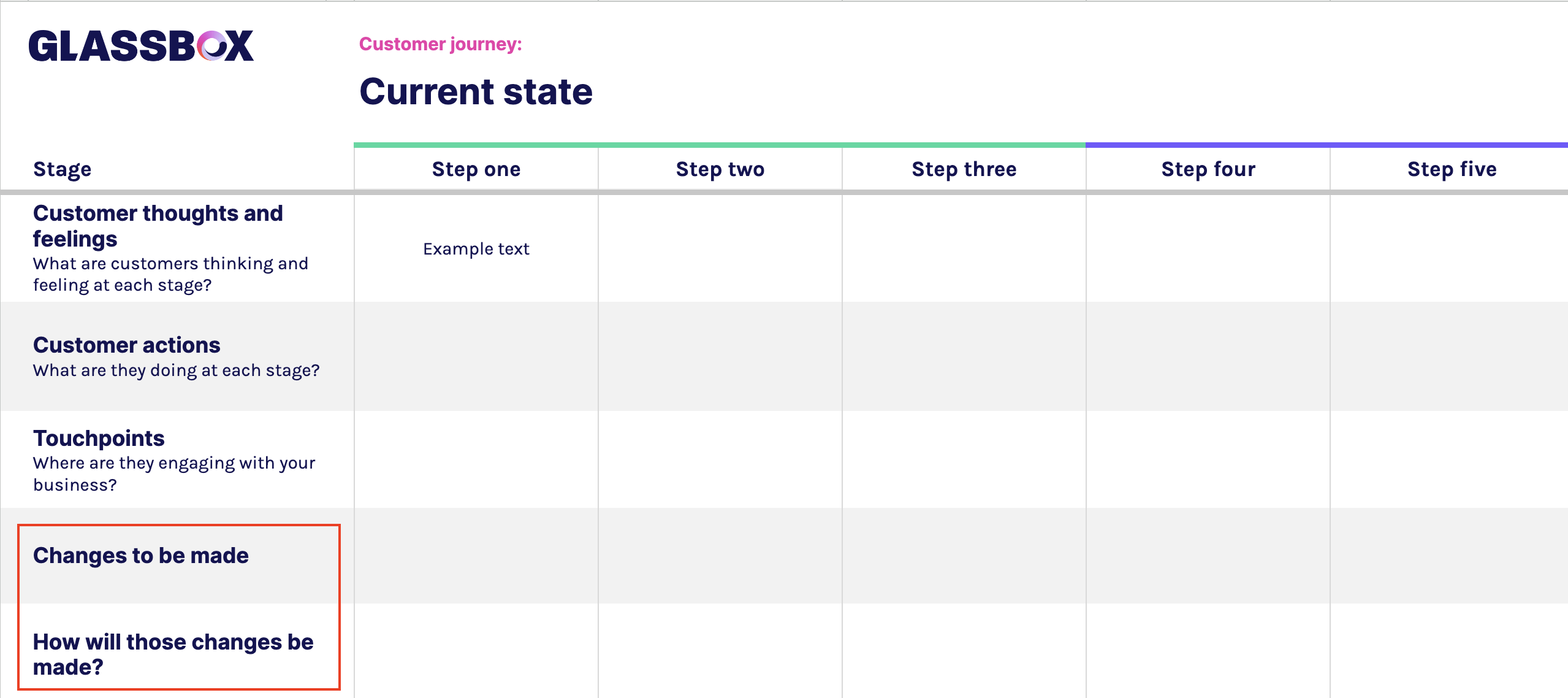

Whatever issues you uncover, put them under the changes-related tabs in the template:

Not sure which changes to realistically prioritize? Realistically speaking, it won’t be possible to resolve all the issues right away.

Instead, we suggest this two-pronged approach:

Prioritize based on current impact

Let's take conversion, for example. Say there’s a technical glitch that’s preventing customers from initiating wire transfers. Glassbox can review the value of these transfers across the affected sessions to tell you how much revenue you’d have generated had these wire transfers gone through smoothly.

