The glaring data analytics gap in digital banking

It’s time for more customer-centric data analytics in banking. Here’s why.

There’s no such thing as a banking app. Not anymore. When your customers can buy everything from houses to cars online, product complexity and regulatory concerns aren’t enough to shield you from their expectations for lightning fast, hyper-relevant digital experiences. To keep up, you can’t just deliver a solid banking app or website, but an outstanding digital experience as a whole.

Consumer platforms like Netflix and Amazon may have initially set the bar, but the meteoric rise of digital-first disruptors have demonstrated that managing personal finances can be just as painless as your latest Ted Lasso binge (well, almost). This has changed the rules of the game for everyone in FSI, as organizations invest in new technology to refine every last click, swipe and tap. The majority (90%) of financial institutions say improving the mobile channel user experience is extremely or very important.

But there’s still a glaring gap between evolving capabilities of data analytics tools and how that data is actually used behind the scenes. In this post, we’re taking a look at the biggest limitations around standard data analytics practices, the benefits of a more customer-centric approach and what the latter actually looks like in practice.

Let’s get started!

Key ingredients to an outstanding digital banking experience

The first step to adopting a more customer-centric approach to data analytics is reverse engineering what your clients actually want from their digital banking experience in the first place. This makes it easier to identify—and correct—some of the bigger gaps getting in the way.

Two of three consumers say they can’t live without their banking app, while 90% prefer to manage their money in one place. There’s no way around it: frequent usage demands strong technical performance. Latency, uptime, responsiveness, memory usage and crash mitigation are all crucial considerations, especially since we’re living in a day and age where:

70% of mobile users will abandon an app if it is taking too long to load.

Nearly one in four people abandon mobile apps after only one use.

If a mobile app is slow, causes crashes or any other annoyance, 68% of people will never use it again.

Here’s the thing. These same customers who will uninstall a clunky app without a second thought also crave personalization—especially banking clients.

62% of FSI customers would switch providers if they felt treated like a number, not a person.

72% of financial customers rate personalization as “highly important.”

When you think about it, this is a pretty big contradiction. “The arrival of digital banking introduces an operating paradox for the financial services industry,” says Lane Martin, a partner at Capco. “How does a bank balance the seemingly contradictory desire to digitize the banking experience while also maintaining a personalized relationship with each individual customer?”

The secret sauce to an outstanding digital experience—at least according to these contrarian customer standards—boils down to a few key ingredients:

Strong technical performance to enable lighting fast, reliable and effortless interactions across multiple channels and touchpoints.

Easy access to the right type of data to support “self-service”-style experiences that are hyper-relevant to each individual.

Effective monitoring to ensure a nuanced yet cohesive understanding of customer behavior to neutralize sources of friction as quickly as possible.

Organizations leverage a wide range of data and analytics tools to deliver—but what happens when real customers get lost in the shuffle?

Limitations of traditional data analytics in digital banking

Digital analytics technology continues to evolve at warp speed, but the way organizations actually assess and improve digital customer experiences remains unchanged. Most organizations still operate with a mishmash of tools and dashboards, with invaluable insights dispersed across CX, marketing, product and engineering teams. This creates an artificial environment for decision-making and analysis that is far removed from your clients’ reality: a singular, holistic experience. It also opens the floodgates to a wide range of issues, like:

Data silos

Old school analytics goes hand in hand with data silos—and it’s easy to see why. The exhausting variety of tools and technology is both a blessing and a curse. In a lot of ways, it’s never been easier to gain nuanced insights into your clients’ behavior—especially considering that a century ago, customer research consisted of literal psychotherapy.

However, you can just as easily find yourself buried beneath mountains of data that isn’t particularly useful or relevant:

73% of bank leaders say that turning loyal customer data into patterns and trends they can leverage is a challenge.

Over 80% of data in an enterprise organization is not usable or actionable.

