10 Strategies for Customer Acquisition in Banking

Today’s financial landscape is an altogether different place from years past, with the competition between financial institutions becoming more fierce by the day. In an era where your customer’s attention is an increasingly valuable commodity, understanding how to capture and keep the focus on your own products and services is a necessity for survival. In this blog, we’ll explore the challenges and opportunities banks face when it comes to customer acquisition—and show how digital experience intelligence (DXI) provides a deeper understanding of your customers that can help you navigate the ever-evolving financial ecosystem, grow a thriving customer base and maximize returns from existing channels.

Key takeaways

The cost of customer acquisition calls for dependable, proven strategies.

Understanding your customers is key to offering valuable, relevant services.

Digital experience intelligence ensures you avoid common pitfalls, prevent lost sales and create stickier, more relevant products and services.

What is customer acquisition in banking?

In the world of banking, customer acquisition is about attracting new customers who will be a good fit for the products and services you have to offer. Acquiring new customers is a process that intersects with almost every department in your bank, from the marketers who create eye-catching campaigns to draw in new banking customers to the product managers and development teams who craft engaging digital experiences that serve as the platform for your bank. The ultimate goal is to cultivate lasting relationships, ensuring new customers become the bedrock of your success long into the future.

The challenges of acquiring new banking customers

Acquiring new customers comes at a cost for every business, and it’s no different for retail banks. On average, it costs $500 to acquire a new banking customer, meaning those banks that can reduce this cost and optimize their return on investment by increasing customer lifetime value (CLV) will have a distinct advantage in the market.

In addition to bank customer acquisition costs, there are several challenges banks are up against when it comes to acquiring new customers. Keep these in mind as you plan your customer acquisition strategies:

Intense competition. The banking industry is highly competitive, with numerous financial institutions vying for the same pool of potential customers. Standing out amidst the competition is a significant challenge.

Changing customer behavior and preferences. Evolving customer preferences and behaviors, such as a shift towards online and mobile banking, require banks to adapt their acquisition strategies continually.

Customer expectations. Customers expect a streamlined, personalized and digital-first experience. Meeting these expectations while complying with regulations is a balancing act.

Product innovation. Developing innovative banking products and services that resonate with potential customers requires ongoing effort and investment.

Customer acquisition cost (CAC). As mentioned earlier, acquiring new customers can be costly, from marketing expenses to the resources required for onboarding and customer support.

Retention efforts. While acquiring new customers is important, retaining them is equally crucial. Banks must implement strategies to keep customers engaged and satisfied.

Digital transformation. Adapting to the digital age and offering user-friendly digital platforms is necessary for attracting tech-savvy customers.

Trust and reputation. Building trust in the banking sector is crucial. Concerns about security breaches or unethical practices can deter potential customers from engaging with a bank.

Data privacy. Ensuring the privacy and security of customer data is a top priority. Meeting stringent data protection standards while still offering a seamless onboarding experience can be challenging.

Regulatory compliance. Banks must navigate complex regulatory frameworks, which can pose challenges when onboarding new customers. Compliance requirements may involve extensive documentation and verification processes.

Top reasons customers switch banks

In today’s tech-savvy market, customers are more willing to shop around for the financial institution that fits their requirements—and less likely to stick with a bank that fails to meet those standards. In fact, 37% of banking customers are more likely to switch banks now than they were in the past.

But what is driving retail banking customers to search for new banking pastures? We’ve listed some of the most common reasons below.

1. Data privacy and protection

Earning and keeping the trust of your customers is especially important for banks. In a poll, consumers stated that the protection of their data was the most important factor when deciding to switch their primary bank. Any compromises on this front could cost your bank in lost customers.

2. Online and mobile banking capabilities

The competitive nature of the financial services industry means there is a wide range of banking websites and apps available, each with its own unique features and innovative additions. If your bank’s digital experiences lack the speed or feature-set customers are looking for, they’re likely to find them somewhere else.

3. Poor customer service

Nothing leaves a customer feeling unappreciated like a negative customer service interaction. Whether it’s an unresolved query, a lengthy call queue time, or a feeling of simply not being understood as a customer, these failings can have long-term negative consequences that cause customers to consider other banks.

4. Prices and fees

Savvy banking customers will do their homework to find the most affordable options available, so your rates will need to be competitive. Pricing models that fail to be competitive and transparent could leave customers with a bad taste in their mouths.

5. Not feeling valued

Your customers may consider switching to a competitor if they don’t feel you appreciate their loyalty or understand their needs. A bank that prioritizes building strong customer relationships and attentive customer service threatens to take these customers from you.

6. Inadequate products and services

To retain clients, your bank must continuously innovate and expand its offerings and stay competitive within the market. If your offering is left to grow stagnant, customers may leave as their financial needs evolve.

7. Lack of personalization

Now more than ever, customers expect a high degree of personalization and relevance in their digital experiences. If your bank doesn’t invest in understanding and accommodating individual preferences, it could miss vital opportunities to foster loyalty and risk people switching to a more customer-centric competitor.

👉🏻 For tips on gaining and retaining banking customers, check out the blog Delivering exceptional customer experience in banking: 6 strategies for success.

