Financial services analytics: A guide to using data to transform your website

Data analytics hasn’t just enhanced the way financial services websites are designed—it has totally revolutionized how they fundamentally operate by taking insights into user behavior and preferences into account. Financial institutions can tailor their online offerings to meet individual needs by collecting and analyzing user data, resulting in a more personalized and engaging user experience.

In this blog post, we’ll show you how it’s done, starting with an overview of how data analytics apply to the financial services industry before jumping into examples of the analytical tools and methods you can use to increase conversion rates, enhance customer loyalty and stay competitive in the digital landscape.

Key takeaways

Data analytics can have a transformative impact on the digital experiences you offer customers.

There are a multitude of analytics tools and methods with different strengths and weaknesses.

A digital experience intelligence (DXI) platform brings them all under one roof to help you achieve your objectives effectively and efficiently.

What is financial services analytics?

When we talk about data analytics as it applies to the financial services industry, we’re primarily talking about two kinds of analysis. The first is behavioral analytics, which focuses on collecting, analyzing and understanding how users navigate your financial services website. The second is an analysis of your website’s technical health, which looks at areas including website performance, security, technical issues impacting the user experience and overall responsiveness.

👉🏻 Check out the Website Performance Test to see how your website stacks up against the competition.

How is data analytics in the financial industry used?

Through the lens of user behavior and technical performance analytics, businesses in the financial services industry can come to a much deeper understanding of their website’s strengths and weaknesses. Using these analytical methods, it’s possible to reveal insights including:

The journey users chart through your website, including the pages they visit most and where they tend to drop off.

The actions users take that lead to a desired outcome, like completing an application or opening an account.

The slow-loading pages or errors that are frustrating users most.

Why do financial services institutions need to use data analytics?

By combining everything there is to learn from technical and user behavior analysis, financial services institutions can formulate an effective strategy for their website based on providing a seamless, secure, personalized experience for every user. Data analytics makes it easy to spot UX and technical issues causing users to abandon their digital journeys. Further, it can help you strategically prioritize addressing the issues with the most measurable impact.

How is data analytics transforming the financial services industry?

Data analytics tools have empowered financial service institutions (FSIs) to adapt and evolve in the digital age. Using behavioral and technical analytics, FSIs are able to adopt a rapid cycle of iterative improvement. By identifying issues with their website, measuring their potential impact and addressing them accordingly, FSIs are able to provide better services, detect and prevent issues and ultimately build trust with customers to ensure they remain happy and loyal long into the future.

10 ways your financial services organization can use data analytics to transform your website

Financial services organizations can use data to transform their websites and create exceptional customer experiences. Here are just a few ways:

1. Personalization

Using customer behavioral data, it’s possible to create a tailored user experience that shows content and recommendations that feel personal and relevant to the individual.

2. Customer journey mapping

Data-driven customer journey mapping allows FSIs to understand how people navigate their digital offerings. A customer journey map helps you to visualize (and optimize) user flows, identify pain points and enhance the overall experience.

3. Data-driven content creation

By leveraging data showing how highly specific content is engaged with, you can prioritize the creation of content that best aligns with the interests and preferences of your audience.

4. A/B testing

Comparing the data from A/B testing (for example, comparing two differently designed versions of an application form) can help you make informed decisions about what performs better, leading to insights you can apply across your website.

5. Predictive analytics

The data captured by a digital experience intelligence platform like Glassbox can facilitate predictive analytics, which helps forecast user behaviors and measure how likely it is that certain kinds of customers will be interested in specific products. These options can then be offered proactively, providing a valuable service to the user.

6. Chatbots and virtual assistants

In a similar fashion to predictive analytics, a user’s pattern of behavior can be compared against all behavioral data to anticipate in order to proactively offer the customer support they may require if they appear to be struggling.

7. Security and fraud prevention

Data analysis plays a central role in identifying unusual patterns and potential security threats, ensuring your website can resist fraudulent activity.

8. Mobile optimization

Data also helps understand the devices customers prefer to use when engaging with your website, helping you provide an optimized experience for their chosen screen size and input method.

9. Performance optimization

By analyzing metrics including load speed, uptime and responsiveness, FSIs can ensure their websites are fast and reliable—essential for retaining the trust and loyalty of customers.

10. Feedback analysis

Collecting and analyzing user feedback data can help financial institutions understand where customers are currently satisfied and areas for improvement. These insights can help guide future website enhancements.

Analytics tools for financial services

Incorporating data analytics into every aspect of your FSI’s website design and management allows you to understand customers better, respond to their needs and continuously improve digital customer experiences.

Let’s look at the tools you can use to adopt this data-driven approach and enhance customer satisfaction, stay competitive and build long-term relationships with your customers.

Overview of analytics tools commonly used in financial services

Web analytics

Web analytics tools track and report on all website traffic and user interactions. Reviewing this information can unlock insights into your customers’ behavior, your website’s most popular pages and common sources of traffic to your domain.