No context

Forced tunnel vision is a natural byproduct of data silos. You can slice and dice digital analytics, web analytics, product analytics, technical performance data or any other variety to your heart’s content, but without access to each and every tool, there’s no way to connect these granular metrics to the broader customer experience—or understand how one impacts the other.

That may be just fine if the sole purpose is to hit specific team goals—why should you care about error logs if you’re on the CX team?—but it doesn’t go far in actually improving the overall digital experiences for banking clients. It’s like trying to bake the perfect pizza but only having the ability to select and refine one of the toppings. The end result is inevitably a lackluster digital customer experience:

Only 21% of customers are completely satisfied with their bank’s digital experiences, and just 37% believe their provider anticipates their needs.

Just 37% of banking customers believe their provider anticipates their needs.

Out of all the customers who switched banks in 2023, the majority (51%) did so for a better digital experience—2X more than insurance customers who switched providers for the same reason,

85% of businesses believe they offer personalized customer experience, but only 60% of consumers agree.

37% of customers want their bank to be more like Amazon.

Isolated improvements

Digital analytics has traditionally existed as its own designated ecosystem, disconnected from other data sources. This configuration doesn’t just limit insights but the scope of improvements any one team can make. For instance, digital analytics technology can analyze historical data to determine creditworthiness and expedite approvals for credit cards. But this is only optimizing a single interaction—getting a faster response to an online credit card application.

There’s no way to ensure that the digital experience is improved in its entirety or that this enhancement won’t cause problems elsewhere—like a line of code that causes a lag.

Limited customer insight

Standard analytics tools make it difficult to understand what your clients want at different customer journey stages. Take voice of the customer (VoC) data, for example. Ninety-three percent of CX leaders report using survey-based metrics like CSAT or CES to measure CX performance. In a way, that makes a lot of sense. Surveys can systematically collect and analyze customer feedback—critical intel to improve digital experiences.

Or is it?

VoC data is sourced from just 4-7% of users, on average. In our own research, we’ve found it to be closer to 4%. Most customers simply opt out of surveys. That means the overwhelming majority of your customers—96%—haven’t even contributed to the primary metric used to gauge their satisfaction in the first place. When analytics only reflect high-level feedback from a vocal minority, it makes it a lot harder to refine digital experiences to more nuanced segments, especially at scale.

Historical focus

Traditional analytics is primarily focused on capturing, measuring, and analyzing historical data. This forces you to adopt a more “reactive” approach, correcting sources of friction after the fact—like when you notice your latest cashback rewards incentive is underperforming and conduct A/B tests to identify ways to improve the promotional copy.

However, there’s no way to automatically take that data and predict future behavior or flag other campaigns that are similarly vulnerable. There’s also a risk of data becoming obsolete—by the time you can analyze and identify an area for improvement, the source of friction may have shifted, expanded or even been solved by another team.

Digital experience intelligence (DXI): a customer-centric analytics alternative

Delivering a technologically seamless digital banking experience that simultaneously feels personal requires a whole new analytics approach—one that truly centers your clients over specific organizational functions. Digital experience intelligence (DXI) is a series of analytics tools, systems and processes designed to put you in your customers’ shoes.

DXI technology spans a range of features to capture, measure and analyze real-time interactions with banking sites and apps. These include:

Data consolidation (digital analytics, web and app performance, technical performance, VoC data)

Real-time user monitoring and analysis

Personalization and segmentation according to behavioral trends

Action-based customer insights and analysis (VoC)

More advanced DXI tools can also leverage AI and machine learning and integrate with your CRM to quantify the business impact of different behavioral patterns. For example, if a tech glitch compromises billing information validation, DXI can quantify the value of abandoned transactions that it was directly responsible for.