If you aren't currently using a customer intelligence platform, you can also use this handy formula:

Average spend of a converted lead X Number of abandoned lead who encountered a specific

friction in their journey X Typical conversion rate for friction-free customer journey = Total cost of that friction point

👉 Pro tip: Even if you or your team aren't goaled on revenue, running through this exercise can still help identify which improvements will have the biggest and most immediate impact to customer behavior at the conversion stage.

Ask across teams you’re working with

List potential changes in order of their impact.

Then, collaborate with your cross-functional customer journey mapping committee (read: IT and engineering teams) to determine which tasks can be realistically completed and in what timeframe.

This will give you a list of items to prioritize on first, second, and last.

Remember: Customer journey maps are only as effective as the changes you implement. Creating them is only half the job, implementing the changes is the other half to offering customers a friction-free, memorable experience.

7. Continuously monitor and update

The customer journey isn’t static and is continuously evolving. It’s important you regularly monitor their interactions and effectively respond to emerging trends in customer behavior.

But how can you keep on top of changing customer behaviors effortlessly?

Thankfully, with Glassbox’s automatic tracking and alerts, you can keep on top of the changes in customer behavior the headache-free way.

Glassbox automatically tracks all customer activity across your website and app and alerts you when there’s an anomaly.

In fact, doing so saved SoFi, a digital personal finance company, from a potential revenue loss of $9 million. This happened as Glassbox captured 100% of its user sessions and technical events—notifying the team of a technical issue in 546 sessions where customers saw an error message that prevented them from completing their loan application.

The team then used the Cashbox dashboard in Glassbox to capture the value of the user input in the loan application form and learned how big of an impact it was having on their revenue.

By proactively solving the root cause of the technical problem, the bank saved itself from a significant revenue loss.

You can also take a page from Wells Fargo's playbook and proactively identify sources of friction in digital customer experiences.

Examples of customer journey mapping in banking

From striving to improve customer experience in a contact center to introducing new customer-centric offerings, many high-profile banks understand the value of customer journey mapping for banking.

Below are examples of three banks that used journey mapping to drive stellar results:

1. Citizens Bank

Citizens Bank leveraged journey mapping to improve customer experiences with its contact centers.

Using customer reviews and feedback to fuel their research, the bank ended up shifting focus away from an internal metric of call handling time to a more customer-centric metric of improved first-call resolution (FCR).

2. An Post Insurance

90% of An Post Insurance’s quotes start from the brand’s website. But only 35% finished the form to purchase an insurance policy from the same channel.

By mapping their customer journey (using session recordings and listening to customer calls), An Post Insurance found the culprit to be a question in the form. It confused people to the point that they’d contact the call center to complete the purchase.

By identifying and correcting this issue, this financial service provider has both reduced deflections to the call center and improved conversions by 6% from their website.

Lisa Melarkey, An Post Insurance’s former Head of Digital and Omnichannel Sales shares, “Combining call listening and session replay pinpoints confusion points for our customers. We can quickly improve the customer experience by changing the wording and adding help text.”

3. Wells Fargo

In its journey to customer experience innovation, Wells Fargo leveraged customer journey mapping to help customers better manage their finances.

This process led to the introduction of a new app that helps customers track and maintain more control over recurring payments for services they may no longer use.

Ready to understand your customers’ banking journeys more clearly?

Journey mapping is key to offering customers an exceptional experience—one that not only retains them but also turns them into loyalists.

For customer journey maps to be invaluable assets in your toolkit, make sure you:

Clearly define your map’s goal and scope

Regularly source and analyze customer feedback

Track customer activity across your website and apps

It’s only when you’ve sufficient data and a razor-sharp focus on what you want to optimize that you can effectively visualize the full customer journey.

To help you get started, we’ll leave you with our customer journey mapping template.

And when you’re ready to automatically track customer behavior across your banking website and products, give Glassbox a shot.

Not only does our digital experience intelligence platform give you rich insights telling what your banking customers are doing but also shows you why they’re behaving that way.

Take this self-guided product tour to see how Glassbox can help you build comprehensive customer journey maps.