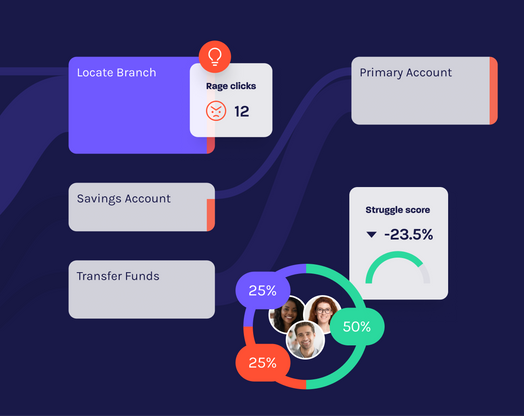

Behavioral analytics

As we discussed earlier, behavioral analytics help you delve deeper and better understand your users’ actions and engagement. With this critical context, you can make data-driven improvements to your financial services website.

Customer journey analytics

Customer journey analytics help you map and analyze a customer's entire path across your website. This map offers a detailed view of their interactions, from their initial touchpoint to conversion or drop-off.

Mobile analytics

Mobile analytics tools are specialized for tracking user interactions on mobile devices, leading to a greater understanding of user behavior.

Product analytics

Product analytics focuses on evaluating how your customers engage with specific financial products or services. This insight is invaluable for product development and optimization.

Session replay

Session replay tools offer a video-like playback of user sessions. It’s an intuitive way of reviewing individual interactions, making identifying pain points or opportunities for CX enhancements easy.

Heatmaps

Heatmaps provide a clear visual representation of user interactions across your website. They’re ideal for spotting areas of high activity and can help you make better website design and content placement decisions.

Surveys tools, such as voice of customer (VoC)

Collecting feedback directly from customers provides valuable insights about user satisfaction, preferences and pain points. These can be used alongside interaction data to arrive at a complete understanding of where improvements can be made.

Conversion funnels

Conversion funnel analytics track the actions users take before converting, identifying where users drop off in the conversion process and helping you to optimize it for better results.

Limitations of standalone financial services analytics tools

While each of the analytical tools we’ve covered can provide useful information, there are limitations to using each in a vacuum. To yield truly valuable insights that provide the most complete view of the digital customer experience on your financial services website, FSIs can leverage a digital experience intelligence (DXI) platform like Glassbox. These advanced insights enable financial services institutions to see the full picture and understand why users behaved the way they did, allowing them to create highly optimized digital experiences.

Use case examples: 8 ways financial services analytics can be used to transform websites

In the previous section, we mentioned how web analytics offer a valuable look into how users behave on your website. Before we wrap things up, let’s explore this in more detail with some specific use cases for web analytics.

1. Conversion rate optimization

One of the ultimate goals of using web analytics is conversion rate optimization (CRO), helping to increase the percentage of people who take desired actions and ensuring your website provides a healthy return on investment.

2. User engagement analysis

User engagement analysis enables financial services institutions to learn how visitors interact with their websites, providing insights that guide user experience enhancements that can be made to keep visitors engaged.

3. Audience segmentation

By dividing website visitors into distinct groups based on their characteristics or behavior, it's possible to tailor content and offers for different segments, improving relevancy and increasing customer satisfaction.

4. Content effectiveness

Measuring the impact of different content types can help you refine your website's messaging and ensure that the information displayed resonates with its intended audience.

5. User journey mapping

Visualizing the paths users take on your website can reveal areas of friction as well as opportunities for optimization. You can act on this information to create a smoother, more efficient user experience.

6. Form optimization

For a financial services institution, forms can be an essential part of the user journey, making them important to get right. Form optimization is about streamlining and improving the user data collection processes to ensure they’re easy for visitors to complete.

7. Website performance monitoring

Keeping a watchful eye on the performance of your website means you’ll stay abreast of any issues affecting load times, reliability and functionality. By addressing these problems quickly, you’ll ensure that your users enjoy a responsive and reliable website.

8. Marketing campaign effectiveness

By monitoring the source of website traffic, it’s possible to judge which marketing strategies are generating results, enabling you to allocate resources more effectively and fine-tune the content of your campaigns for better outcomes.

Final thoughts

Throughout this blog, we’ve shown just how transformative adopting a data-driven decision-making mindset can be when it comes to enhancing the website of your financial services institution. The digital landscape is always evolving, making it essential to remain competitive and offer an exceptional user experience—and the methods and tools we’ve described in this blog are the surest way of doing so.

If you’d like to learn more about the topics covered in this guide, we encourage you to visit the links or contact us to see how Glassbox can help you revolutionize your website.

FAQs

1. What is financial services analytics?

Financial services analytics refers to leveraging user behavior and website performance analytics to track, understand and improve how users navigate your financial services website.

2. What are 10 ways financial services organizations can use data analytics to transform their website?

Personalization

Customer journey mapping

Data-driven content creation

A/B testing

Predictive analytics

Chatbots and virtual assistants

Security and fraud prevention

Mobile optimization

Performance optimization

Feedback analysis

3. What are examples of how financial services analytics can transform websites?

Conversion rate optimization

User engagement analysis

Audience segmentation

Content effectiveness

User journey mapping

Form optimization

Website performance monitoring

Marketing campaign effectiveness