Design Experiences Driving Engagement and Loyalty

Want customer loyalty? Start creating experiences that people actually love. In the financial services , where trust and long-term relationships matter as much as convenience, experience has become a key loyalty driver. Designing experiences that drive engagement and loyalty is your new secret weapon, enticing customers so they stick around, spend more and actually seek you out.

Today’s consumers aren’t impressed by basic functionality. They crave personalized digital experiences that anticipate their needs, remove friction and spark an emotional connection. Increasingly, financial institutions are looking to retail brands as a benchmark, adopting the same customer-first mindset that prioritizes ease, personalization and emotional engagement. Every interaction, from swiping through an app to navigating a website, matters.

Get it right, and you boost customer engagement, brand loyalty and revenue. Get it wrong, and customers bounce before you even know they were there. In financial services, that bounce often translates into churn, account switching or lost lifetime value. The clock is ticking, and every digital touchpoint offers an opportunity to turn a casual user into a loyal fan.

In this article, we’ll show how to design experiences that drive engagement and loyalty by mapping customer journeys, personalizing interactions and reducing friction. You’ll also discover how to turn insights into action by creating seamless, memorable experiences that boost customer loyalty and brand engagement—the same principles retail leaders have long used to keep customers coming back.

Why Experience Design Shapes Customer Loyalty

The connection between user experience (UX) and loyalty is profound. So profound that consumers are willing to pay more for brands that deliver consistent, meaningful experiences—including banks, insurers and wealth providers, once chosen primarily for rates or products. Satisfied customers engage more, spend more and become loyal customers who advocate for the brand.

Conversely, friction in digital journeys—slow load times, confusing navigation or inconsistent messaging—erodes trust and weakens emotional loyalty. For financial service providers, where switching barriers are lower than ever, poor digital experiences can quickly push customers toward competitors offering more retail-like simplicity.

Experience design goes beyond aesthetics. It involves creating interactions that resonate emotionally, meet customer expectations and foster lasting loyalty. Every touchpoint, from onboarding emails to in-app navigation, presents an opportunity to strengthen the emotional bond and deliver a memorable experience. This shift mirrors retail’s long-standing focus on convenience, consistency and emotional connection at scale.

To achieve this, brands must combine UX principles with data-driven insights. With platforms like Glassbox, businesses can capture, analyze and act on rich data from real user interactions. By understanding customer behavior at scale, companies—including financial institutions modernizing their customer experience (CX) approach—can tailor experiences that reinforce loyalty across digital channels.

Understanding the Customer Journey

A customer journey represents the sequence of interactions a person has with a brand, from discovery to purchase and post-purchase engagement. Mapping these journeys is a cornerstone of effective CX design. In financial services, this often spans longer, more complex lifecycles than retail, making journey clarity even more critical.

Businesses that actively monitor journeys see higher retention and customer satisfaction. Tools like customer journey analytics enable teams to visualize end-to-end interactions, identify friction points and uncover opportunities for personalization. By applying retail-style journey thinking to financial services, organizations can simplify complex processes and create more intuitive digital paths.

Personalization Drives Engagement

Personalization is a key differentiator in driving customer engagement and brand loyalty. Customers expect brands to recognize their preferences and tailor experiences accordingly. The reality is, personalized interactions boost emotional engagement, deepen customer relationships and improve loyalty metrics.

