Enhancing insurance customer experience: 10 strategies for success

To deliver a truly seamless experience for their customers, insurers need access to better data.

In this blog, we’ll explore how insurers are embracing data-driven improvements to CX and reflect on common pitfalls that result in negative insurance customer experiences. We’ll also consider the most important CX analytics metrics for insurers to monitor, as well as proven strategies insurers can adopt to improve the customer experience, with examples. Let’s dive in!

Key takeaways

More than ever, customers expect world-class digital experiences

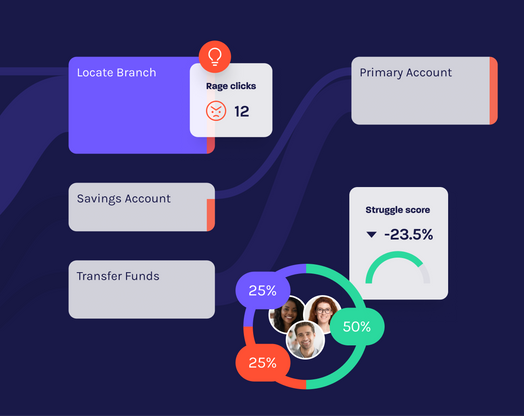

Advanced insights reveal specific points where your website or mobile app falls short

Behavioral data and analytics help you prioritize high-impact improvements

What customers expect from their digital insurance experience

At the dawn of the commercial internet, the novelty and convenience of conducting business online was enough for forward-thinking insurers to impress and reassure their potential customers. Today, the average consumer’s expectations are much higher. Companies like Amazon and Netflix have raised the bar for seamless customer journeys—creating a new standard for speed, convenience and personalization that all companies operating in the digital world need to match (or even exceed) to remain competitive.

How do those standards apply to an insurer’s digital offering? Firstly, a user-friendly website and mobile app are core to a positive customer experience. An insurer’s digital platforms need to be simple to navigate, with customers able to find information quickly and request quotes, manage policies and initiate claims easily. In addition, an insurer’s digital channels need to provide personalized recommendations based on a customer’s behavior and demographic. That applies not only to product recommendations but also to platform content, ensuring customers are pointed toward relevant, valuable information they are likely to be interested in.

Trends in insurance customer experience

Offering well-designed, highly personalized websites and mobile apps are just two of the ways insurers are working to create a good customer experience for their users. But what other improvements are insurers making in this space? Let’s look at some current trends.

Digitalization and online services

As an increasing number of customers are using online channels to research, purchase and manage insurance policies, it makes sense that the most notable trend among insurers is their adoption of these channels. By embracing the digital shift among their prospective customers, insurers are working to ensure they meet the expectations of consumers. It’s a smart move, as according to a McKinsey report, 90% of insurance customer interactions could be all-digital by 2025.

Personalization

Earlier, we mentioned that a highly personalized experience is a huge draw for the modern insurance customer. The potency of a tailored approach can’t be overstated—for example, a survey undertaken by Accenture found that 80% of insurance customers are more likely to purchase from insurers that offer personalized advice. Personalization is also an effective way to increase customer satisfaction.

Claims processing speed

Fast claims processing and payouts are a top priority for insurance customers. According to an IBM report, 66% of insurance customers expect real-time communication for claims processing. Streamlining this particular flow with online claims reporting, document submission and real-time status updates is, therefore, an emerging priority for insurers looking to offer the best possible customer experience.

AI and chatbots

The use case for AI-driven support is growing, with a recent PwC survey finding that 34% of insurers are already using AI-powered chatbots for claims processing and customer service. These virtual assistants can provide an instant response to customer inquiries, creating a more seamless experience for users.

Data security

Insurance customers are increasingly concerned about the security and privacy of their personal data. A Capgemini survey revealed that 85% of insurance customers are willing to share data with insurers they trust. Prioritizing security and privacy features is, therefore, a powerful way to build trust with your customers.

Customer feedback

Gathering and acting on customer feedback is a growing trend among insurers. According to a Deloitte survey, 70% of insurers use customer feedback to drive their customer experience strategies. By listening to the voice of the customer (VoC) through surveys, reviews and other tools and combining this feedback with the customer insights offered by a digital experience intelligence platform, it’s possible to improve digital CX continuously.