How DXI improves digital banking experiences

DXI dramatically improves your ability to quickly and accurately understand clients to deliver outstanding digital banking experiences. Some of the biggest benefits over a more traditional approach to analytics include:

Contextual data

DXI captures and consolidates real-time insights from several data sources across multiple teams. This enables you to dig into the nitty and gritty and contextualize your findings within a holistic customer journey, mimicking the real digital experiences of your clients.

Consider DXI the Goldilocks approach to data analytics—you’re not burdened by excessive data you don’t actually need, but also aren’t scrambling to understand the root cause of specific behavior. You have just the right amount to understand how and why customers are using your banking app or site.

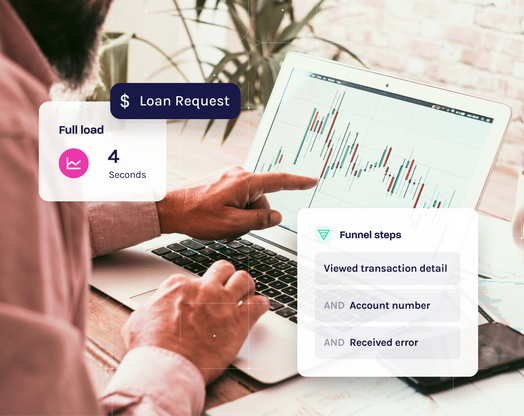

As a more integrated approach to data analytics, DXI can also establish cause-effect relationships between an infinite number of variables, down to a single technical event that occurred during a particular session and the resulting customer behavior.

Unsilencing the majority

Relying exclusively on NPS scores leaves a vast amount of insights on the table. DXI alternatively captures real-time behavioral data and identifies patterns, trends and sources of friction, regardless of whether clients agree to participate in a satisfaction survey. “Identifying true customer patterns and behavior can be done only by observing customers in their ‘natural habitat,” says Chandra Gnanasambandam, Martin Harrysson, Jeremy Schneider and Rikki Singh from McKinsey.

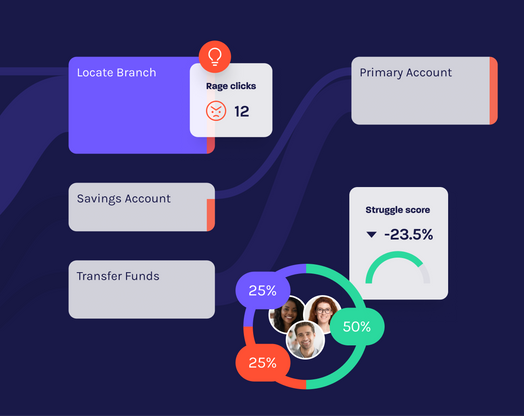

Connecting customer behavior to business impact

Clients may engage differently with your website or app may change over time, and it’s easy to get overwhelmed by a laundry list of tests and improvements to keep them returning. DXI helps prioritize optimization and troubleshooting by identifying behavior associated with customer acquisition, retention and churn.

For example, a DXI platform can analyze behavioral patterns among clients who closed their accounts in the past 30 days and flag at-risk customers based on similar declines in activity or transaction frequency. This intel gives you the ability to proactively intervene and stop churn in its tracks—either through re-engagement campaigns or by targeting the correct source of friction to improve.

Since DXI is grounded in data integration, friction can also be quantified—both in terms of immediate cost and how much future revenue will be lost if the problem isn’t fixed.

For example, lending solution SoFi noticed that 546 sessions ended with application abandonment in a single week. The culprit? A recurring error message. Using DXI technology, the team captured the input value on every abandoned loan application. They then discovered that—if abandonment continued at a similar rate—this technical glitch would eventually cost them $9 million in revenue. It was prioritized and resolved in one day.

Final thoughts

At the end of the day, traditional analytics is at odds with how banking clients actually think about your app or website—as a singular, holistic experience rather than a series of isolated interactions. A more customer-centric approach, grounded in DXI, embraces the complex, nonlinear nature of real-life digital experiences. Your clients are expecting more from your bank and website. You need to expect more from your data.