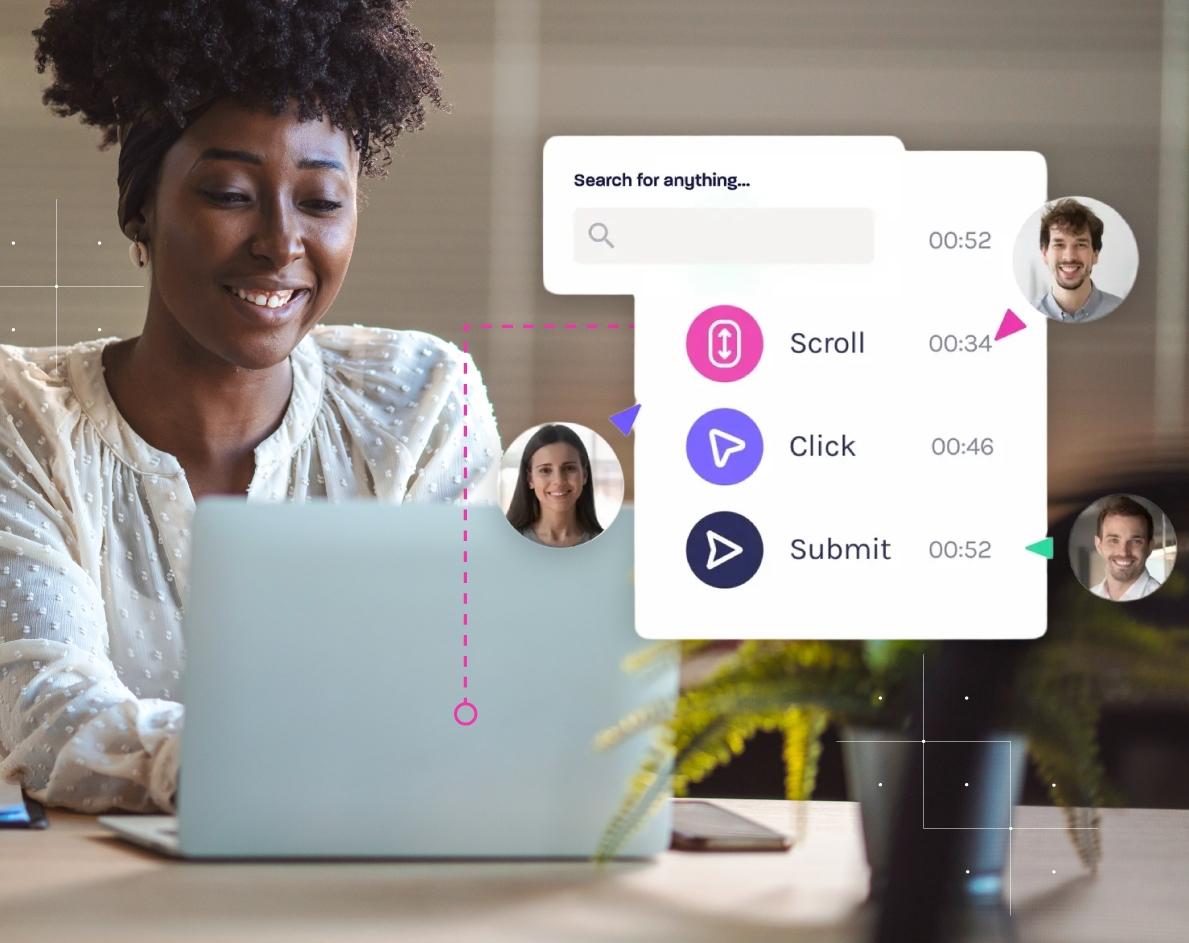

Implementing personalized digital experiences requires understanding user behavior across touchpoints. Customer session replay tools help you see exactly how users experience your product, enabling designers to refine flows, remove friction and deliver interactions aligned with customer needs. Whether it’s a loyalty program or a dynamic content recommendation, personalization fosters a unique experience that strengthens emotional bonds.

Reducing Friction Improves Satisfaction and Retention

Personalization is a key differentiator in driving customer engagement and brand loyalty. Customers expect brands to recognize their preferences and tailor experiences accordingly—an expectation shaped largely by retail and ecommerce leaders and reinforced by consistent, responsive customer service interactions.

The reality is, personalized interactions boost emotional engagement, deepen customer relationships and improve loyalty metrics. Implementing personalized digital experiences requires understanding user behavior across touchpoints, including key customer service journeys such as support requests, issue resolution and follow-up interactions. Customer session replay tools help you see exactly how users experience your product, enabling designers and service teams to refine flows, remove friction and deliver interactions aligned with customer needs—whether that’s a retail checkout, a service interaction or a digital banking journey.