Digital claims and self-service

Customers appreciate self-service options, a preference that is only growing over time. A survey by J.D Power found that 77% of auto insurance customers prefer digital claims processes, showing the importance of ensuring customers can update contact information, change their coverage, view policy documents, and initiate and track claims online.

Reasons why insurers fall short of delivering good customer experiences

We’ve seen some of the emerging trends insurers are embracing to improve digital CX for their customers, but what about the other side of the story? Where do insurers tend to fall short of providing best-in-class customer experiences?

They lack the right tools

Many insurers struggle to provide seamless CX because they simply don’t have access to the tools they need to understand their customers. Without access to digital analytics, an insurance carrier’s efforts to provide streamlined services are substantially hindered.

They’re struggling to keep pace with digital transformation

Falling short of delivering a top-quality customer experience is all the more likely when insurers are stuck operating outdated online platforms that fail to offer the features their users want most. Without access to real-time insights that illustrate how consumer demand is changing, insurers can fall behind the curve and lose out to industry competitors who have their fingers on the pulse of customer priorities.

They don’t offer a personalized experience

In today’s digital world, a one-size-fits-all approach simply won’t do. Insurers who do not harness customer data to deliver tailored recommendations, products, and experiences are missing the opportunity to create a more engaging and satisfying customer experience.

They don’t have an open line of communication with customers

Insurers who don’t provide easy, accessible channels for their customers to reach out with questions, concerns or feedback are more likely to fall short in delivering a good customer experience. If customers don’t feel their voice is heard and appreciated, they’re bound to be left frustrated and dissatisfied.

They lack insights into customer satisfaction

Without access to behavioral analytics and information gathered through feedback mechanisms, insurers are flying blind when it comes to understanding how best to improve their customers’ experience. That’s because it’s difficult to make informed improvements if you’re in the dark about how well you’re currently meeting the expectations of your users.

12 customer experience metrics for insurance carriers to track

It’s clear from the above that gaining a complete and objective view of how users interact with your digital channels is the surest route to making meaningful CX improvements. A digital experience intelligence (DXI) platform offers the means to make this happen—but what metrics should insurance carriers focus on when evaluating their performance? Here are a few suggestions.

1. Net promoter score (NPS)

Tracking your NPS is vital for gauging the likelihood of customer referrals, which is often a good indication of how satisfied and loyal your customers are.

2. Customer satisfaction (CSAT)

Monitoring CSAT will help you measure the immediate satisfaction of customers, enabling you to identify areas that require urgent improvement.

3. Customer effort score (CES)

Tracking your CES will show you just how easy (or difficult) it is for customers to do business with you and highlight processes that could be streamlined to reduce friction.

4. Retention rate

Examining retention rates is crucial for insurance companies to understand how effectively they retain existing policyholders. It’s a good indication of your ability to maintain long-term customer relationships.

5. Churn rate

Churn rate measurement highlights the number of customers leaving, which is essential for identifying areas where you may be falling short so you can take quick corrective action.

6. Average handle time (AHT)

Monitoring AHT is essential for assessing the efficiency of your customer service, with shorter handling times indicating faster issue resolution. This is a critical metric, as slow or frustrating customer service experiences can dramatically impact how consumers perceive your company.

7. First contact resolution (FCR)

Focusing on FCR aids in improving the quality of your customer interactions. As with AHT, it’s important to reduce the need for customers to get in touch repeatedly to have their problems resolved.

8. Customer lifetime value (CLV)

Understanding CLV is critical for assessing the long-term value of each customer and prioritizing strategies that enhance customer retention and profitability.

9. Customer feedback volume

Tracking the volume of customer feedback allows you to grasp the scale of customer opinions and sentiments, providing insights that enable targeted improvements.

10. Digital experience metrics

Monitoring digital experience metrics, including website usability, mobile app performance and response times, will help you optimize your digital platforms for a smoother customer experience.

11. Customer surveys and feedback

Gathering structured customer feedback through surveys or voice of customer programs will provide valuable insights into specific pain points and preferences, allowing you to make tailored CX improvements.

12. Response and resolution time on digital channels

Measuring response and resolution times on your digital channels will help you ensure you provide timely support and issue resolution that leaves digital customers feeling satisfied.