10 strategies to acquire more bank customers using digital experience intelligence

The most powerful bank customer acquisition strategies are fueled by data-driven insights. Digital experience intelligence provides a deeper understanding of your customer’s needs, wants, preferences and behaviors, driving better decisions that enhance the customer acquisition process. Whether it’s your marketing and outreach or the design and feature set of your mobile or online banking experience, DXI can help you create a seamless, customer-centric acquisition journey that not only attracts customers but also retains them in a highly competitive banking landscape.

Let’s take a look at how DXI can enrich your customer acquisition strategies, resulting in more effective customer acquisition.

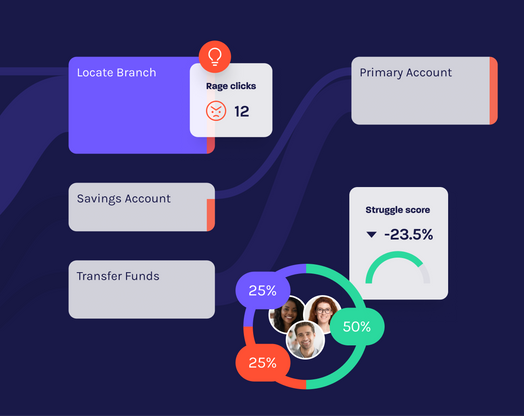

1. User behavior analysis

By analyzing user behavior, your bank can achieve a greater understanding of how and why users interact with your digital platforms. It’s easy to identify pain points, optimize user journeys and design more user-friendly interfaces with these insights, ultimately attracting and retaining more customers.

2. Segmentation and personalization

Digital experience intelligence makes it possible to segment your customer base by a wide variety of metrics so you can deliver more personalized and relevant digital experiences to your customers. By tailoring products, services and offers to meet individual preferences, you can enhance customer satisfaction and loyalty.

3. A/B testing and optimization

Experimenting with different elements of your online banking and mobile app experience can help you discover what resonates most with your customers. Refining customer journeys in this way results in more engaging, effective experiences that will attract new customers.

4. Real-time user monitoring (RUM)

A digital experience intelligence platform like Glassbox allows your bank to benefit from real-time user monitoring, ensuring you can detect and resolve issues quickly. Whether it’s squashing technical problems before they escalate or addressing user experience issues promptly, customers will appreciate the smooth, responsive journey your website and app provide.

🔍How does your bank stack up? Check out the Web Performance Index to see how your bank compares to leading financial institutions.

5. Content quality and messaging

DXI plays a crucial role in evaluating the quality and effectiveness of the content found on your banking website or app. With a clear picture of what grabs the attention of your customers, you can prioritize compelling messaging and refine your marketing efforts to appeal directly to your best potential customers.

6. Understand the customer journey

Using DXI, banks can visualize the entire customer journey across digital channels to better understand touchpoints, pain points and opportunities for further optimization and improvement.

7. Gather and implement customer feedback

Collecting customer feedback is essential, but often comes with barriers and friction that limit the volume of feedback you receive. Digital experience intelligence platforms like Glassbox allow you to integrate feedback touchpoints along the customer journey through voice of the customer (VoC) programs, making it easier for customers to share their concerns and suggestions. By listening to and acting on feedback, you can create more customer-centric experiences that make users feel valued and appreciated.

8. Optimize the mobile experience

Mobile banking is more popular than ever, making it essential for your bank to offer a seamless experience in this space. DXI offers insights that are invaluable for highlighting performance or UX-related issues within your mobile app, allowing you to make targeted refinements that will positively impact mobile-first customers.

👉🏻 Get more mobile app optimization tips in the guide 5 Mobile App Optimization Best Practices for Banks.

9. Conversion funnel analysis

Digital experience intelligence platforms allow you to visualize each customer’s journey through the conversion funnel. By tracking each step in an individual’s journey (or viewing thousands of journeys in aggregate), you can see how purchasing decisions are influenced and identify patterns that can be used to reduce drop-offs among new customers.

10. Continuous improvement

As this list has highlighted, DXI ultimately enables your bank to continuously review and refine its digital offering to ensure it remains responsive to evolving customer needs and preferences. By adopting a culture of continuous improvement, you can make sure your products and services continue to appeal to potential customers.

It pays to know what your customers want

Reaching, attracting and retaining new customers is vital for any business, yet the challenge for banks is greater than ever due to heightened customer expectations and the increasing ease of moving to an alternative provider. However, the strategies discussed in this blog show that there is a promising outlook for any bank to create unique, valuable and relevant products, services and digital experiences for their customers.

If you’re interested in implementing these strategies, check out how Glassbox’s Financial Services platform can help your bank accelerate the customer acquisition process.

FAQs

1. What is customer acquisition in banking?

In the world of banking, customer acquisition is about attracting new customers who will be a good fit for the products and services your bank offers.

2. What are 10 customer acquisition in banking strategies?

2. Segmentation and personalization

3. A/B testing and optimization

5. Content quality and messaging

6. Understand the customer journey

7. Gather and implement customer feedback

8. Optimize the mobile experience

10. Continuous improvement