Whether it’s a loyalty program, personalized financial insight or a dynamic content recommendation, personalization fosters a unique experience that strengthens emotional bonds. By continuously monitoring the customer journey, brands can identify service-related friction early and adapt experiences in real time, reinforcing trust and long-term loyalty.

Leveraging Data To Inform Experience Design

Effective experience design relies on turning observation into insight. Understanding customer preferences, behavior patterns and feedback informs the creation of exceptional CX that drives engagement and loyalty. For financial services, this data-driven approach helps balance compliance, security and customer-centric design—much like retail brands have done for years.

Data analyticsallows organizations to turn user information into design insights and analyze user behavior at scale. By integrating analytics across web, mobile and app platforms, companies can make informed decisions, from UX refinements to loyalty strategy adjustments. Data-backed design fosters lasting loyalty by aligning digital experiences with the evolving expectations of users.

Emotional Engagement Creates Lasting Loyalty

Emotional connections are the strongest predictor of customer loyalty. Consumers remember experiences that evoke positive feelings, not just functional benefits. As financial services brands compete on experience rather than products alone, emotional engagement has become a critical differentiator.

Loyalty programs succeed when they reward more than transactions; they recognize individual preferences, create meaningful connections and build a unique experience that resonates. Powered by advanced customer experience analytics, experience design that prioritizes emotional engagement enhances both customer engagement and brand loyalty—a lesson long mastered by retail leaders and now embraced by leaders in financial services.

Integrating Employee Experience With Customer Experience

An often-overlooked driver of customer satisfaction is employee experience. Employees empowered with actionable insights provide better support, create smoother interactions, and deliver consistent messaging. Engaged employees directly influence customer engagement and loyalty.

Teams with good digital CX strategy frameworks and winning CX strategies integrate employee insights with customer-facing initiatives. By ensuring employees understand user journeys and customer preferences, brands can consistently deliver personalized interactions and memorable experiences.

Optimizing Loyalty Programs for Deeper Connections

A customer loyalty program is more than points and discounts; it’s a tool for nurturing emotional loyalty that integrates experience design, personalization and seamless interaction yield higher retention and advocacy. In financial services, this may take the form of personalized rewards, proactive insights or service recognition rather than traditional retail-style incentives.

Brands can leverage the Glassbox platform to optimize these programs by monitoring customer interaction, analyzing engagement and personalizing rewards. Insights on customer behavior allow companies to create lasting loyalty by aligning program benefits with what matters most to users. Combining a loyalty strategy with digital experience optimization transforms routine transactions into memorable experiences and lasting customer loyalty.

Best Practices for Designing Experiences That Drive Engagement

To consistently design experiences that drive engagement and loyalty, brands should focus on several key principles:

Map the complete customer journey to uncover pain points and opportunities

Use experience analytics to quantify customer behavior and detect friction

Implement personalized interactions that align with customer preferences and history

Monitor digital channels with digital experience monitoring to catch issues proactively

Integrate customer feedback into experience design iterations

Empower employees with insights to improve customer service and create consistent experiences

Align loyalty programs with emotional engagement, offering rewards that reinforce brand loyalty

These practices allow brands to deliver unique experiences, increase customer engagement and deepen emotional connections. Businesses that embrace this approach often experience measurable gains in loyalty metrics, customer satisfaction and revenue growth.

Turning Insights Into Action With Glassbox

In an era of rising expectations, brands cannot rely solely on products or price; they must boost engagement and loyalty by providing outstanding CX. By leveraging tools like Glassbox’s customer journey analytics and session replay, organizations gain a full view of customer interactions and the insights needed to optimize every touchpoint.

From personalized experiences and friction-free service to emotionally engaging loyalty programs, businesses can transform customer behavior into actionable insights that strengthen brand loyalty and create lasting loyalty. By prioritizing experience design, leveraging real-time analytics and aligning employee experience with customer needs, brands can consistently deliver memorable experiences that drive engagement and satisfaction.

Ready to see your digital experience in action? Discover how Glassbox improves engagement and start designing experiences that your customers will love and return to again and again.