If you’re unsure about any of these metrics, be sure to check our guide to measuring customer experience for a full explanation. Tracking these over time and analyzing trends will enable you to identify areas for improvement and celebrate successes in enhancing the customer experience.

How to improve customer experience in insurance: 10 proven strategies

Insurers can improve the digital customer experience in several ways to meet policyholders' evolving needs and expectations. Here are some key strategies:

1. Streamline the onboarding process

Simplifying the onboarding process will expedite policy issuance and ensure customers experience value as soon as possible. A more efficient onboarding experience guarantees a smoother start to customers’ relationship with your business.

2. Provide a personalized customer journey

Creating a personalized customer journey involves tailoring your policy recommendations, coverage options and communication to individual preferences, enhancing overall customer engagement and satisfaction.

3. Offer self-service

Enabling customers to manage their policies, make changes and access important information through self-service flows makes users feel empowered, reduces the need for support agent intervention and increases convenience.

4. Implement a digital claims processing system

A digital claims processing system allows customers to easily file claims online, streamlining the claims experience—which, as we’ve seen, is an increasingly important element for insurance customers.

5. Provide online quoting tools

Online quoting tools allow customers to quickly obtain quotes and compare policy options so they can make informed decisions, increasing the likelihood they’ll feel satisfied with the product they choose.

6. Ensure documents are mobile-friendly

Ensuring customers can access critical information on their smartphones provides a huge boost to the accessibility and convenience of your service.

7. Offer educational content

Educational content, such as articles, videos and webinars, helps policyholders better understand insurance concepts, risk management and the claims process, empowering them to make informed decisions. Offering this kind of content will also increase customers’ loyalty to your brand as they come to view you as a trusted authority on these subjects.

8. Implement AI and chatbots

Leveraging AI chatbots to provide immediate responses to common inquiries, guide customers through processes and offer 24/7 support will improve the efficiency and accessibility of your digital channels.

9. Gather and implement customer feedback

Collecting and acting on customer feedback through surveys and reviews is essential for identifying pain points, addressing issues and continually improving your digital CX.

10. Invest in robust security measures

Prioritizing data security and privacy measures helps build trust with customers, assuring them that their sensitive information is well-protected and ultimately enhancing the credibility of the digital services you offer.

By focusing on these strategies, insurers can enhance the digital customer experience, retain existing customers and attract new ones in an increasingly competitive market.

Customer experience in insurance: Examples of insurers doing it right

Geico

Geico is known for its user-friendly website and mobile app, making it easy for customers to get quotes, manage policies and report claims. Their digital experience is highly rated.

Progressive

Progressive is recognized for its innovation and digital customer experience. They offer a user-friendly website and the ability to get auto insurance quotes online quickly.

Lemonade

Lemonade is a digital-native insurer known for its innovative approach to insurance. They offer renters, homeowners and pet insurance with a focus on quick and easy digital interactions.

Nationwide

Nationwide offers various insurance products and is known for its user-friendly digital tools, making it easy for customers to access policy information and manage their accounts online.

Final thoughts

We hope this blog has given you a sense of the many opportunities insurance carriers have to embrace customer analytics and deliver impactful CX improvements that create happy, satisfied and loyal customers. However, there are limitations to standalone analytics tools. The transformative power of customer analytics is truly unlocked when it is combined with digital experience intelligence that adds a deep, practical understanding of why customers behave the way they do. If you’d like to learn more about using DXI to fix issues, optimize user journeys and make a positive revenue impact, be sure to check out our financial services solutions.

FAQs

1. What are 12 customer experience metrics for insurance carriers?

Net promoter score (NPS)

Customer satisfaction (CSAT)

Customer effort score (CES)

Retention rate

Churn rate

Average handle time (AHT)

First contact resolution (FCR)

Customer lifetime value (CLV)

Customer feedback volume

Digital experience metrics

Customer surveys and feedback

Respon

2. What are 10 ways to improve the insurance customer experience?

Streamline the onboarding process

Provide a personalized customer journey

Offer self-service

Implement a digital claims processing system

Provide online quoting tools

Ensure documents are mobile-friendly

Offer educational content

Implement AI and chatbots

Gather and implement customer feedback

Invest in robust security measures

3. What are the top insurance customer experience trends?

Digitalization and online services

Personalization

Claims processing speed

AI and chatbots

Data security

Customer feedback

Digital claims and self-service